Report of Foreign Issuer (6-k)

August 25 2015 - 5:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of: August 2015

Commission File Number: 001-11444

MAGNA INTERNATIONAL INC.

(Exact Name of Registrant as specified in its Charter)

337 Magna Drive, Aurora, Ontario, Canada L4G 7K1

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F o Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant, by furnishing the information contained in this Form, is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: |

August 25, 2015 |

|

MAGNA INTERNATIONAL INC. |

|

|

|

(Registrant) |

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ “Bassem A. Shakeel” |

|

|

|

|

Bassem A. Shakeel |

|

|

|

|

Vice-President and Corporate Secretary |

2

EXHIBIT 99

Press release issued August 25, 2015, in which the Registrant announced that the Ontario Securities Commission has issued an issuer bid exemption order permitting the Registrant to make private agreement purchases of its Common Shares.

3

Exhibit 99

|

|

|

Magna International Inc. |

|

|

|

337 Magna Drive |

|

|

|

Aurora, Ontario L4G 7K1 |

|

|

|

Tel (905) 726-2462 |

|

|

|

Fax (905) 726-7164 |

PRESS RELEASE

MAGNA OBTAINS ISSUER BID EXEMPTION ORDER TO PERMIT PURCHASES BY WAY OF PRIVATE AGREEMENT

August 25, 2015 Aurora, Ontario, Canada……Magna International Inc. (TSX: MG, NYSE: MGA) today announced that the Ontario Securities Commission (“OSC”) has issued an issuer bid exemption order (the “August 2015 Order”) permitting us to make private agreement purchases of Magna International Inc.’s (“Magna”) Common Shares from an arm’s length third-party seller. Any purchases of our Common Shares made by way of private agreement under the August 2015 Order will be at a discount to the prevailing market price, may be made in tranches over time, and must otherwise comply with the terms of the August 2015 Order, including that: only one such purchase is permitted per calendar week; and any such purchase must occur prior to the expiry of our Normal Course Issuer Bid (the “Bid”) on November 12, 2015.

Magna was previously granted issuer bid exemption orders (the “Prior Orders”) on November 25, 2014 permitting us to make private agreement purchases from three arm’s length third-party sellers on certain terms and conditions contained in the Prior Orders. The maximum number of Common Shares which may be purchased by way of all such private agreements cannot exceed 13,333,333, being one-third of the total number of Common Shares which may be purchased under the Bid after giving effect to the two-for-one stock split completed by Magna on March 25, 2015 (the “Stock Split”). The maximum number of Common Shares purchased in any weekly tranche by way of private agreement will not exceed 1,000,000. As of today, we have purchased 5,320,000 Common Shares under the Prior Orders after giving effect to the Stock Split.

All Common Shares purchased by way of private agreement made pursuant to the Prior Orders and the August 2015 Order will be included in computing the number of Common Shares purchased under the Bid, and information regarding each purchase, including the number of Common Shares purchased and aggregate price paid, will be available on the System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com following the completion of any such purchase.

Subject to regulatory requirements, the actual number of Common Shares to be purchased under the Bid, whether by way of any such private agreement or otherwise, and the timing of any such purchases will continue to be determined by us having regard to future price movements, our determination that such purchases would be an appropriate use of corporate funds and in the best interests of Magna, and other factors. All purchases will be subject to our normal trading blackouts.

CONTACT

For further information, please contact Vince Galifi, Executive Vice-President and Chief Financial Officer at 905-726-7100 or Louis Tonelli, Vice-President, Investor Relations at 905-726-7035.

ABOUT MAGNA

We are a leading global automotive supplier with 319 manufacturing operations and 85 product development, engineering and sales centres in 29 countries. We have over 136,000 employees focused on delivering superior value to our customers through innovative products and processes, and World Class Manufacturing. Our product capabilities include producing body, chassis, interior, exterior, seating, powertrain, electronic, vision, closure and roof systems and modules, as well as complete vehicle engineering and contract manufacturing. Our Common

Shares trade on the Toronto Stock Exchange (MG) and the New York Stock Exchange (MGA). For further information about Magna, visit our website at www.magna.com.

FORWARD-LOOKING STATEMENTS

This press release may contain statements that, to the extent that they are not recitations of historical fact, constitute “forward-looking statements” within the meaning of applicable securities legislation, including, but not limited to, future purchases of our Common Shares under the Normal Course Issuer Bid or pursuant to private agreements under an issuer bid exemption order issued by the Ontario Securities Commission. Forward-looking statements may include financial and other projections, as well as statements regarding our future plans, objectives or economic performance, or the assumptions underlying any of the foregoing. We use words such as “may”, “would”, “could”, “should” “will”, “likely”, “expect”, “anticipate”, “believe”, “intend”, “plan”, “forecast”, “outlook”, “project”, “estimate” and similar expressions suggesting future outcomes or events to identify forward-looking statements. Any such forward-looking statements are based on information currently available to us, and are based on assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances. However, whether actual results and developments will conform to our expectations and predictions is subject to a number of risks, assumptions and uncertainties, many of which are beyond our control, and the effects of which can be difficult to predict. These risks, assumptions and uncertainties include, without limitation, the impact of: economic or political conditions on consumer confidence, consumer demand for vehicles and vehicle production; fluctuations in relative currency values; legal claims and/or regulatory actions against us; liquidity risks as a result of an unanticipated deterioration of economic conditions; the unpredictability of, and fluctuation in, the trading price of our Common Shares; changes in laws and governmental regulations; and other factors set out in our Annual Information Form filed with securities commissions in Canada and our annual report on Form 40-F filed with the United States Securities and Exchange Commission, and subsequent filings. In evaluating forward-looking statements, we caution readers not to place undue reliance on any forward-looking statements and readers should specifically consider the various factors which could cause actual events or results to differ materially from those indicated by such forward-looking statements. Unless otherwise required by applicable securities laws, we do not intend, nor do we undertake any obligation, to update or revise any forward-looking statements to reflect subsequent information, events, results or circumstances or otherwise.

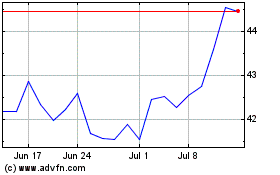

Magna (NYSE:MGA)

Historical Stock Chart

From Mar 2024 to Apr 2024

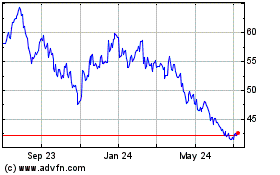

Magna (NYSE:MGA)

Historical Stock Chart

From Apr 2023 to Apr 2024