UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16 or

15d-16 of the Securities Exchange Act of 1934

For the month of March 2015

Commission File Number 001-11444

MAGNA INTERNATIONAL INC.

(Exact Name of Registrant as specified in its Charter)

337 Magna Drive, Aurora, Ontario, Canada L4G 7K1

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F o Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commissionfiling on EDGAR.

Indicate by check mark whether the registrant, by furnishing the information contained in this Form, is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: |

March 23, 2015 |

|

MAGNA INTERNATIONAL INC. |

|

|

(Registrant) |

|

|

|

|

|

|

|

|

By: |

/s/ Bassem A. Shakeel |

|

|

|

Bassem A.Shakeel, |

|

|

|

Vice-President and Corporate Secretary |

2

EXHIBIT

|

Exhibit 99.1 |

|

Audit Committee Charter/Mandate approved March 19, 2015. |

3

Exhibit 99.1

MAGNA INTERNATIONAL INC.

AUDIT COMMITTEE CHARTER

MAGNA INTERNATIONAL INC.

AUDIT COMMITTEE CHARTER/MANDATE

Purpose

This Charter has been adopted by the Board of Directors of the Corporation (the “Board”) to assist the Audit Committee (the “Committee”) and the Board in the exercise of their responsibilities, particularly by defining the scope of the Committee’s authority in respect of financial and audit-related matters delegated to it by the Board.

Where used in this Charter, the term “Executive Management” has the meaning ascribed to it in the Corporation’s Board Charter.

Role and Responsibilities of the Committee

1. The Board has delegated to the Committee the responsibility for the following matters:

Independent Auditor

(a) Selection and Compensation of Independent Auditor: recommending to the Board:

· the independent auditor to be nominated for the purpose of preparing or issuing an audit report or related work or performing other audit, review or attest services for the Corporation (“Independent Auditor”); and

· the compensation of the Independent Auditor.

(b) Oversight of Independent Auditor: overseeing the work of the Independent Auditor, which shall report directly to the Committee, including with respect to the resolution of disagreements between Executive Management and the Independent Auditor regarding financial reporting.

(c) Pre-Approval of Audit Fees: pre-approving, or establish procedures and policies for the pre-approval of, the engagement and compensation of the Independent Auditor in respect of the provision of all audit, audit-related, review or attest engagements required by applicable law.

(d) Pre-Approving of Non-Audit Fees: pre-approving all non-audit services permitted to be provided by the Independent Auditor in accordance with applicable law and rules governing the Independent Auditor, provided that the Committee may pre-approve certain services within designated thresholds on an annual basis and further provided that the Committee may delegate to the Chairman of the Committee, or such other member or members of the Committee that it deems appropriate, certain pre-approval authority provided that any such approval granted by such persons shall be reported at the next regularly scheduled meeting of the Committee.

(e) Audit Scope: reviewing and approving the objectives and general scope of the external audit (including the overall audit plan, the proposed timing and completion dates) and discussing the external audit with the Independent Auditor.

(f) Independent Auditor’s Quality Control Procedures, Performance and Independence: evaluating the quality control procedures, performance and independence of the Independent Auditor in carrying out its responsibilities, including by obtaining and reviewing at least annually a report by the Independent Auditor describing:

· the firm’s internal quality-control procedures;

· any material issues raised by the most recent internal quality-control review, or peer review, of the firm, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the firm, and any steps taken to deal with any such issues; and

· all relationships between the independent auditor and the Corporation.

(g) Staffing of Audit Team: reviewing the experience and qualifications of the Independent Auditor’s audit team assigned to the audit of the Corporation and making annual recommendations to the Board as to the need (if any) for rotation of the Independent Auditor or the members of the Independent Auditor’s audit team assigned to the audit of the Corporation.

(h) Required Disclosures: reviewing and discussing with the Independent Auditor all disclosures required by applicable accounting or other regulators to be reviewed with respect to the conduct of the audit and quarterly review of the interim financial results.

(i) Relationship between Independent Auditor and Management: satisfying itself generally that there is a good working relationship between Executive Management and the Independent Auditor, and reviewing

· any management representation letters;

· the Independent Auditor’s management letters and management’s responses thereto;

· the Independent Auditor’s schedule of unadjusted differences; and

· any other reports of the Independent Auditor,

as well as discussing any material differences of opinion between management and the Independent Auditor.

(j) Hiring from Independent Auditor: reviewing and approving the hiring of partners, employees and former partners and employees of the present and any former Independent Auditor who were engaged on the Corporation’s account within the last three years prior to such hiring.

Internal Controls

(k) System of Internal Controls: satisfying itself that Executive Management has (i) established and is maintaining an adequate and effective system of internal control over financial reporting and information technology general controls (“ITGCs”), and (ii) is responding on a timely basis to any material weaknesses or significant deficiencies which have been identified, including by meeting with and reviewing reports of the Corporation’s Internal Audit Department (“IAD”) and the Independent Auditor relating to the Corporation’s internal controls and ITGCs.

(l) Reports on Internal Controls: annually reviewing:

· Executive Management’s report relating to the effectiveness of the Corporation’s disclosure controls and procedures, internal control over financial reporting, changes in internal controls over financial reporting and ITGCs; and

2

· the Independent Auditor’s report on internal controls under standards of the United States Public Company Accounting Oversight Board.

Internal Audit

(m) Internal Audit Department: overseeing the appointment, termination and replacement of the senior management of IAD, the scope of the IAD’s work plan and the overall performance, staffing and resources of the IAD.

Accounting Matters

(n) Critical Accounting Policies: reviewing and discussing with the Independent Auditor:

· the selection, use and application of, as well as proposed material changes to, critical accounting policies, principles, practices and related judgments; and

· alternative GAAP treatments for policies and practices relating to material items, including the ramifications of such alternative disclosures or treatments and any recommended treatment,

to ensure that the critical accounting policies and practices and GAAP treatments adopted are appropriate and consistent with the Corporation’s needs and applicable requirements.

(o) Disagreements: satisfying itself that there is an agreed course of action leading to the resolution of significant unsettled issues between Executive Management and either the Independent Auditor or IAD that do not affect the audited financial statements (e.g. disagreements regarding correction of internal control weaknesses or the application of accounting principles to proposed transactions), if any.

(p) Off-Balance Sheet Transactions: reviewing all material off-balance sheet transactions and the related accounting presentation and disclosure.

Risk Management

(q) Financial Risk Management: assessing with Executive Management the Corporation’s material risk exposures relating to financial and financial reporting matters and the Corporation’s actions to identify, monitor and mitigate such exposures.

(r) Information Technology Risk Management: assessing with Executive Management the material risk exposures relating to the Corporation’s information technology systems and the Corporation’s actions to identify, monitor and mitigate such exposures.

Ethical Business Conduct

(s) Ethical Business Conduct: reviewing on behalf of the Board:

· any actual or potential illegal, improper or fraudulent behaviour brought to the attention of the Committee which may have a negative effect on the integrity or reputation of the Corporation, including reports of same submitted through the Good Business Line ; and

· the findings of any regulatory authorities in relation to the financial affairs of the Corporation;

3

(t) Code of Conduct: monitoring the implementation, operation and effectiveness of the Corporation’s Code of Conduct, periodically reviewing and recommending to the Board changes to such Code, authorizing any waiver of compliance of such Code and overseeing the investigation of any alleged breach thereof.

(u) Whistle-Blowing Procedures: overseeing the implementation, operation and effectiveness of the Corporation’s Good Business Line, which constitutes the Corporation’s procedure for:

· the receipt, retention and treatment of complaints received by the Corporation regarding accounting, internal controls, and auditing matters; and

· the confidential, anonymous submission of complaints by employees of the Corporation of concerns regarding questionable accounting or auditing matters.

(v) Reports of Fraud: reviewing with Executive Management and the Independent Auditor any complaints received through the Good Business Line, or any media reports which raise material issues regarding the Corporation’s financial statements or accounting or auditing practices.

Financial Disclosures

(w) Disclosure Controls: satisfying itself that procedures are in place for the review of the Corporation’s public disclosure of financial information extracted or derived from the Corporation’s financial statements and assessing the adequacy of those procedures annually.

(x) Approval of Disclosures: meeting to review and discuss the Corporation’s financial statements with Executive Management and the Independent Auditor and recommending to the Board prior to release, all such financial statements of the Corporation, together with related Management’s Discussion & Analysis of Results of Operations and Financial Position (“MD&A”), earnings press releases and all other public disclosure documents of the Corporation containing financial information of the Corporation.

(y) Audit Committee Report: preparing the Audit Committee report for inclusion in the Corporation’s information circular/proxy statement, in the form and at the time required by the laws, rules and regulations of applicable regulatory authorities.

Reporting to Board

(z) Reporting: quarterly reporting to the Board with respect to the Committee’s review of the Corporation’s financial statements, MD&A, financial disclosures, earnings press releases and related matters, and at least annually in respect of the Committee’s other activities; and annually reporting to the Enterprise Risk Oversight Committee with respect to the risk management topics described in Section 1(q) of this Charter.

Size, Composition and Independence

2. Size: The Committee shall be composed of not less than three (3) nor more than five (5) members. The Board shall annually appoint the members of the Committee and a Chairman from amongst those appointed, to hold office until the next annual meeting of shareholders of the Corporation. The members of the Committee shall serve at the pleasure of the Board and vacancies occurring from time to time shall be filled by the Corporate Governance, Compensation and Nominating Committee. Any member of the Committee may be removed or replaced at any time by the Board and shall automatically cease to be a member of the Committee upon ceasing to be a director of the Corporation.

4

3. Independence: All of the members of the Committee shall meet the independence standards specified under applicable law, currently being Sections 1.4 and 1.5 of National Instrument 52-110 of the Canadian Securities Administrators.

4. Financial Literacy and Expertise: All of the members of the Committee shall be “financially literate” as such term is defined in National Instrument 52-110 of the Canadian Securities Administrators and at least one member of the Committee shall have such accounting or financial expertise as is required to comply with applicable rules and regulations of the Ontario Securities Commission (“OSC”), the United States Securities and Exchange Commission (the “SEC”), The New York Stock Exchange (“NYSE”) and any other regulatory authority having jurisdiction.

5. Limit on Outside Audit Committees: No director shall serve as a member of the Committee if that director is a member of the audit committees of more than two other boards of directors of other public companies.

6. Independent Advisors: The Committee may retain and compensate such outside financial, legal and other advisors at the expense of the Corporation as it deems reasonably necessary to assist and advise the Committee in carrying out the Committee’s duties and responsibilities.

7. Role of Chairman: The Chairman of the Committee shall generally provide leadership to enhance the effectiveness of the Committee and act as the liaison between the Committee and the Board as well as between the Committee and Executive Management. The Chairman shall also manage the Committee’s activities and meetings, manage any outside legal or other advisors retained by the Committee and manage the process of reporting to the Board on the Committee’s activities and related recommendations.

8. Secretary of the Committee: Unless otherwise determined or approved by the Committee, the Secretary or an Assistant Secretary of the Corporation shall act as the Secretary of the Committee. In the absence of the Secretary or an Assistant Secretary, the Committee shall select an individual to act as the Secretary of the Committee. The Secretary of the Committee shall keep minutes of the Committee and such minutes shall be retained in the corporate records of the Corporation.

Committee Meeting Administration

9. Meetings: The Committee shall hold at least five scheduled meetings each year, consisting of four quarterly meetings held within the timeframes set forth in Section 10 of this Charter and one special meeting to address financial and financial reporting risks, as well as other topics as determined by the Committee. Other meetings shall be scheduled as required. Regular meetings of the Committee shall be called by the Chairman of the Committee, and additional meetings may be called by any member of the Committee, the Chairman of the Board, Chief Executive Officer, Chief Financial Officer, Chief Legal Officer or the Secretary of the Corporation. At each quarterly meeting, the Committee shall meet separately with: the Independent Auditor and the head of IAD, in the absence of management; and management, in the absence of the Independent Auditor.

10. Quarterly Meetings: the Committee shall meet with Executive Management and the Independent Auditor of the Corporation within:

(a) forty-five (45) days, or such lesser period as may be prescribed by applicable law, following the end of each of the first three financial quarters of the Corporation, but in any event prior to the release of the financial results for each such quarter and their filing with the applicable regulatory authorities, to review and discuss the financial results of the Corporation for the preceding fiscal quarter and the related MD&A as well as the results of the Independent Auditor’s review of the financial results for such quarter and, if satisfied, report thereon to, and

5

recommend their approval by, the Board and their inclusion in the Corporation’s required regulatory filings for such quarter; and

(b) sixty (60) days, or such lesser period as may be prescribed by applicable law, following the financial year-end of the Corporation, but in any event prior to the release of the financial results for the financial year and their filing with the applicable regulatory authorities, to review and discuss the audited financial statements of the Corporation for the preceding fiscal year and the related MD&A and, if satisfied, report thereon to, and recommend their approval by, the Board and the Corporation’s shareholders as required by applicable law and their inclusion in the Corporation’s Annual Report and other required regulatory filings.

In reviewing the quarterly and annual financial results the Committee shall ensure that there are adequate procedures for review of such financial results, including timely review by the Independent Auditor.

11. Minimum Attendance: Each member of the Committee is expected to use all reasonable efforts to attend a minimum of 75% of all regularly scheduled Committee meetings, except to the extent that any absence is due to medical or other valid reasons.

12. Notice of Meeting: Unless otherwise determined or approved by the Committee, the Secretary of the Committee shall provide notice of each meeting of the Committee to the following persons, all of whom shall be entitled to attend each Committee meeting:

· the Committee Chairman and each member of the Committee;

· the Chief Executive Officer, the Chief Financial Officer, Chief Legal Officer of the Corporation, Vice-President, Finance and the Controller;

· the Independent Auditor;

· the head of the IAD; and

· any other person whose attendance is deemed necessary or advisable by the Chairman of the Committee.

13. Committee Access to Employees and Others: For the purpose of performing their duties and responsibilities, the members of the Committee shall have full access to and the right to discuss any matters relating to such duties with any or all of:

· any employee of the Corporation;

· the Independent Auditor; and/or

· any advisors to the Corporation (including advisors retained by the Committee),

as well as the right to inspect all applicable books, records and facilities of the Corporation and its subsidiaries and shall be permitted to discuss such books, records and facilities and any other matters within the Committee’s mandate with any of the foregoing.

14. Meeting Agendas: The Committee Chairman shall establish a preliminary agenda for each Committee meeting with the assistance of the Secretary of the Corporation. Any director or other person entitled to call a meeting may request items to be included on the agenda for any meeting.

6

15. Meeting Materials: To the extent reasonably practicable, meeting materials shall be distributed sufficiently in advance of Committee meetings to permit members to properly review and consider such materials.

16. Quorum: A majority of the members of the Committee shall constitute a quorum and all actions of the Committee shall be taken by a majority of the members present at the meeting. If the Committee only has two members as a result of a vacancy on the Committee, both members shall constitute a quorum.

Delegation of Responsibility

17. Right of Delegation: Subject to applicable law, the Committee may from time to time delegate one or more of its duties and responsibilities under this Charter to the Chairman of the Committee, any other member of the Committee or any sub-committee of the Committee.

Review and Revision of Charter

18. Annual review: The Committee shall annually review this Charter and recommend to the Corporate Governance, Compensation and Nominating Committee of the Board such changes as it deems advisable.

Board Approved: March 19, 2015

7

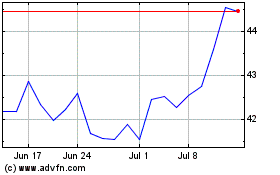

Magna (NYSE:MGA)

Historical Stock Chart

From Mar 2024 to Apr 2024

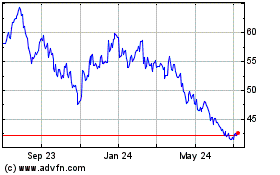

Magna (NYSE:MGA)

Historical Stock Chart

From Apr 2023 to Apr 2024