GM Europe President: Market Won't Return To Pre-Crisis Level Anytime Soon

January 10 2011 - 5:06PM

Dow Jones News

General Motors Co.'s (GM) European division could reach

break-even in 2011, excluding restructuring costs, if the sales

improvement seen towards the end of last year continues, but demand

for new cars in the region isn't expected to return to pre-crisis

level in the forseeable future.

GM Europe president Nick Reilly told reporters at the North

American International Auto Show the division needs a sales volume

of around 1.3 million vehicles to operate profitably in this

relatively low market.

He said sales came in just under 1.2 million vehicles last year,

which is roughly flat compared to 2009. Reilly cited a difficult

start into last year as reason for what he described as "a pretty

average" year in 2010 in terms of sales, noting that sales and

market share improved in most European countries towards the end of

last year.

In 2009, GM skipped the sale of its European Opel and Vauxhall

brands to Canadian auto parts maker Magna International Inc. (MGA,

MG.T) and decided to finance the wide-ranging turnaround program

itself. Reilly reiterated that restructuring costs last year were

around EUR1 billion, but declined to comment on the anticipated

costs to be booked this year.

GM Europe posted a $559 million loss in the third quarter last

year and $1.2 billion loss in the January-to-September period,

making it the firm's only money-losing region.

As part of GM's latest turnaround effort in Europe, Reilly plans

to lift market share, ramping up exports and broadening the product

line-up to lure new customers.

-By Christoph Rauwald, Dow Jones Newswires; +49 170 966 8093;

christoph.rauwald@dowjones.com

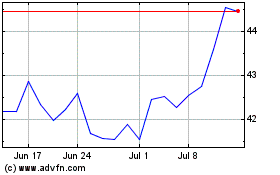

Magna (NYSE:MGA)

Historical Stock Chart

From Mar 2024 to Apr 2024

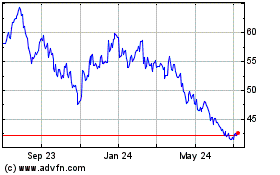

Magna (NYSE:MGA)

Historical Stock Chart

From Apr 2023 to Apr 2024