By Leslie Scism and Lauren Pollock

Two of the biggest themes in the market -- persistently low

interest rates and the continued poor performance of hedge funds --

stung some insurers in the first quarter, as four of the most

prominent companies in the sector reported sharply lower operating

profits.

Insurers earn a substantial portion of their income from the

investments they make with customers' premium dollars, holding them

until claims are due. A protracted low-interest-rate environment in

the U.S. and many other parts of the world has stung the industry

broadly.

Analysts said the quarter was one of the worst in the past

couple years for U.S. insurers. They have grappled with low

interest rates since 2008, cutting expenses and raising fees on

customers among other efforts to keep their profits intact. This

quarter, some were let down by hedge funds, which on average lost

about 1% in the first quarter, according to researcher HFR Inc.

Insurers' portfolios mostly hold high-quality bonds, but some

allocate a sliver to riskier holdings.

For the first quarter, life insurers MetLife Inc., Prudential

Financial Inc. and Lincoln Financial Group reported lackluster

investment income, while property and casualty giant Allstate Corp.

logged a sharp increase in catastrophe losses for the quarter.

MetLife said weak hedge-fund performance dented its investment

income, which declined 5.5% to $4.71 billion. That followed similar

comments about hedge funds earlier in the week from American

International Group Inc.

Prudential logged a slight 0.4% increase in investment income

but said its business took a hit on fluctuations in a portfolio

that includes hedge funds, private equity and real estate. Lincoln

Financial blamed lower investment income for declines in fee income

and earnings at its retirement plan services segment.

Among the major insurers that reported Wednesday, Chubb Ltd. was

the only one to report an increase in operating income, a key

measure in the insurance industry that excludes realized capital

gains and losses in the companies' big investment portfolios.

Prudential shares declined 3.2% after hours, followed by

MetLife, which dropped 3%. Operating earnings at both companies

declined more than expected. The other stocks were little

changed.

MetLife said in January that it would divest itself of a large

chunk of its operations, as part of a plan to slim down and reduce

some of the capital burden it would face under new federal

regulations as "systemically important." In March, a federal judge

ruled for MetLife in the New York company's challenge of the

designation, and that ruling is now being appealed by the

government.

Within the property and casualty market, Allstate had already

warned that its results would take a big hit on catastrophe losses

incurred in the period. The insurer primarily blamed hailstorms in

the southern U.S., one of which was the largest to ever hurt the

company. Its catastrophe losses grew to $827 million from $294

million a year earlier.

Those comments echo sentiments expressed in recent weeks by

Travelers Cos., car insurer Progressive Corp. and Kemper Corp., all

of which highlighted a spike in claims from punishing hailstorms in

March.

Chubb, meanwhile, reported catastrophe losses declined to $258

million from $315 million a year earlier.

In all, at MetLife, the largest U.S. life insurer by assets,

operating income declined to $1.33 billion, or $1.20 a share, from

$1.64 billion, or $1.44 a share, a year earlier. Analysts polled by

Thomson Reuters expected $1.38 a share. Revenue, meanwhile, slipped

2.5% to $16.61 billion.

At Prudential, which earns about half of its profit abroad,

mostly from Japan, perating earnings declined to $997 million, or

$2.18 a share, versus the $2.37 a share expected by analysts.

Revenue at Prudential, with its annuities, retirement-income and

asset-management businesses, fell 4.4% to $11.29 billion.

Lincoln Financial posted an 11% slide in operating income to

$314 million, or $1.25 a share. Analysts had called for $1.49 a

share.

Allstate, meanwhile, said operating earnings dropped 48% to $322

million, or 84 cents a share, while Wall Street predicted 68 cents

a share. Revenue slipped 0.9% to $8.87 billion, though insurance

premiums increased.

Chubb, formed earlier this year when ACE Ltd. acquired Chubb in

a nearly $30 billion deal and took its name, reported operating

earnings of $1.02 billion, or $2.26 a share, beating the $2.16 a

share expected by analysts. Net premiums were $5.48 billion.

Corrections & Amplifications: Chubb's catastrophe losses

declined to $258 million from $315 million a year earlier. The

metric used in an earlier version of this article didn't take into

account the recent merger of ACE and Chubb.

Write to Leslie Scism at leslie.scism@wsj.com, Tess Stynes at

tess.stynes@wsj.com and Lauren Pollock at

lauren.pollock@wsj.com

(END) Dow Jones Newswires

May 05, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

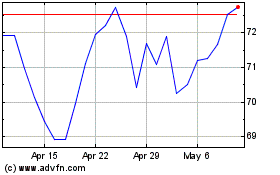

MetLife (NYSE:MET)

Historical Stock Chart

From Mar 2024 to Apr 2024

MetLife (NYSE:MET)

Historical Stock Chart

From Apr 2023 to Apr 2024