By Aruna Viswanatha and Leslie Scism

MetLife Inc. agreed to pay $25 million for allegedly misleading

customers as they bought retirement-income products and surrendered

older versions that sometimes were cheaper and had more generous

features, regulators said Tuesday, in one of the largest such

settlements to date.

The insurer's MetLife Securities Inc. unit "made negligent

misrepresentations and omissions to customers" when replacing their

variable annuities, an increasingly popular investment for

retirees, making them seem better for the customers than they

actual were, said the Financial Industry Regulatory Authority, the

brokerage industry's regulator.

The violations took place between 2009 and 2014 and affected

"tens of thousands of customers," Finra said.

MetLife neither admitted nor denied the Wall Street watchdog's

findings, according to the settlement. The company said in a

statement that it "fully cooperated with the Finra

investigation."

"This is kind of a perfect storm," Finra Chairman Richard

Ketchum said in an interview. The investigation into MetLife found

both "meaningful conflicts with respect to fees" and "a consistent

failure in supervision with respect to clearly providing the

information a customer needs," he said.

Mr. Ketchum said that while he didn't expect similar cases

against other firms, complicated products "have shown up as an area

of investor harm for a period of years."

"We continue to see firms have problems managing their

supervision with respect to more complex products, whether those

are structured products, whether those are the more complex ETFs

[exchange-traded funds], or whether it's something like variable

annuities," he said.

Variable annuities are popular with older, risk-averse investors

and offer tax advantages over investing directly in stock and bond

funds. For an added fee at many insurers, investors can receive

lifetime payments of a guaranteed minimum amount even if the

underlying funds perform poorly.

Steep stock-market declines during the 2008 financial crisis

exposed the potential dangers of such generous guarantees to the

insurers, and by 2009 they were launching less risky and more

expensive versions of the products.

Consumer advocates and other critics say agents, financial

advisers and others who are licensed to sell the products have a

financial incentive to encourage consumers to replace an existing

variable annuity with a new one. That is because insurers typically

pay upfront commissions of 5% to 7% for the sales.

The Obama administration is counting on a new rule from the

Labor Department to address the problem. The so-called fiduciary

rule, which goes into effect next year, requires financial advisers

and others who sell investment products for retirement accounts to

act as fiduciaries, putting their clients' interest first.

Finra said the MetLife settlement, which includes a $20 million

fine and $5 million to reimburse customers, is the second-largest

fine it has ever levied. The largest, a $50 million penalty against

Credit Suisse First Boston Corp. over allegedly inflated

commissions for hot initial public offerings, came in 2002.

According to the Tuesday settlement, MetLife sometimes

overstated the cost of a customer's existing variable annuity

contract, which in some instances increased a customer's cost by 2%

annually. The firm also sometimes failed to tell customers a

proposed replacement would reduce or eliminate features of their

existing variable annuity, Finra said.

Finra said it sampled some 35,500 applications that MetLife

representatives submitted for replacement contracts, and found that

72%, or about 25,560 applications, contained at least one error

that understated the value of the contract being replaced, Finra

said.

"The understanding of the advisers providing those

products...understanding the fees and what people were giving up

with respect to their existing contracts versus the ones they were

passing on...just wasn't there. And the error...occurred again and

again," Mr. Ketchum said.

MetLife sold at least $3 billion in variable annuities through

replacements between 2009 and 2014, and made $152 million in

commissions off the products, Finra said. It didn't have an

"adequate supervisory structure" that made sure brokers had

accurate information about the replacement products, the regulator

said.

Finra didn't accuse MetLife of promoting the replacements but

instead cited the company's failure to properly supervise the

replacement activity. It said that the company's registered

representatives weren't provided "adequate training or guidance on

how to conduct a comparative analysis" of products, and that

"deficient systems and procedures" were evident.

The investigation dates back to March 2012, when MetLife fired

two New York brokers after receiving customer complaints that the

brokers had inappropriately transferred them into new variable

annuities.

Finra investigated the terminations and barred the two brokers

from the industry in 2014, according to regulatory records, saying

they had "carried out a scheme" for seven years to submit false

paperwork around putting customers into new retirement products, so

they could collect extra commissions to which they weren't

entitled.

As Finra investigator Kevin Link dug into the brokers' case, Mr.

Ketchum said, he realized the "numbers didn't add up," and

unearthed more systemic issues.

Mr. Ketchum said investigators didn't find any evidence of

improper pressure to move customers into the new products, but that

there was an emphasis on the business. "There was clearly a

significant push to sell replacement products," he said.

Before recommending that a customer replace a variable annuity,

brokers are required to make sure the recommendation is suitable

for the customer and compare it with the customer's existing

contracts.

In November, MetLife had warned it may face a "significant fine"

from Finra over the issue. The insurer is in the process of

divesting its retail business as part of an effort to slim down and

respond to a shifting regulatory environment, and separately signed

an agreement in February to sell its sales force to Massachusetts

Mutual Life Insurance Co.

The problems cited by Finra at MetLife surprised many who know

the company. "They are one of the most compliance-centric insurers

in the industry," said Colin Devine, principal of insurance

consulting firm C. Devine & Associates. He noted that the

problematic sales cited by Finra are a small fraction of the more

than $50 billion in total variable-annuity sales by MetLife from

2009 to 2014.

Write to Aruna Viswanatha at Aruna.Viswanatha@wsj.com

(END) Dow Jones Newswires

May 03, 2016 17:42 ET (21:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

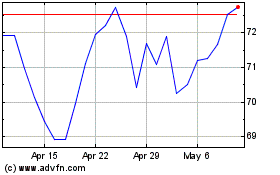

MetLife (NYSE:MET)

Historical Stock Chart

From Mar 2024 to Apr 2024

MetLife (NYSE:MET)

Historical Stock Chart

From Apr 2023 to Apr 2024