MetLife to Take $792 Million Third-Quarter Charge

September 16 2015 - 4:40PM

Dow Jones News

By Leslie Scism

Life insurer MetLife Inc. said it would take a $792 million

charge against third-quarter earnings to reflect that it may owe

more federal taxes for past years, prompted by an adverse court

ruling earlier this month involving other companies in a similar

tax dispute.

The nation's biggest life insurer said it stands by its tax

treatment, but said the charge "is the result of the company's

consideration of recent decisions of the U.S. Court of Appeals for

the Second Circuit upholding the disallowance [by the Internal

Revenue Service] of foreign tax credits" claimed by other

companies. MetLife's action relates to tax years 2000 to 2009 and

involves the tax treatment of a wholly-owned U.K. investment

subsidiary of MetLife.

"There has been no change in the company's position on the

disallowance of its foreign tax credits" by the IRS, the company

said Wednesday. "MetLife continues to contest the disallowance of

these foreign tax credits by the IRS as management believes the

facts strongly support the company's position."

MetLife said the noncash, after-tax charge to operating earnings

and net income would be 70 cents a share. The company also said it

does not expect any additional charges related to this matter.

In the third quarter of 2014, MetLife reported net income of

$2.1 billion, or $1.81 per share.

MetLife's statement didn't name the companies that were the

subject of the appellate court ruling earlier this month. According

to the ruling, they are Bank of New York Mellon and American

International Group Inc. Their disputes involved hundreds of

millions of dollars of foreign tax credits.

MetLife's regulatory filing for its second-quarter earnings

cited a disagreement with the IRS over foreign tax credits. It said

the IRS in April had issued a "Statutory Notice of Deficiency" for

years 2000, 2001 and 2002, asserting that MetLife owes additional

taxes and interest for these years "primarily due to the

disallowance of foreign tax credits."

MetLife added in the filing that "the transactions that are the

subject of the notice continue through 2009, and it is likely that

the IRS will seek to challenge these later periods."

Write to Leslie Scism at leslie.scism@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 16, 2015 16:25 ET (20:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

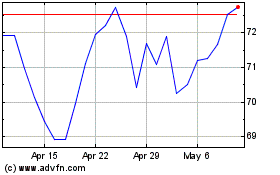

MetLife (NYSE:MET)

Historical Stock Chart

From Mar 2024 to Apr 2024

MetLife (NYSE:MET)

Historical Stock Chart

From Apr 2023 to Apr 2024