Medtronic PLC (MDT) filed a Form 8K - Other Events - with the

U.S Securities and Exchange Commission on March 21, 2017.

On March 21, 2017, Medtronic Global Holdings S.C.A. ("Medtronic

Luxco"), Medtronic plc and Medtronic, Inc. entered into an

underwriting agreement with Citigroup Global Markets Inc., Goldman,

Sachs & Co. and Morgan Stanley & Co. LLC, as

representatives of the several underwriters named therein (the

"Luxco Underwriting Agreement"), pursuant to which Medtronic Luxco

agreed to issue $1,000,000,000 aggregate principal amount of 1.700%

senior notes due 2019 and $850,000,000 aggregate principal amount

of 3.350% senior notes due 2027 (collectively, the "Luxco notes").

All of Medtronic Luxco's obligations under the Luxco notes will be

fully and unconditionally guaranteed by Medtronic plc and

Medtronic, Inc. on a senior unsecured basis.

On March 21, 2017, Medtronic, Inc., Medtronic plc and Medtronic

Luxco entered into an underwriting agreement with Citigroup Global

Markets Inc., Goldman, Sachs & Co. and Morgan Stanley & Co.

LLC, as representatives of the several underwriters named therein

(the "Medtronic, Inc. Underwriting Agreement" and together with the

Luxco Underwriting Agreement, the "Underwriting Agreements"),

pursuant to which Medtronic, Inc. agreed to issue $150,000,000 in

aggregate principal amount of its 4.625% Senior Notes due 2045 (the

"2045 notes"). The 2045 notes will be a further issuance of, and

will form a single series with, the $4,000,000,000 aggregate

principal amount of Medtronic, Inc.'s currently outstanding 4.625%

Senior Notes due 2045, and will be fully and unconditionally

guaranteed by Medtronic Luxco and Medtronic plc on a senior

unsecured basis.

The offerings of the Luxco notes and the 2045 notes are being

conducted pursuant to an effective registration statement on Form

S-3 (File No. 333-215895), a related prospectus and prospectus

supplements, each as filed with the Securities and Exchange

Commission (the "SEC").

The Luxco notes are to be issued under an indenture to be

entered into among Medtronic Luxco, Medtronic plc and Medtronic,

Inc. and Wells Fargo Bank, National Association (the "Trustee"), as

supplemented by a first supplemental indenture to be entered into

among Medtronic Luxco, Medtronic plc and Medtronic, Inc. and the

Trustee. The 2045 notes are to be issued under the Indenture, dated

as of December 10, 2014, between Medtronic, Inc. and the Trustee,

as supplemented by the First Supplemental Indenture, dated as of

December 10, 2014, between Medtronic, Inc. and the Trustee, the

Second Supplemental Indenture, dated as of January 26, 2015,

between Medtronic plc and the Trustee and the Third Supplemental

Indenture, dated as of January 26, 2015, between Medtronic Luxco

and the Trustee. The offerings are expected to close on March 28,

2017, subject to customary closing conditions.

We expect that the net proceeds from the offerings will be

approximately $2.0 billion after deducting underwriting discounts

and commissions and payment of estimated offering expenses. The net

proceeds of the offerings will be used for general corporate

purposes.

The above description is qualified in its entirety by reference

to the Underwriting Agreements, which are filed as Exhibit 1.1 and

Exhibit 1.2 hereto and incorporated herein by reference.

This Current Report on Form 8-K contains forward-looking

statements that involve a number of risks and uncertainties.

Important factors that could cause actual results to differ

materially from those indicated by such forward-looking statements

are set forth in the prospectuses related to the offerings

referenced above, Medtronic plc's Annual Report on Form 10-K for

the year ended April 29, 2016 and each of Medtronic plc's most

recent Quarterly Reports on Form 10-Q, under the section "Risk

Factors," which are on file with the SEC. All statements other than

statements of historical fact are statements that could be deemed

forward-looking statements. These statements are based on current

expectations, estimates, forecasts, and projections about the

industries in which we operate and the beliefs and assumptions of

our management. Words such as "expects," "anticipates," "targets,"

"goals," "projects," "intends," "plans," "believes," "seeks,"

"estimates," "continues," "may," "could" and "will," and variations

of such words and similar expressions are intended to identify such

forward-looking statements. In addition, any statements that refer

to the offerings of the notes and the use of proceeds therefrom,

and the expected closing date for the offerings are forward-looking

statements. Readers are cautioned that these forward-looking

statements are only predictions and are subject to risks,

uncertainties, and assumptions that are difficult to predict,

including those identified in the section entitled "Risk Factors"

and elsewhere in our Annual Report on Form 10-K

and Quarterly Reports on Form 10-Q. Therefore, actual results

may differ materially and adversely from those expressed in any

forward-looking statements. We undertake no obligation to revise or

update any forward-looking statements, including to reflect events

or circumstances occurring after the date of the filing of this

Current Report on Form 8-K, except to the extent required by

law.

The full text of this SEC filing can be retrieved at:

http://www.sec.gov/Archives/edgar/data/1613103/000119312517092281/d364265d8k.htm

Any exhibits and associated documents for this SEC filing can be

retrieved at:

http://www.sec.gov/Archives/edgar/data/1613103/000119312517092281/0001193125-17-092281-index.htm

Public companies must file a Form 8-K, or current report, with

the SEC generally within four days of any event that could

materially affect a company's financial position or the value of

its shares.

(END) Dow Jones Newswires

March 22, 2017 17:32 ET (21:32 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

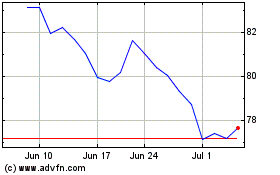

Medtronic (NYSE:MDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

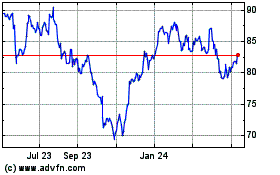

Medtronic (NYSE:MDT)

Historical Stock Chart

From Apr 2023 to Apr 2024