Medtronic Cuts Guidance on Sluggish Revenue

November 22 2016 - 8:40AM

Dow Jones News

Medtronic PLC on Tuesday said revenue growth lagged behind

expectations in the latest quarter while customers waited for new

product releases, and the company signaled some of that

sluggishness could linger.

Shares fell 5.7% to $76 in premarket trading as the company also

cut its guidance for the quarter.

"Revenue was disappointing and did not meet our expectations,"

Chief Executive Omar Ishrak said. Slower-than-expected revenue

growth was hurt by upcoming new product introductions in its

cardiovascular and diabetes units, which reduces the demand for

current products as consumers wait for new ones.

In September, the Food and Drug Administration approved for sale

a long-awaited insulin pump made by Medtronic in a significant

advance toward a so-called artificial pancreas for Type 1 diabetes

patients, as it takes some of the guesswork out of blood-sugar

control.

The company said new products should drive revenue growth back

to normal ranges but also warned that "some of the challenges" that

hurt revenue in the quarter could continue in the near term.

Medtronic said it now expects revenue growth in the mid-single

digit range compared with the upper half of the mid-single digit

previously forecast. It also now expects fiscal year 2017 adjusted

earnings per share of between $4.55 to $4.60, down from between

$4.60 to $4.70 previously.

Medtronic reported a fiscal first-quarter profit of $1.12

billion, or 80 cents a share, compared with $520 million, or 36

cents a share, a year ago. Excluding items, the company earned

$1.12 a share. Analysts polled by Thomson Reuters expected earnings

of $1.11 a share.

Revenue grew 4.1% to $7.35 billion.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

November 22, 2016 08:25 ET (13:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

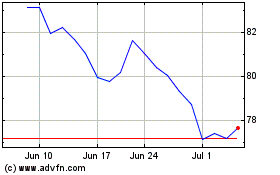

Medtronic (NYSE:MDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

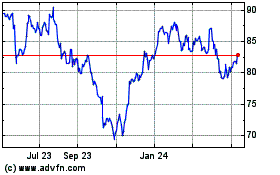

Medtronic (NYSE:MDT)

Historical Stock Chart

From Apr 2023 to Apr 2024