Medtronic Wins Tax Court Case Over IRS

June 09 2016 - 6:06PM

Dow Jones News

By Richard Rubin and Jeanne Whalen

The U.S. Tax Court handed Medtronic Plc a victory in a $1.4

billion dispute with the Internal Revenue Service over how much of

the medical device maker's profits should be taxed by Puerto Rico

and how much should face higher federal taxes instead.

In a 144-page ruling, Judge Kathleen Kerrigan agreed with the

company, saying it had proved the government's "allocations were

arbitrary, capricious, or unreasonable." The Puerto Rican

subsidiary, she wrote, "was involved in every aspect of the

manufacturing process" and thus was making significant

contributions to the overall company's profits.

The dispute dates back to the 2005 and 2006 tax years, before

Medtronic merged with Covidien PLC and moved its legal address to

Ireland.

The case involved transfer pricing, or the rules that govern

transactions between different arms of the same company.

Corporations must make such transactions as if they were engaged in

arm's length deals between unrelated companies, and allocate income

where it is earned, depending on which entity truly generates the

profits.

But those standards frequently lead to fact-intensive disputes

with the IRS. In this case, the company and the government were

arguing about the proper methods for determining how profits should

be split between foreign and domestic operations.

Although Puerto Rico is part of the U.S., companies based there

are considered foreign corporations for U.S. corporate income-tax

purposes. That means companies pay the local tax and don't have to

pay the full 35% U.S. tax rate until they repatriate the money.

Medtronic's Puerto Rican subsidiary manufactured medical

devices, and the company said it was attributing an appropriate

amount of the profits to its U.S. operations.

Judge Kerrigan, who was also critical of some parts of the

company's analysis, determined precise income allocations that were

different from what the IRS or Medtronic contended. Her findings,

however, were close to what Medtronic had initially proposed.

The exact amount Medtronic will owe hasn't been determined at

this stage of the case.

The IRS and Medtronic didn't immediately respond to requests for

comment Thursday.

Write to Richard Rubin at richard.rubin@wsj.com and Jeanne

Whalen at jeanne.whalen@wsj.com

(END) Dow Jones Newswires

June 09, 2016 17:51 ET (21:51 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

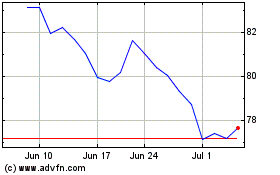

Medtronic (NYSE:MDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

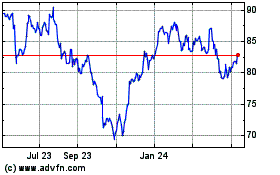

Medtronic (NYSE:MDT)

Historical Stock Chart

From Apr 2023 to Apr 2024