Medtronic Says New Inversion Rules Won't Hurt Finances

April 06 2016 - 9:53AM

Dow Jones News

By Anne Steele

Medtronic Inc. on Wednesday said the Treasury Department's new

proposed tax regulations on inversion deals won't have a material

financial impact on the medical supply company, which moved its

corporate address abroad in a deal last year.

In January 2015, Metronic closed a $43 billion acquisition of

Ireland's Covidien PLC, combining two of the world's largest

medical-supply companies. Medtronic, formerly based in Minneapolis,

redomiciled in Ireland upon completion of the merger, part of a

wave of controversial deals aimed at taking advantage of lower

corporate-tax rates overseas.

Medtronic said Wednesday that the acquisition "was undertaken

for strategic reasons and has created a company that is positively

impacting the lives of more patients, in more ways and in more

places around the world."

On Monday, the Treasury Department imposed tough new curbs on

corporate inversions, making it harder for companies to move their

tax addresses out of the U.S. and then shift profits to low-tax

countries using a maneuver known as earnings stripping.

The new rules -- the government's third wave of administrative

action against inversions -- shocked Wall Street and forced Pfizer

Inc. and Allergan PLC to terminate their planned $150 billion

merger, which was on track to be the biggest deal of its kind.

The Treasury's regulations would limit what is known as earnings

stripping, a practice that follows many inversions and other

cross-border acquisitions that helps lower companies' effective tax

rates.

Inverted companies -- in fact, all non-U.S.-based companies --

can lend money to their U.S. subsidiaries. Those moves create

deductible interest in the U.S., reducing the income subject to the

35% U.S. corporate tax rate and shifting income to a lower-taxed

jurisdiction. If a U.S.-based company tried the same technique by

borrowing from its offshore subsidiaries, the government would tax

that income at the U.S. rate.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

April 06, 2016 09:38 ET (13:38 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

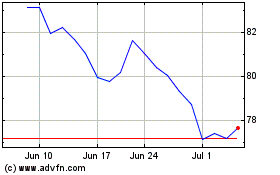

Medtronic (NYSE:MDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

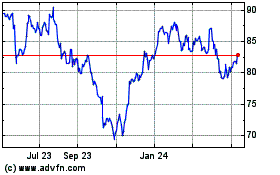

Medtronic (NYSE:MDT)

Historical Stock Chart

From Apr 2023 to Apr 2024