Tyco Reaches Resolution with IRS

January 19 2016 - 8:30AM

Dow Jones News

Tyco International PLC disclosed Tuesday that it has reached a

potential settlement in a long-running tax dispute with the

Internal Revenue Service that would result in payments of up to

$525 million.

The settlement, which still must be finalized, relates to

tax-sharing agreements set up by Tyco in 2007 when it spun off TE

Connectivity Ltd. and Covidien PLC. The agreements split

responsibility for income tax liabilities between the companies.

The IRS has raised issues about Tyco's treatment of certain

intercompany debt deals from 1997 to 2000.

In 2013, the IRS said Tyco's former U.S. subsidiaries owed about

$1 billion in additional taxes and penalties.

Tyco said the settlement would result in payments to the IRS of

$475 million to $525 million. It would be split among Tyco, TE

Connectivity, and Covidien, which has since been bought by

Medtronic PLC.

Tyco said it has enough reserves and doesn't expect to record

any additional charges related to the resolution. It expects to

make the payment in the next six months.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

(END) Dow Jones Newswires

January 19, 2016 08:15 ET (13:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

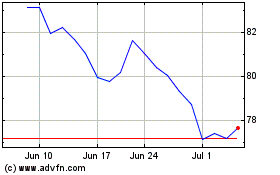

Medtronic (NYSE:MDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

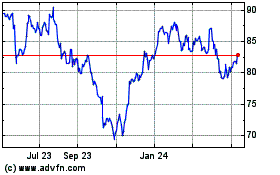

Medtronic (NYSE:MDT)

Historical Stock Chart

From Apr 2023 to Apr 2024