Medtronic's Ireland Move Results in Lower Taxes

September 28 2015 - 8:14PM

Dow Jones News

By Jeanne Whalen

In a sign of how Medtronic PLC is benefiting from moving its

headquarters to Ireland from the U.S., the medical-device company

said it is paying $500 million in U.S. income tax on $9.8 billion

of cash and investments that it has transferred to the U.S. from

its overseas subsidiaries.

That amounts to a 5% U.S. tax rate on the money. For U.S.-based

companies, profits earned overseas are subject to the 35% U.S.

corporate tax rate when repatriated to the U.S.

Medtronic said it is transferring the money after completing an

"internal restructuring" in the wake of its acquisition of

Dublin-based Covidien PLC earlier this year. That acquisition

allowed Medtronic to move its headquarters from Minneapolis to

Dublin, a so-called tax inversion move aimed at lowering the

company's tax burden.

U.S. Treasury officials didn't immediately respond to a request

for comment.

In a securities filing after the U.S. market's close, Medtronic

said it moved the $9.8 billion out of its overseas subsidiaries.

Medtronic spokesman Fernando Vivanco said the company moved the

money to the U.S.

Medtronic said it would take a $500 million charge in the second

quarter of the company's current fiscal year in relation to the

move, primarily to cover U.S. income tax. "We're paying about $500

million in taxes to the U.S. Treasury to allow us to use these

dollars in the U.S.," Mr. Vivanco said.

In its filing, Medtronic said it plans to use the cash to meet

its financial goals, including pursuing "financially disciplined"

mergers and acquisitions, reducing its debt to Ebitda ratio, and

returning free cash flow to shareholders through dividends and

share buybacks.

Write to Jeanne Whalen at jeanne.whalen@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 28, 2015 19:59 ET (23:59 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

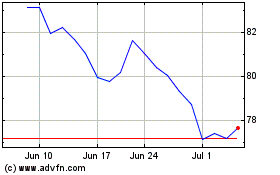

Medtronic (NYSE:MDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

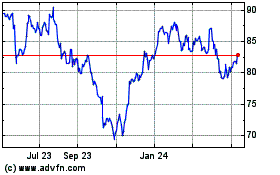

Medtronic (NYSE:MDT)

Historical Stock Chart

From Apr 2023 to Apr 2024