UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): September 1, 2015

MEDTRONIC PUBLIC LIMITED COMPANY

(Exact name of Registrant as Specified in its Charter)

|

|

|

|

|

| Ireland |

|

1-36820 |

|

98-1183488 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

20 On Hatch, Lower Hatch Street

Dublin 2, Ireland

(Address of principal executive offices)

(Registrant’s telephone number, including area code): +353 1 438-1700

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

On September 1, 2015, Medtronic plc (the “Company”) issued

a press release (the “Press Release”) announcing the results of exchange offers (the “Exchange Offers”) with respect to:

(i) up to $500,000,000 aggregate principal amount of outstanding Floating Rate Senior Notes due March 15, 2020 issued by

Medtronic, Inc. (“Medtronic, Inc.”), together with the subsequent full and unconditional guarantees of such notes by the Company and Medtronic Global Holdings S.C.A. (“Medtronic Luxco” and, together with the Company, the

“guarantors,” and such notes together with such guarantees, the “original floating rate notes”), for a like principal amount of Floating Rate Senior Notes due March 15, 2020, issued by Medtronic, Inc. and guaranteed by the

guarantors, which have been registered under the Securities (the “exchange floating rate notes”);

(ii) up to

$1,000,000,000 aggregate principal amount of outstanding 1.500% Senior Notes due March 15, 2018 issued by Medtronic, Inc. together with the subsequent full and unconditional guarantees of such notes by the guarantors (such notes together with

such guarantees, the “original 2018 notes”) for a like principal amount of 1.500% Senior Notes due March 15, 2018, issued by Medtronic, Inc. and guaranteed by the guarantors, which have been registered under the Securities Act (the

“exchange 2018 notes”);

(iii) up to $2,500,000,000 aggregate principal amount of outstanding 2.500% Senior Notes

due March 15, 2020 issued by Medtronic, Inc. together with the subsequent full and unconditional guarantees of such notes by the guarantors (such notes together with such guarantees, the “original 2020 notes”) for a like principal

amount of 2.500% Senior Notes due March 15, 2020, issued by Medtronic, Inc. and guaranteed by the guarantors, which have been registered under the Securities Act (the “exchange 2020 notes”);

(iv) up to $2,500,000,000 aggregate principal amount of outstanding 3.150% Senior Notes due March 15, 2022 issued by

Medtronic, Inc. together with the subsequent full and unconditional guarantees of such notes by the guarantors (such notes together with such guarantees, the “original 2022 notes”) for a like principal amount of 3.150% Senior Notes due

March 15, 2022, issued by Medtronic, Inc. and guaranteed by the guarantors, which have been registered under the Securities Act (the “exchange 2022 notes”);

(v) up to $4,000,000,000 aggregate principal amount of outstanding 3.500% Senior Notes due March 15, 2025 issued by

Medtronic, Inc. together with the subsequent full and unconditional guarantees of such notes by the guarantors (such notes together with such guarantees, the “original 2025 notes”) for a like principal amount of 3.500% Senior Notes due

March 15, 2025, issued by Medtronic, Inc. and guaranteed by the guarantors, which have been registered under the Securities Act (the “exchange 2025 notes”);

(vi) up to $2,500,000,000 aggregate principal amount of outstanding 4.375% Senior Notes due March 15, 2035 issued by

Medtronic, Inc. together with the subsequent full and unconditional guarantees of such notes by the guarantors (such notes together with such guarantees, the “original 2035 notes”) for a like principal amount of 4.375% Senior Notes due

March 15, 2035, issued by Medtronic, Inc. and guaranteed by the guarantors, which have been registered under the Securities (the “exchange 2035 notes”); and

(vii) up to $4,000,000,000 aggregate principal amount of outstanding 4.625% Senior Notes due March 15, 2045 issued by

Medtronic, Inc. together with the subsequent full and unconditional guarantees of such notes by the guarantors (such notes together with such guarantees, the “original 2045 notes” and, together with the original floating rate notes,

original 2018 notes, original 2020 notes, original 2022 notes, original 2025 notes, and original 2035 notes, the “original notes”) for a like principal amount of 4.625% Senior Notes due March 15, 2045, issued by Medtronic, Inc. and

guaranteed by the guarantors, which have been registered under the Securities Act (the “exchange 2045 notes” and, together with the exchange floating rate notes, exchange 2018 notes, exchange 2020 notes, exchange 2022 notes, exchange 2025

notes, and exchange 2035 notes, the “exchange notes”).

A copy of the Press Release is attached hereto as Exhibit 99.1 and

incorporated herein by reference.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press Release dated September 1, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

MEDTRONIC PUBLIC LIMITED COMPANY |

|

|

|

|

|

By |

|

/s/ Gary L. Ellis |

| Date: September 1, 2015 |

|

|

|

Gary L. Ellis |

|

|

|

|

Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit Number |

|

Description |

|

|

| 99.1 |

|

Press Release dated September 1, 2015. |

Exhibit 99.1

|

|

|

|

|

|

NEWS RELEASE |

|

|

|

|

|

|

|

|

|

|

|

Contacts: |

|

|

|

|

|

|

|

|

|

|

Cindy Resman |

|

Ryan Weispfenning |

|

|

|

|

Public Relations |

|

Investor Relations |

|

|

|

|

+1-763-505-0291 |

|

+1-763-505-4626 |

FOR IMMEDIATE RELEASE

MEDTRONIC, INC. ANNOUNCES RESULTS OF THE

REGISTERED EXCHANGE OFFERS FOR CERTAIN OF ITS SENIOR NOTES

DUBLIN – September 1, 2015 – Medtronic plc (the “Company”) (NYSE: MDT) today announced the final results of its exchange

offers (the “exchange offers”) with respect to:

(i) up to $500,000,000 aggregate principal amount of outstanding

Floating Rate Senior Notes due March 15, 2020 issued by Medtronic, Inc. (“Medtronic, Inc.”), together with the subsequent full and unconditional guarantees of such notes by the Company and Medtronic Global Holdings S.C.A.

(“Medtronic Luxco” and, together with the Company, the “guarantors,” and such notes together with such guarantees, the “original floating rate notes”), for a like principal amount of Floating Rate Senior Notes due

March 15, 2020, issued by Medtronic, Inc. and guaranteed by the guarantors, which have been registered under the Securities (the “exchange floating rate notes”);

(ii) up to $1,000,000,000 aggregate principal amount of outstanding 1.500% Senior Notes due March 15, 2018 issued by

Medtronic, Inc. together with the subsequent full and unconditional guarantees of such notes by the guarantors (such notes together with such guarantees, the “original 2018 notes”) for a like principal amount of 1.500% Senior Notes due

March 15, 2018, issued by Medtronic, Inc. and guaranteed by the guarantors, which have been registered under the Securities Act (the “exchange 2018 notes”);

(iii) up to $2,500,000,000 aggregate principal amount of outstanding 2.500% Senior Notes due March 15, 2020 issued by

Medtronic, Inc. together with the subsequent full and unconditional guarantees of such notes by the guarantors (such notes together with such guarantees, the “original 2020 notes”) for a like principal amount of 2.500% Senior Notes due

March 15, 2020, issued by Medtronic, Inc. and guaranteed by the guarantors, which have been registered under the Securities Act (the “exchange 2020 notes”);

(iv) up to $2,500,000,000 aggregate principal amount of outstanding 3.150% Senior Notes due March 15, 2022 issued by

Medtronic, Inc. together with the subsequent full and unconditional guarantees of such notes by the guarantors (such notes together with such guarantees, the “original 2022 notes”) for a like principal amount of 3.150%

Senior Notes due March 15, 2022, issued by Medtronic, Inc. and guaranteed by the guarantors, which have been registered under the Securities Act (the “exchange 2022 notes”);

(v) up to $4,000,000,000 aggregate principal amount of outstanding 3.500% Senior Notes due March 15, 2025 issued by

Medtronic, Inc. together with the subsequent full and unconditional guarantees of such notes by the guarantors (such notes together with such guarantees, the “original 2025 notes”) for a like principal amount of 3.500% Senior Notes due

March 15, 2025, issued by Medtronic, Inc. and guaranteed by the guarantors, which have been registered under the Securities Act (the “exchange 2025 notes”);

(vi) up to $2,500,000,000 aggregate principal amount of outstanding 4.375% Senior Notes due March 15, 2035 issued by

Medtronic, Inc. together with the subsequent full and unconditional guarantees of such notes by the guarantors (such notes together with such guarantees, the “original 2035 notes”) for a like principal amount of 4.375% Senior Notes due

March 15, 2035, issued by Medtronic, Inc. and guaranteed by the guarantors, which have been registered under the Securities (the “exchange 2035 notes”); and

(vii) up to $4,000,000,000 aggregate principal amount of outstanding 4.625% Senior Notes due March 15, 2045 issued by

Medtronic, Inc. together with the subsequent full and unconditional guarantees of such notes by the guarantors (such notes together with such guarantees, the “original 2045 notes” and, together with the original floating rate notes,

original 2018 notes, original 2020 notes, original 2022 notes, original 2025 notes, and original 2035 notes, the “original notes”) for a like principal amount of 4.625% Senior Notes due March 15, 2045, issued by Medtronic, Inc. and

guaranteed by the guarantors, which have been registered under the Securities Act (the “exchange 2045 notes” and, together with the exchange floating rate notes, exchange 2018 notes, exchange 2020 notes, exchange 2022 notes, exchange 2025

notes, and exchange 2035 notes, the “exchange notes”).

The exchange offers commenced on August 4, 2015 and expired at 11:59 p.m., New York

City time, on August 31, 2015.

Wells Fargo Bank, National Association, acting as exchange agent for the exchange offers, advised the Company that:

(i) $495,000,000 of the $500,000,000 aggregate principal amount of the original floating rate notes have been validly

tendered for exchange, representing 99.000% of the principal amount of the outstanding original floating rate notes;

2

(ii) $999,800,000 of the $1,000,000,000 aggregate principal amount of the

original 2018 notes have been validly tendered for exchange, representing 99.980% of the principal amount of the outstanding original 2018 notes;

(iii) $2,368,955,000 of the $2,500,000,000 aggregate principal amount of the original 2020 notes have been validly tendered for

exchange, representing 94.758% of the principal amount of the outstanding original 2020 notes;

(iv) $2,494,335,000 of the

$2,500,000,000 aggregate principal amount of the original 2022 notes have been validly tendered for exchange, representing 99.773% of the principal amount of the outstanding original 2022 notes;

(v) $3,979,850,000 of the $4,000,000,000 aggregate principal amount of the original 2025 notes have been validly tendered for

exchange, representing 99.496% of the principal amount of the outstanding original 2025 notes;

(vi) $2,499,000,000 of the

$2,500,000,000 aggregate principal amount of the original 2035 notes have been validly tendered for exchange, representing 99.960% of the principal amount of the outstanding original 2035 notes; and

(vii) $3,995,189,000 of the $4,000,000,000 aggregate principal amount of the original 2045 notes have been validly tendered for

exchange, representing 99.880% of the principal amount of the outstanding original 2045 notes.

In accordance with the terms of the exchange offers, the

Company has accepted all of the original notes validly tendered and not withdrawn.

This announcement does not constitute an offer to purchase any

securities or the solicitation of an offer to sell any securities. The exchange offer was made only pursuant to the prospectus dated August 4, 2015 and the related letter of transmittal and only to such persons and in such jurisdictions as is

permitted under applicable law.

About Medtronic

Medtronic plc (www.medtronic.com), headquartered in Dublin, Ireland, is the global leader in medical technology – alleviating pain, restoring health, and

extending life for millions of people around the world.

This press release contains forward-looking statements, which are statements other than

statements of historical fact, relating to Medtronic plc, Medtronic, Inc. and Medtronic Global Holdings S.C.A. Such forward looking statements are subject to risks and uncertainties, such as competitive factors, difficulties and delays inherent in

the development, manufacturing, marketing and sale of medical products, government regulation and general economic conditions and other risks and uncertainties described in Medtronic plc’s periodic reports on file with the U.S. Securities and

Exchange Commission and described in and

3

incorporated by reference into the Registration Statement on Form S-4 of Medtronic plc, Medtronic, Inc. and Medtronic Global Holdings S.C.A., as filed with the U.S. Securities and Exchange

Commission, relating to the exchange offers. Actual results may differ materially from anticipated results. None of Medtronic plc, Medtronic, Inc. or Medtronic Global Holdings S.C.A. undertakes to update its forward-looking statements or

any of the information contained in this press release, even in the event that the information becomes materially inaccurate.

4

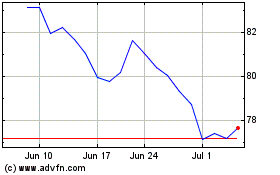

Medtronic (NYSE:MDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

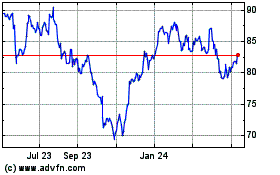

Medtronic (NYSE:MDT)

Historical Stock Chart

From Apr 2023 to Apr 2024