DUBLIN - September 1, 2015 -

Medtronic plc (the "Company") (NYSE: MDT) today announced the final

results of its exchange offers (the "exchange offers") with respect

to:

(i) up to

$500,000,000 aggregate principal amount of outstanding Floating

Rate Senior Notes due March 15, 2020 issued by Medtronic, Inc.

("Medtronic, Inc."), together with the subsequent full and

unconditional guarantees of such notes by the Company and Medtronic

Global Holdings S.C.A. ("Medtronic Luxco" and, together with the

Company, the "guarantors," and such notes together with such

guarantees, the "original floating rate notes"), for a like

principal amount of Floating Rate Senior Notes due March 15, 2020,

issued by Medtronic, Inc. and guaranteed by the guarantors, which

have been registered under the Securities (the "exchange floating

rate notes");

(ii) up to

$1,000,000,000 aggregate principal amount of outstanding 1.500%

Senior Notes due March 15, 2018 issued by Medtronic, Inc. together

with the subsequent full and unconditional guarantees of such notes

by the guarantors (such notes together with such guarantees, the

"original 2018 notes") for a like principal amount of 1.500% Senior

Notes due March 15, 2018, issued by Medtronic, Inc. and guaranteed

by the guarantors, which have been registered under the Securities

Act (the "exchange 2018 notes");

(iii) up to

$2,500,000,000 aggregate principal amount of outstanding 2.500%

Senior Notes due March 15, 2020 issued by Medtronic, Inc. together

with the subsequent full and unconditional guarantees of such notes

by the guarantors (such notes together with such guarantees, the

"original 2020 notes") for a like principal amount of 2.500% Senior

Notes due March 15, 2020, issued by Medtronic, Inc. and guaranteed

by the guarantors, which have been registered under the Securities

Act (the "exchange 2020 notes");

(iv) up to

$2,500,000,000 aggregate principal amount of outstanding 3.150%

Senior Notes due March 15, 2022 issued by Medtronic, Inc. together

with the subsequent full and unconditional guarantees of such notes

by the guarantors (such notes together with such guarantees, the

"original 2022 notes") for a like principal amount of 3.150% Senior

Notes due March 15, 2022, issued by Medtronic, Inc. and guaranteed

by the guarantors, which have been registered under the Securities

Act (the "exchange 2022 notes");

(v) up to

$4,000,000,000 aggregate principal amount of outstanding 3.500%

Senior Notes due March 15, 2025 issued by Medtronic, Inc. together

with the subsequent full and unconditional guarantees of such notes

by the guarantors (such notes together with such guarantees, the

"original 2025 notes") for a like principal amount of 3.500% Senior

Notes due March 15, 2025, issued by Medtronic, Inc. and guaranteed

by the guarantors, which have been registered under the Securities

Act (the "exchange 2025 notes");

(vi) up to

$2,500,000,000 aggregate principal amount of outstanding 4.375%

Senior Notes due March 15, 2035 issued by Medtronic, Inc. together

with the subsequent full and unconditional guarantees of such notes

by the guarantors (such notes together with such guarantees, the

"original 2035 notes") for a like principal amount of 4.375% Senior

Notes due March 15, 2035, issued by Medtronic, Inc. and guaranteed

by the guarantors, which have been registered under the Securities

(the "exchange 2035 notes"); and

(vii) up to

$4,000,000,000 aggregate principal amount of outstanding 4.625%

Senior Notes due March 15, 2045 issued by Medtronic, Inc. together

with the subsequent full and unconditional guarantees of such notes

by the guarantors (such notes together with such guarantees, the

"original 2045 notes" and, together with the original floating rate

notes, original 2018 notes, original 2020 notes, original 2022

notes, original 2025 notes, and original 2035 notes, the "original

notes") for a like principal amount of 4.625% Senior Notes due

March 15, 2045, issued by Medtronic, Inc. and guaranteed by the

guarantors, which have been registered under the Securities Act

(the "exchange 2045 notes" and, together with the exchange floating

rate notes, exchange 2018 notes, exchange 2020 notes, exchange 2022

notes, exchange 2025 notes, and exchange 2035 notes, the "exchange

notes").

The exchange offers commenced on August 4, 2015

and expired at 11:59 p.m., New York City time, on August 31,

2015.

Wells Fargo Bank, National Association, acting as

exchange agent for the exchange offers, advised the Company

that:

(i)

$495,000,000 of the $500,000,000 aggregate principal amount of the

original floating rate notes have been validly tendered for

exchange, representing 99.000% of the principal amount of the

outstanding original floating rate notes;

(ii)

$999,800,000 of the $1,000,000,000 aggregate principal amount of

the original 2018 notes have been validly tendered for exchange,

representing 99.980% of the principal amount of the outstanding

original 2018 notes;

(iii)

$2,368,955,000 of the $2,500,000,000 aggregate principal amount of

the original 2020 notes have been validly tendered for exchange,

representing 94.758% of the principal amount of the outstanding

original 2020 notes;

(iv)

$2,494,335,000 of the $2,500,000,000 aggregate principal amount of

the original 2022 notes have been validly tendered for exchange,

representing 99.773% of the principal amount of the outstanding

original 2022 notes;

(v)

$3,979,850,000 of the $4,000,000,000 aggregate principal amount of

the original 2025 notes have been validly tendered for exchange,

representing 99.496% of the principal amount of the outstanding

original 2025 notes;

(vi)

$2,499,000,000 of the $2,500,000,000 aggregate principal amount of

the original 2035 notes have been validly tendered for exchange,

representing 99.960% of the principal amount of the outstanding

original 2035 notes; and

(vii)

$3,995,189,000 of the $4,000,000,000 aggregate principal amount of

the original 2045 notes have been validly tendered for exchange,

representing 99.880% of the principal amount of the outstanding

original 2045 notes.

In accordance with the terms of the exchange

offers, the Company has accepted all of the original notes validly

tendered and not withdrawn.

This announcement does not constitute an offer to

purchase any securities or the solicitation of an offer to sell any

securities. The exchange offer was made only pursuant to the

prospectus dated August 4, 2015 and the related letter of

transmittal and only to such persons and in such jurisdictions as

is permitted under applicable law.

About Medtronic

Medtronic plc (www.medtronic.com), headquartered in Dublin,

Ireland, is the global leader in medical technology - alleviating

pain, restoring health and extending life for millions of people

around the world.

This press release contains

forward-looking statements, which are statements other than

statements of historical fact, relating to Medtronic plc,

Medtronic, Inc. and Medtronic Global Holdings S.C.A. Such

forward looking statements are subject to risks and uncertainties,

such as competitive factors, difficulties and delays inherent in

the development, manufacturing, marketing and sale of medical

products, government regulation and general economic conditions and

other risks and uncertainties described in Medtronic plc's periodic

reports on file with the U.S. Securities and Exchange Commission

and described in and incorporated by reference into the

Registration Statement on Form S-4 of Medtronic plc, Medtronic,

Inc. and Medtronic Global Holdings S.C.A., as filed with the U.S.

Securities and Exchange Commission, relating to the exchange

offers. Actual results may differ materially from anticipated

results. None of Medtronic plc, Medtronic, Inc. or Medtronic Global

Holdings S.C.A. undertakes to update its forward-looking statements

or any of the information contained in this press release, even in

the event that the information becomes materially

inaccurate.

Contacts:

Cindy Resman

Public Relations

+1-763-505-0291

Ryan Weispfenning

Investor Relations

+1-763-505-4626

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Medtronic plc via Globenewswire

HUG#1949136

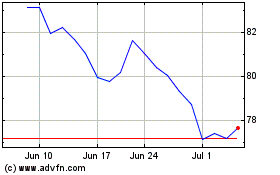

Medtronic (NYSE:MDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

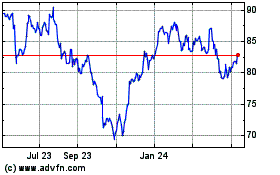

Medtronic (NYSE:MDT)

Historical Stock Chart

From Apr 2023 to Apr 2024