UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant þ Filed by a Party other than the

Registrant ¨

Check the appropriate box:

| ¨ |

|

Preliminary Proxy Statement |

| ¨ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| x |

Definitive Proxy Statement |

| ¨ |

|

Definitive Additional Materials |

| ¨ |

|

Soliciting Material Pursuant to §240.14a-12 |

MEDTRONIC PUBLIC LIMITED COMPANY

(Name of Registrant as Specified In Its Charter)

(Name of Person(s)

Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ |

|

Fee computed on table below per Exchange Act Rules 14a-60(i)(l) and

0-11. |

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined): |

| |

(4) |

Proposed maximum aggregate value of transaction: |

| ¨ |

|

Fee paid previously with preliminary materials. |

| ¨ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing

for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

Amount Previously Paid: |

| |

(2) |

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

Proxy Statement

AND NOTICE OF 2015 ANNUAL GENERAL MEETING OF SHAREHOLDERS

|

Friday, December 11, 2015, at 9 a.m. Local Time

Dublin, Ireland

NOTICE OF ANNUAL GENERAL MEETING

MEETING AGENDA:

| 1. |

Electing, by separate resolutions, the 13 director nominees named in the proxy statement to hold office until the 2016 Annual General Meeting of the Company;

|

| 2. |

Ratifying the re-appointment of PricewaterhouseCoopers LLP as the Company’s independent auditor for fiscal year 2016 and authorizing the Board of Directors, acting through

the Audit Committee, to set its remuneration; |

| 3. |

Advisory approval of the Company’s executive compensation; |

| 4. |

Advisory approval of the frequency of Say-on-Pay votes; |

| 5. |

To receive and consider the Company’s Irish Statutory Accounts for the fiscal year ended April 24, 2015 and the reports of the directors and auditors thereon and to review

the affairs of the Company; and |

| 6. |

Transacting any other business that may properly come before the meeting. |

Proposals 1 to 4 above are ordinary resolutions requiring a simple majority of the votes cast at the meeting. All proposals are more fully described in this proxy statement. There is no requirement under Irish law

that Medtronic’s Irish Statutory Accounts for the fiscal year ended April 24, 2015 or the directors’ and auditor’s reports thereon be approved by the shareholders, and no such approval will be sought at the annual general

meeting.

By order of the Board of Directors,

Bradley E. Lerman

Senior

Vice President, General Counsel and Company Secretary

August 1, 2015

|

| YOUR VOTE IS IMPORTANT. WE ENCOURAGE YOU TO VOTE. |

| If possible, please vote your shares using the toll-free telephone number or Internet instructions found in the Notice. Alternatively, you may request a printed copy of the proxy materials and mark, sign, date and

mail your proxy form to the Company’s registered office in the postage-paid envelope that will be provided. Voting by any of these methods will not limit your right to vote in person at the annual general meeting.

Under New York Stock Exchange rules, if you hold your shares in

“street” name through a brokerage account, your broker will NOT be able to vote your shares on non-routine matters being considered at the annual general meeting unless you have given instructions to your broker prior

to the meeting on how to vote your shares. Proposals 1, 3 and 4 are not considered routine matters under New York Stock Exchange rules. This means that you must give specific voting instructions to your broker on how to vote your shares so that your

vote can be counted. |

|

|

|

| Date: |

|

Friday, December 11, 2015 |

|

|

| Time: |

|

9:00 a.m. local time |

|

|

| Location: |

|

Conrad Dublin Hotel Earlsfort Terrace Dublin 2, Ireland |

Record date:

Shareholders of record at the close of business on October 12, 2015 are entitled to vote at the meeting.

Online proxy delivery and voting: As permitted by the Securities and Exchange Commission, we are making this proxy statement, the Company’s

annual report to shareholders and our Irish statutory accounts available to our shareholders electronically via the Internet. We believe electronic delivery expedites your receipt of materials, reduces the environmental impact of our annual general

meeting and reduces costs significantly. The Notice Regarding Internet Availability of Proxy Materials (the “Notice”) contains instructions on how you can access the proxy materials and how to vote online. If you received the Notice by

mail, you will not receive a printed copy of the proxy materials unless you request one in accordance with the instructions provided in the Notice. The Notice has been mailed to shareholders on or about October 22, 2015 and provides

instructions on how you may access and review the proxy materials on the Internet and how to vote.

Admission to the Annual General Meeting: If you wish to attend the Annual General Meeting, you must be a shareholder on the record date and request

an admission ticket in advance by visiting www.proxyvote.com and following the instructions provided (you will need the 12 digit number included on your proxy card, voter instruction form or notice), or bring proof of ownership of

ordinary shares to the meeting. Tickets will be issued to registered and beneficial owners and to one guest accompanying each registered or beneficial owner.

Important Notice Regarding the Availability of Proxy Materials for the Annual General Meeting of Shareholders to be held on December 11, 2015: This proxy statement, the Company’s 2015 Annual Report to

Shareholders and our Irish Statutory Accounts for the year ended April 24, 2015 are available at www.proxyvote.com.

TABLE OF CONTENTS

PROXY SUMMARY

This summary highlights information described in more detail elsewhere in this proxy statement. It does not contain all of the information that you should consider, and you should read the entire proxy statement

carefully before voting.

2015 Annual General Meeting of Shareholders

|

|

|

| Date and Time: |

|

Friday, December 11, 2015, at 9:00 a.m. (Local Time) |

|

|

| Place: |

|

Conrad Dublin Hotel Earlsfort

Terrace Dublin 2, Ireland |

|

|

| Commence Mail Date: |

|

October 22, 2015 |

|

|

| Record Date: |

|

October 12, 2015 |

Advance Voting Methods and Deadlines

|

|

|

|

|

|

|

|

|

| Method |

|

Instruction

|

|

|

|

Deadline |

|

|

|

|

|

Internet |

|

†

|

|

Go to http://www.proxyvote.com and follow the instructions (have your proxy card or internet notice in hand when you access the

website) |

|

Internet and telephone voting are available 24 hours a day, seven days a week up to these deadlines:

|

| |

|

|

|

†

|

|

Shares Held Through the Medtronic Puerto Rico Employees’ Savings and Investment Plan –

11:59 p.m., Eastern Standard Time, on December 8, 2015 |

| |

|

|

|

|

† |

|

Registered Shareholders or Beneficial Owners – 11:59 p.m., Eastern Standard Time, on December 10,

2015 |

|

|

|

|

|

|

Telephone |

|

† |

|

Dial 1-800-690-6903 and following the instructions (have your proxy card or internet notice in hand when you call) |

|

|

|

|

|

|

|

|

|

Mail |

|

†

|

|

Mark your selections on the enclosed proxy card |

|

Return promptly to ensure it is received before the date of the Annual General Meeting |

| |

†

|

|

Date and sign your name exactly as it appears on proxy card

|

|

|

|

|

| |

† |

|

Promptly mail the proxy card in the enclosed postage-paid envelope |

|

|

|

|

Questions and Answers About Attending our Annual General Meeting and Voting

We encourage you to review the questions and answers about our annual general meeting and voting beginning on page 1 to learn more about the rules

and procedures surrounding the proxy and annual general meeting process, as well as the business to be conducted at our Annual General Meeting. If you plan to attend the Annual General Meeting in person, we direct your attention to the information

following “Admission to the Meeting” on page 2.

If you wish to attend the Annual General Meeting, you must request an

admission ticket in advance.

Your vote is important! Please cast your vote and play a part in the future of Medtronic.

Voting Matters and Board Recommendations

|

|

|

|

|

|

|

| Proposal

|

|

Board Recommendation |

|

For More Information |

| Proposal 1 — |

|

To elect, by separate resolutions, the thirteen director nominees named in the proxy statement to hold office until the 2016 Annual

General Meeting of the Company |

|

“FOR” all

nominees |

|

Page 3 |

| Proposal 2 — |

|

To ratify the re-appointment of PricewaterhouseCoopers LLP as Medtronic’s independent auditor for fiscal year 2016 and authorize

the Board of Directors, acting through the Audit Committee, to set its remuneration |

|

“FOR” |

|

Page 66 |

| Proposal 3 — |

|

To approve, in a non-binding advisory vote, named executive officer compensation (a “Say-on-Pay” vote) |

|

“FOR” |

|

Page 67 |

| Proposal 4 — |

|

To approve, in a non-binding advisory vote, the frequency of

Say-on-Pay votes |

|

“FOR” |

|

Page 68 |

Director Nominees

You are being asked to vote, by separate resolutions, on the election of the following 13 Directors. Each Director nominee is elected annually by a majority of votes cast. Detailed information about each

Director’s background, skill sets and areas of expertise can be found beginning on page 3.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Committee Memberships |

|

Other

Current

Public

Boards |

| Name |

|

Age* |

|

Director

Since |

|

Principal Position |

|

Indep. |

|

AC |

|

CC |

|

FC |

|

NCGC |

|

QTC |

|

| Richard H. Anderson |

|

60 |

|

2002 |

|

Chief Executive Officer of Delta Air Lines, Inc. |

|

Y |

|

|

|

M |

|

|

|

C |

|

|

|

1 |

| Craig Arnold |

|

55 |

|

2015 |

|

Vice Chairman and Chief Operating Officer of Industrial Sector of Eaton Corporation |

|

Y |

|

|

|

M |

|

|

|

M |

|

|

|

0 |

| Scott C. Donnelly |

|

53 |

|

2013 |

|

Chairman, President and Chief Executive Officer of Textron, Inc. |

|

Y |

|

M |

|

M |

|

|

|

|

|

M |

|

1 |

| Randall Hogan, III |

|

59 |

|

2015 |

|

Chairman & Chief Executive Officer of Pentair plc |

|

Y |

|

M |

|

|

|

M |

|

|

|

|

|

1 |

| Omar Ishrak |

|

59 |

|

2011 |

|

Chairman and Chief Executive Officer of Medtronic plc |

|

N |

|

|

|

|

|

|

|

|

|

|

|

0 |

| Shirley Ann Jackson, Ph.D. |

|

68 |

|

2002 |

|

President of Rensselaer Polytechnic Institute |

|

Y |

|

C |

|

|

|

|

|

M |

|

|

|

3 |

| Michael O. Leavitt |

|

64 |

|

2011 |

|

Founder and Chairman of Leavitt Partners |

|

Y |

|

|

|

|

|

M |

|

|

|

M |

|

1 |

| James T. Lenehan |

|

66 |

|

2007 |

|

Financial Consultant and retired Vice Chairman and President of Johnson & Johnson |

|

Y |

|

|

|

|

|

M |

|

|

|

C |

|

0 |

| Elizabeth Nabel, M.D. |

|

63 |

|

2014 |

|

President of Brigham & Women’s Healthcare |

|

Y |

|

|

|

|

|

|

|

M |

|

M |

|

0 |

| Denise M. O’Leary |

|

57 |

|

2000 |

|

Private Venture Capital Investor |

|

Y |

|

|

|

M |

|

M |

|

|

|

|

|

2 |

| Kendall J. Powell |

|

61 |

|

2007 |

|

Chairman and Chief Executive Officer of General Mills, Inc. |

|

Y |

|

M |

|

C |

|

|

|

M |

|

|

|

1 |

| Robert C. Pozen |

|

68 |

|

2004 |

|

Former Chairman of MFS Investment Management |

|

Y |

|

M |

|

|

|

C |

|

|

|

|

|

1 |

| Preetha Reddy |

|

57 |

|

2012 |

|

Executive Vice Chairperson of Apollo Hospitals Enterprise Limited |

|

Y |

|

|

|

|

|

M |

|

|

|

M |

|

0 |

| |

*Age is as of the date the Proxy Statement was filed with the SEC.

|

|

|

|

|

| AC: Audit Committee

CC: Compensation Committee

FC: Finance Committee |

|

NCGC: Nominating and Corporate Governance Committee

QTC: Quality and Technology Committee |

|

C: Chair

M: Member |

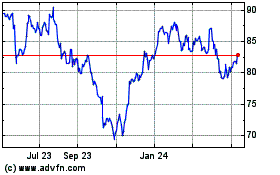

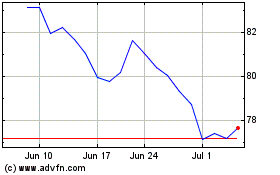

Performance Highlights

On January 26, 2015, Medtronic plc acquired Covidien plc, a public limited company organized under the laws of Ireland (Covidien), and Medtronic, Inc., a Minnesota corporation (Medtronic). In connection with the

transaction, Medtronic, Inc. and Covidien were combined under and became subsidiaries of Medtronic plc, a public limited company organized under the laws of Ireland (Medtronic).

Medtronic is the global leader in medical technology – alleviating pain, restoring health, and extending life for millions of people around

the world. Fiscal year 2015 was a transformational year for Medtronic, with the announcement of the Covidien acquisition in the first quarter and subsequent closing of the transaction in the fourth quarter. During fiscal year 2015, we delivered

consistent and dependable revenue growth across all four of our groups: Cardiac and Vascular, Minimally Invasive Therapies, Restorative Therapies, and Diabetes. This was a result of our continued focus on our three strategies: Therapy Innovation,

Globalization, and Economic Value. Fiscal year 2015 was a strong year for therapy innovation at Medtronic, with all four groups launching meaningful innovations, including those that make advances into new disease areas, innovate on our existing

market leading technologies, or enhance our diagnostic, therapy, and monitoring products with key wrap-around programs. We continue to focus on addressing the evolving needs of our customers regarding delivery system efficiency and more integrated,

connected care models for patients around the world. We feel we are well positioned to demonstrate the role medical technology and related services can play in improving healthcare system efficiency and care integration in key disease states, and to

serve as a key partner and collaborator with the healthcare systems, payers, and governments who are working to deliver better patient outcomes at lower costs.

Ultimately, our fiscal year 2015 results reflect the dedication and passion of over 92,000 full-time equivalent employees collaborating with our partners in healthcare to deliver therapies and services to millions

of patients around the globe to fulfill our Mission. A few of our most notable performance highlights include the following:

| |

➤ |

|

We closed the acquisition of Covidien on January 26, 2015 to create the industry leading Global Medical Device company. |

| |

➤ |

|

We achieved revenue of $20.3 billion and cash flows from operations of $4.9 billion. |

| |

• |

|

Grew topline revenues by 6% year-over year on a constant currency basis.(1) |

| |

• |

|

Grew earnings per share by 6%

year-over-year.(1) |

| |

➤ |

|

Medtronic’s stock price increased by 33.3% during Fiscal Year 2015 (add appropriate qualifiers/disclaimers). |

| |

➤ |

|

We returned $3.3 Billion, over 50 percent of our free cash flow, to shareholders through dividends and share repurchases and increased our dividend for the 37th

consecutive year. |

| |

➤ |

|

We began the integration of Covidien, embarking on our goal of delivering a minimum of $850 million in cost synergies by the end of fiscal year 2018.

|

| |

➤ |

|

We had robust growth in the second year of our Cath Lab Managed Services business, ending the year with 50 long-term agreements with hospital systems to manage

their cath labs, which collectively represent $1.1 billion in revenue over the life of these contracts. |

| |

➤ |

|

Our Cardiac Rhythm & Heart Failure division grew 5 percent, driven in part by the robust growth of our Reveal

LINQ® Insertable Cardiac Monitor (ICM) System, which is used for the diagnosis from unexplained syncope, atrial

fibrillation, and cryptogenic stroke. |

| |

➤ |

|

We experienced strong customer adoption in CE Mark countries for our CoreValve® Evolut® R next-generation

self-expanding transcatheter aortic valve system, which features an option to recapture and reposition the valve during the procedure and a differentiated 14-French equivalent delivery catheter allowing access to smaller anatomies.

|

| |

➤ |

|

We received FDA approval and launched our

IN.PACT® Admiral® drug-coated balloon in the United States, which drove solid fourth quarter growth in our Aortic & Peripheral Vascular division. |

| (1) |

Revenue growth rate on a comparable, constant currency basis and diluted EPS are considered “non-GAAP” financial measures under applicable SEC rules and regulations.

Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in Appendix A of this proxy statement. |

| |

➤ |

|

We saw strong adoption of our Solitaire™ FR revascularization device in our Neurovascular division following the presentation of four meaningful clinical

trials at the International Stroke Conference in February, and subsequent publication of three of these studies in the New England Journal of Medicine. These studies provided evidence that the standard of care for the treatment of stroke should be

changed to include stent thrombectomy as a primary treatment in addition to IV tPA. |

| |

➤ |

|

We began the launch in select international countries of the MiniMed® 640G System in our Diabetes group, which features a new insulin pump design, the Enhanced Enlite™ continuous glucose monitoring sensor, and SmartGuard™

technology, which can automatically suspend insulin delivery when sensor glucose levels are predicted to approach a low limit and then resume insulin delivery once levels recover. |

Executive Compensation Philosophy, Goals and Principles

Our compensation programs are designed to align the interests of our NEOs with those of our shareholders. We provide market competitive programs that enable us to attract and retain highly talented individuals with

pay linked to the attainment of short-and long-term performance goals according to the following principles:

| |

➤ |

|

We attract and retain talented executives by providing market competitive total direct compensation consisting of base salary, annual cash incentives, and

long-term cash and equity incentives. |

| |

➤ |

|

We attempt to calibrate all elements of total direct compensation at the market median, with a +/- 15% range developed for base salary and annual incentives, and

a +/- 20% range for long-term incentives and total direct compensation. |

| |

➤ |

|

We couple competitive total direct compensation with comprehensive benefits to support retirement, health and wellness, and other life events.

|

| |

➤ |

|

We emphasize pay for performance by basing at least 75% of total direct compensation on short-term and long-term financial incentives with a heavy emphasis on

long-term performance. |

| |

➤ |

|

Short-term and long-term incentives align executives with shareholders by using annual and three-year performance measures that drive shareholder value.

Short-term and long-term incentive goals are derived from our Board-approved annual operating plan and Board-approved long-term strategic guidance provided to investors, respectively. |

| |

➤ |

|

We also emphasize a culture of quality through the executives’ annual incentive plan. Payouts are reduced if a quality compliance performance threshold is

not achieved. The modifier cannot increase payouts under the annual incentive plan. The quality modifier is based on maintaining quality standards that prevent U.S. Food and Drug Administration inspection observations and warning letters. The

modifier is designed not to impede proactive quality actions such as product recalls and complaint handling procedures. |

| |

➤ |

|

We hold an annual advisory vote regarding named executive officer compensation. Last year, 95.65% of votes cast were in favor of the Medtronic, Inc. say-on-pay

resolution. |

For additional information, see the CD&A and Executive Compensation sections of this Proxy Statement.

Corporate Governance Highlights

|

|

|

|

|

| Strong Lead Independent Director

SEE PAGE 11 |

|

Annual Board and Committee Evaluation Processes

SEE PAGE 12 |

|

Robust Risk

Management

Program SEE PAGE 11 |

|

Stock Ownership Guidelines for Named Executive Officers and Directors

SEE PAGES 20 AND 43 |

|

Annual Board of Director Elections and Majority Voting for Directors

SEE PAGE 3 |

|

Regular Executive

Sessions of

Independent Directors SEE PAGE 11 |

|

Maintain High Ethical Standards Through Written Policies and Actions (Includes Codes of

Conduct, U.S. Patient Privacy Principles, Political Contribution Policy, and Policies Regarding

Environmental, Health and Safety and the Use of Animals) SEE PAGE 21 AND OUR INVESTOR RELATIONS WEBSITE |

PROXY STATEMENT

Medtronic plc

Registered Address—

20 on Hatch, Lower Hatch Street

Dublin 2, Ireland

This proxy statement, the accompanying proxy form, Medtronic’s annual report for the year ended April 24, 2015, and our Irish Statutory Accounts for the year ended April 24, 2015 will be made

available or sent to shareholders commencing on or about October 22, 2015.

Throughout this proxy statement, all references to our Board of

Directors (or its committees) or officers for periods prior to January 26, 2015, are references to the Board of Directors (or its committees) or officers, respectively, of Medtronic, Inc., our predecessor. Similarly, all references to the

Company for such periods refer to Medtronic, Inc.

Voting by Proxy

Shareholders of the Company who are entitled to attend and vote at the Annual General Meeting are entitled to appoint a proxy or proxies to attend and vote at the Annual General Meeting on their behalf. A proxy is

not required to be a shareholder of the Company.

Proxy Solicitation

Medtronic’s Board of Directors solicits your proxy for use at the 2015 annual general meeting of shareholders and any adjournments or postponements of the

meeting.

In addition to soliciting proxies over the Internet and through the mail, certain persons may solicit proxies in person

or by telephone or fax. Medtronic has retained The Proxy Advisory Group, LLC, 18 East 41st Street, Suite 2000, New York, New York 10017, to assist in the solicitation of proxies, primarily from brokers, banks and other nominees, for a fee of $15,000, plus reasonable out-of-pocket expenses. Brokerage

firms, nominees, custodians and fiduciaries may be asked to forward proxy soliciting material to the beneficial shareholders. All reasonable soliciting costs will be borne by Medtronic.

How Proxies will be Voted

The individuals named in the enclosed form of proxy have advised

the Board of their intention to vote at the meeting in accordance with instructions on all proxy forms submitted by shareholders and, where no contrary instruction is indicated on the proxy form, as follows: for the election by separate

resolution of the individuals nominated to serve as directors, for the ratification of PricewaterhouseCoopers LLP as independent auditor for fiscal year 2016 and authorizing Board of Directors, through the Audit Committee, to set its

remuneration, for advisory approval of the Company’s executive compensation, and for an annual (one year) Say-on-Pay frequency vote.

You may revoke a proxy by submitting a later-dated proxy, by notifying Medtronic by fax, email, letter sent to Medtronic’s registered office, or other

verifiable communication before the meeting, or by revoking it at the meeting. All properly executed or transmitted proxies not revoked will be voted at the meeting.

Voting at the Meeting

Each Medtronic shareholder of record at the

close of business on October 12, 2015 is entitled to one vote for each share then held. As of July 17, 2015, 1,414,188,681 Medtronic ordinary shares (par value US $0.0001 each) were outstanding and entitled to vote.

At the 2015 annual general meeting, the inspector of election appointed by the Board of Directors for the meeting will determine the presence of a quorum and

tabulate the results of shareholder voting. As provided by the Company’s Articles of Association, one or more shareholders present in person or by proxy holding not less than a majority of

Medtronic Proxy Statement and Notice of 2015 Annual General Meeting of Shareholders 1

PROXY STATEMENT

the issued and outstanding shares of Medtronic entitled to vote at the meeting will constitute a quorum. The inspector of election intends to treat as “present” for these purposes

shareholders who have submitted properly executed and transmitted proxies even if marked “abstain” as to some matters. The inspector will also treat as “present” shares held in “street name” by brokers that are voted on

at least one proposal to come before the meeting.

Adoption of all proposals to come before the meeting will require the affirmative vote of a majority

of the votes cast by the holders of ordinary shares represented at the annual general meeting in person or by proxy.

Abstentions and broker non-votes

will not be considered votes cast at the annual general meeting. The practical effect of this is that abstentions and shares held in “street name” by brokers that are not voted in respect of these proposals will not have any effect on the

outcome of voting on the proposals.

There is no requirement under Irish law that Medtronic’s Irish Statutory Accounts for the fiscal year ended

April 24, 2015 or the related directors’ and auditor’s reports thereon be approved by the shareholders, and no such approval will be sought at the annual general meeting.

Admission to the Meeting

If you wish to attend the Annual General Meeting, you must be a

shareholder on the record date and request an admission ticket in advance by visiting www.proxyvote.com and

following the instructions provided (you will need the 12 digit number included on your proxy card, voter instruction form or notice), or bring proof of ownership of ordinary shares to the meeting. Tickets will be issued to registered and beneficial

owners and to one guest accompanying each registered or beneficial owner.

Requests for admission tickets must be requested no later than

December 8, 2015. On the day of the meeting, each shareholder will be required to present valid picture identification such as a driver’s license or passport with their admission ticket. If you do not request an admission ticket in

advance, we will need to determine if you owned ordinary shares on the record date by:

| |

†

|

|

verifying your name and share ownership against our list of registered shareholders; or |

| |

†

|

|

asking to review evidence of your share ownership as of October 12, 2015, such as your brokerage statement. You must bring such evidence with you in order

to be admitted to the meeting. |

Seating will begin at 8:15 a.m. and the meeting will begin at 9:00 a.m. Cameras (including cell phones

with photographic capabilities), recording devices and other electronic devices will not be permitted at the meeting. You will be required to enter through a security check point before being granted access to the meeting.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements may be identified by words like “anticipate,” “expect,”

“project,” “believe,” “plan,” “may,” “estimate,” “intend” and other similar words. Forward-looking statements in this proxy statement include, but are not limited to, statements regarding

individual and Company performance objectives and targets, and statements relating to the benefits of Medtronic’s collaboration with Apollo Hospitals. These and other forward-looking statements are based on our beliefs, assumptions and

estimates using information available to us at the time and are not intended to be guarantees of future events or performance. Factors that may cause actual results to differ materially from those contemplated by the statements in this proxy

statement can be found in Medtronic’s periodic reports on file with the Securities and Exchange Commission. The forward-looking statements speak only as of the date of this proxy statement and undue reliance should not be placed on these

statements. We disclaim any intention or obligation to publicly update or revise any forward-looking statements. This cautionary statement is applicable to all forward-looking statements contained in this document.

2 Medtronic Proxy Statement and Notice of 2015 Annual General Meeting of Shareholders

PROPOSAL 1 — ELECTION OF DIRECTORS

Directors and Nominees

Our Board of Directors is currently

comprised of 13 members, all of whom serve for a term of one year or until a respective successor is elected and has qualified. All nominees are currently Medtronic directors who were elected by shareholders at the 2014 annual general meeting,

except Elizabeth Nabel, M.D., who was elected by the Board of Directors on September 14, 2014 and Craig Arnold and Randall Hogan, III, who were elected by the Board of Directors on January 26, 2015 as a result of the Covidien

Acquisition. In order to be elected as a director, each nominee must be appointed by an ordinary resolution and each must receive the affirmative vote of a majority of the votes cast by the holders of ordinary shares represented at the annual

general meeting in person or by proxy. If any of the nominees become unable or decline to serve, the individuals named as proxies in the enclosed proxy form will have the authority to vote for any substitutes who may be nominated in accordance with

Medtronic’s Articles of Association. However, we have no reason to believe that this will occur.

NOMINEES FOR DIRECTORS FOR

ONE-YEAR TERMS ENDING IN 2016:

|

|

|

|

|

|

|

RICHARD H. ANDERSON

Chief Executive Officer Delta Air Lines,

Inc. |

|

Director since 2002 age 60 |

| |

Mr. Anderson has been Chief Executive Officer of Delta Air Lines, Inc., a commercial

airline, since 2007. He was Executive Vice President of UnitedHealth Group Incorporated, a diversified health care company, and President, Commercial Services Group, of UnitedHealth Group Incorporated from 2006 to 2007, Executive Vice President of

UnitedHealth Group and Chief Executive Officer of its Ingenix subsidiary from 2004 until 2006. Mr. Anderson was Chief Executive Officer of Northwest Airlines Corporation from 2001 to 2004. Northwest Airlines Corporation and Delta Air Lines,

Inc. filed for bankruptcy in 2005, which is within two years of Mr. Anderson serving as an executive officer of each company. Mr. Anderson serves on the board of directors of Delta Air Lines, Inc.

Director

Qualifications: Mr. Anderson’s qualifications to serve on our Board include his more than 25 years of business, operational, financial and executive management experience. He also

serves on the board of directors of another public company. Mr. Anderson’s extensive experience, including within the health care industry and for Fortune 500 companies, allows him to contribute valuable strategic management and risk

assessment insight to Medtronic. |

|

|

|

|

|

CRAIG ARNOLD Vice

Chairman and Chief Operating Officer Industrial Sector of Eaton Corporation |

|

Director since 2015 age 55 |

| |

Mr. Arnold is the Vice Chairman and Chief Operating Officer, Industrial Sector of Eaton Corporation, a diversified industrial

manufacturer. From 2000 to 2008 he served as Senior Vice President of Eaton Corporation and President of the Fluid Power Group of Eaton. Prior to joining Eaton, Mr. Arnold was employed in a series of progressively more responsible positions at

General Electric Company from 1983 to 2000. Within the past five years, Mr. Arnold served as a director of Covidien plc, a leading global healthcare products company.

Director Qualifications: With his years of

managerial experience, both at Eaton and at General Electric, Mr. Arnold brings to the Board of Directors demonstrated management ability at senior levels. His position as Chief Operating Officer of the Eaton Industrial Sector gives Mr. Arnold

critical insights into the operational requirements of a large, multinational company. In addition, in previously serving on the Audit Committee of another public company, Mr. Arnold gained valuable experience dealing with accounting principles and

financial reporting rules and regulations, evaluating financial results and generally overseeing the financial reporting process of a large corporation. |

Medtronic Proxy Statement and Notice of 2015 Annual General Meeting of Shareholders 3

PROPOSAL 1 — ELECTION OF DIRECTORS

|

|

|

|

|

|

|

SCOTT C. DONNELLY

Chairman, President and Chief Executive Officer Textron,

Inc. |

|

Director since 2013 age 53 |

| |

Mr. Donnelly is Chairman, President and Chief Executive Officer of Textron, Inc., a producer

of aircraft, defense and industrial products. Mr. Donnelly joined Textron in June 2008 as Executive Vice President and Chief Operating Officer and was promoted to President and Chief Operating Officer in January 2009. He was appointed to the Board

of Directors in October 2009, became Chief Executive Officer of Textron in December 2009 and Chairman of the Board in September 2010. Previously, Mr. Donnelly was the President and CEO of General Electric Company’s aviation business unit,

GE Aviation, a leading maker of commercial and military jet engines and components as well as integrated digital, electric power and mechanical systems for aircraft. Prior to July 2005, Mr. Donnelly held various other management positions since

joining General Electric in 1989. Director Qualifications: Mr. Donnelly’s qualifications to serve on our Board include more than two decades of business experience in

innovation, manufacturing, sales and marketing, and business processes. Mr. Donnelly also serves on the board of directors of another public company. His extensive executive decision-making experience and corporate governance work make Mr. Donnelly

a valuable director. Additionally, Mr. Donnelly qualifies as an “audit committee financial expert” as defined by SEC rules. |

|

|

|

|

|

RANDALL J. HOGAN, III

Chairman & Chief Executive Officer Pentair

plc |

|

Director since 2015 age 59 |

| |

Mr. Hogan has been the Chief Executive Officer of Pentair plc, an industrial manufacturing company, since January 2001 and was

appointed Chairman in May 2002. From December 1999 to December 2000, he was President and Chief Operating Officer of Pentair and from March 1998 to December 1999, he was Executive Vice President and President of Pentair’s Electrical and

Electronic Enclosures Group. Prior to joining Pentair, he was President of the Carrier Transicold Division of United Technologies Corporation. Before that, he was with the Pratt & Whitney division of United Technologies, General Electric Company

and McKinsey & Company. Mr. Hogan is currently Chair of the board of the Federal Reserve Bank of Minneapolis. Within the past five years, Mr. Hogan served as a director of Covidien plc and as a director of Unisys Corporation.

Director

Qualifications: Having served in the roles of Chairman, Chief Executive Officer, President and Chief Operating Officer of Pentair, Mr. Hogan offers a wealth of management experience and business

acumen. Running a public company gives Mr. Hogan front-line exposure to many of the issues facing public companies, particularly on the operational, financial and corporate governance fronts. Mr. Hogan’s service on the Board of Directors and

Governance Committee of Unisys as well as on the Board of the Federal Reserve Bank of Minneapolis further augments his range of knowledge, providing experience on which he can draw while serving as a member of our Board and Audit Committee.

Additionally, Mr. Hogan qualifies as an “audit committee financial expert” as defined by SEC rules. |

4 Medtronic Proxy Statement and Notice of 2015 Annual General Meeting of Shareholders

PROPOSAL 1 — ELECTION OF DIRECTORS

|

|

|

|

|

|

|

OMAR ISHRAK Chairman and

Chief Executive Officer Medtronic plc |

|

Director since 2011 age 59 |

| |

Mr. Ishrak has been Chairman and Chief Executive Officer of Medtronic since 2011. Prior to

joining Medtronic, Mr. Ishrak served as President and Chief Executive Officer of GE Healthcare Systems, a comprehensive provider of medical imaging and diagnostic technology and a division of GE Healthcare, from 2009 to 2011. Before that,

Mr. Ishrak was President and Chief Executive Officer of GE Healthcare Clinical Systems from 2005 to 2008 and President and Chief Executive Officer of GE Healthcare Ultrasound and BMD from 1995 to 2004.

Director

Qualifications: Mr. Ishrak’s qualifications to serve on our Board include his more than 20 years in the health care industry and more than 31 years of technology development and business

management experience. Mr. Ishrak’s strong technical expertise and deep understanding of our customers, as well as his long history of success as a global executive in the medical technology industry, make him a valuable and qualified director

with critical technical, leadership and strategic skills. |

|

|

|

|

|

SHIRLEY ANN JACKSON, Ph.D. President Rensselaer Polytechnic Institute |

|

Director since 2002 age 68 |

| |

Dr. Jackson has been President of Rensselaer Polytechnic Institute, a technological research university, since 1999. She was Chair of

the U.S. Nuclear Regulatory Commission under President Clinton from 1995 to 1999, and Professor of Physics at Rutgers University and consultant to AT&T Bell Laboratories from 1991 to 1995. Dr. Jackson currently serves as co-chair of The

President’s Intelligence Advisory Board, appointed by President Obama in 2013. She is a member of the National Academy of Engineering and the American Philosophical Society and a Fellow of the American Academy of Arts and Sciences, the American

Association for the Advancement of Science, and the American Physical Society. She is a trustee of the Brookings Institution, a Life Trustee of M.I.T. and a member of the Council on Foreign Relations. She is also a director of FedEx Corporation, a

global courier delivery company, Public Service Enterprise Group, a publicly owned gas and electric utility company in the state of New Jersey, and International Business Machines Corporation, a multinational technology and consulting corporation.

Within the past five years, Dr. Jackson also served as a director of NYSE Euronext, a multinational financial services corporation, and Marathon Oil Corporation, a company with international operations in exploration and production, oil sands mining

and integrated gas.

Director Qualifications:

Dr. Jackson’s qualifications to serve on our Board include her leadership experience in government, industry and within a number of educational organizations (President, Rensselaer Polytechnic Institute; Trustee, M.I.T.), including those

that bring technological innovation to the marketplace. In addition, Dr. Jackson serves on the boards of directors of other public companies and has accumulated over 33 years of audit, compensation, and governance and nominating committee

experience, including as chair. Her leadership and strategic and innovative insight make her a valuable contributor to our Board. Additionally, Dr. Jackson qualifies as an “audit committee financial expert” as defined by SEC

rules. |

Medtronic Proxy Statement and Notice of 2015 Annual General Meeting of Shareholders 5

PROPOSAL 1 — ELECTION OF DIRECTORS

|

|

|

|

|

|

|

MICHAEL O. LEAVITT

Founder and Chairman Leavitt Partners |

|

Director since 2011 age 64 |

| |

Governor Leavitt has been founder and Chairman of Leavitt Partners, a healthcare and food

safety consulting firm, since 2009. Prior to that he was the United States Secretary of Health and Human Services from 2005 to 2009; Administrator of the Environmental Protection Agency from 2003 to 2005; and Governor of Utah from 1993 to 2003. He

is a director of American Express Company, a global services company. Director Qualifications: Governor Leavitt’s qualifications to serve on our Board include his extensive management and leadership

experience, including serving as the Governor of Utah, a large state with a diverse body of constituents, appointments to positions with the U.S. government, where he oversaw and advised on issues of national concern, and overseeing Leavitt

Partners, LLC’s work advising clients in the health care and food safety sectors. Mr. Leavitt’s decades of leadership experience with valuable knowledge of the governmental regulatory environment and corporate governance makes him a

valuable member of our Board. |

|

|

|

|

|

JAMES T. LENEHAN

Financial Consultant and Retired Vice Chairman and

President of Johnson & Johnson |

|

Director since 2007 age 66 |

| |

Mr. Lenehan served as President of Johnson & Johnson, an international pharmaceutical

company, from 2002 until 2004 when he retired after 28 years of service to Johnson & Johnson. During those 28 years, Mr. Lenehan also served as Vice Chairman of Johnson & Johnson from 2000 until 2004; Worldwide Chairman of Johnson &

Johnson’s Medical Devices and Diagnostics Group from 1999 until he became Vice Chairman of the Board; and Worldwide Chairman, Consumer Pharmaceuticals & Professional Group. Mr. Lenehan has been a financial consultant since 2004,

including serving as Senior Advisor of Cerberus Operations and Advisory Company, LLC, a private investment firm. Within the past five years, Mr. Lenehan served as a director of Talecris Biotherapeutics Holding Corp, a global biopharmaceutical

company. Director

Qualifications: Mr. Lenehan’s qualifications to serve on our Board include 31 years of business, operational and management experience in medical device, pharmaceutical, biotherapeutics and

related industries. He also serves on the board of directors of private companies. His management ability at senior levels and financial experience make his input valuable to Medtronic. |

|

|

|

|

|

ELIZABETH G. NABEL, M.D.

President of Brigham & Women’s Healthcare |

|

Director since 2014 age 63 |

| |

Elizabeth Nabel, M.D., has been President of Brigham & Women’s Healthcare, hospitals operating inpatient and outpatient

facilities, clinics, primary care health centers, and diagnostic and treatment technologies and research laboratories, as well as Harvard Medical School’s second largest teaching affiliate. Dr. Nabel has also been a Professor of Medicine at

Harvard Medical School since 2010. Prior to that, Dr. Nabel held a variety of roles at the National Heart, Lung and Blood Institute at the National Institutes of Health, a federal agency funding research, training, and education programs to promote

the prevention and treatment of heart, lung, and blood diseases, from 1999 to 2009, including as Director. Dr. Nabel is an elected member of the Institute of Medicine of the National Academy of Sciences.

Director

Qualifications: Dr. Nabel’s qualifications to serve on the Board include extensive experience in the health care field, including senior positions with a number of research universities and

organizations. Dr. Nabel has a deep understanding of medical sciences and innovations, as well as physicians and other health care providers who are central to the use and development of our products. |

6 Medtronic Proxy Statement and Notice of 2015 Annual General Meeting of Shareholders

PROPOSAL 1 — ELECTION OF DIRECTORS

|

|

|

|

|

|

|

DENISE M. O’LEARY

Private Venture Capital Investor |

|

Director since 2000 age 57 |

| |

Ms. O’Leary has been a private venture capital investor in a variety of early stage

companies since 1996. Ms. O’Leary is also a director of American Airlines Group, Inc., a commercial airline, and Calpine Corporation, a national power generation company based in the United States. She was a member of the Stanford University

Board of Trustees from 1996 through 2006, where she chaired the Committee of the Medical Center. Within the past five years, Ms. O’Leary served as a director of US Airways Group, Inc., a commercial airline.

Director

Qualifications: Ms. O’Leary’s qualifications to serve on our Board include her extensive experience with companies at a variety of stages and her success as an investor. She also serves

on the boards of directors of other public companies. Her financial expertise, experience in the oversight of risk management, and thorough knowledge and understanding of capital markets provide valuable insight with regard to corporate governance

and financial matters. |

|

|

|

|

|

KENDALL J. POWELL

Chairman and Chief Executive Officer General Mills,

Inc. |

|

Director since 2007 age 61 |

| |

Mr. Powell has been Chairman of General Mills, Inc., an international producer, marketer

and distributor of cereals, snacks and processed foods, since 2008 and Chief Executive Officer of General Mills, Inc. since 2007. He was President and Chief Operating Officer of General Mills, Inc. from 2006 to 2007, and became a director of General

Mills, Inc. in 2006; Executive Vice President and Chief Operating Officer, U.S. Retail from 2005 to 2006; and Executive Vice President of General Mills, Inc. from 2004 to 2005. From 1999 to 2004, Mr. Powell was Chief Executive Officer of Cereal

Partners Worldwide, a joint venture of General Mills, Inc. and the Nestle Corporation. Mr. Powell joined General Mills, Inc. in 1979.

Director Qualifications: Mr. Powell’s

qualifications to serve on our Board include more than three decades of business, operational and management experience. Mr. Powell also serves on the board of directors of another public company. His extensive marketing and executive

decision-making experience and corporate governance work make Mr. Powell a valuable director. Additionally, Mr. Powell qualifies as an “audit committee financial expert” as defined by SEC rules. |

|

|

|

|

|

ROBERT C. POZEN Former

Chairman MFS Investment Management |

|

Director since 2004 age 68 |

| |

Mr. Pozen was Chairman of MFS Investment Management and a director of MFS Mutual Funds from 2004 until 2011. He previously was

Secretary of Economic Affairs for the Commonwealth of Massachusetts in 2003 and the John Olin Visiting Professor at Harvard Law School from 2002 to 2003. He also was Vice Chairman of Fidelity Investments from 2000 to 2001 and President of Fidelity

Management & Research from 1997 to 2001. From 2007 to 2008, he was the chairman of the SEC Advisory Committee on Improvements to Financial Reporting; and from January 2008 through June 2015, he was a senior lecturer at Harvard Business

School. Mr. Pozen currently serves on the board of Nielsen Holdings N.V., a global information and measurement company, and on the board of Asset Management Company, a fund management subsidiary of The World Bank Group. As of July 2015, he also is a

senior lecturer at M.I.T. Sloan School of Management. Within the past five years, Mr. Pozen also served as a director of MFS Investment Management, a global asset manager, and MFS Mutual Funds, a global provider of mutual fund services.

Director

Qualifications: Mr. Pozen’s qualifications to serve on our Board include his many successful investing experiences. He also served on President George W. Bush’s Commission to

Strengthen Social Security and as Secretary of Economic Affairs for Massachusetts Governor Mitt Romney. His extensive financial knowledge, previous performance as a board member, and years of work in corporate governance make Mr. Pozen a qualified

and valuable director. Additionally, Mr. Pozen qualifies as an “audit committee financial expert” as defined by SEC rules. |

Medtronic Proxy Statement and Notice of 2015 Annual General Meeting of Shareholders 7

PROPOSAL 1 — ELECTION OF DIRECTORS

|

|

|

|

|

|

|

PREETHA REDDY Executive

Vice Chairperson Apollo Hospitals Enterprise Limited |

|

Director since 2012 age 57 |

| |

Ms. Reddy has been Managing Director of Apollo Hospitals Enterprise Limited, a specialized hospital system in India and a division of

The Apollo Group, since 1993. Prior to that she was Joint Managing Director from 1991-1993 and Director of Apollo Hospitals since February 1989. Ms. Reddy serves on several boards under the Apollo Group, an owner of for-profit educational

institutions. She is a member of the Wipro Business Leadership Council, and Senior Vice President of the All India Management Association (AIMA).

Director Qualifications: Ms. Reddy’s

qualifications to serve on our Board include her extensive experience in the field of health and managing the operations of one of the largest hospital chains in India and its network of highly skilled professionals. She also serves on the Boards of

Directors of other organizations. Ms. Reddy has worked with industry bodies and government in India to advance health care in India. Her extensive experience in health care in developing countries and in managing complex organizations makes her a

valuable director. |

THE BOARD RECOMMENDS A VOTE FOR THE DIRECTOR NOMINEES.

Director Independence

Under the New York Stock Exchange Corporate Governance Standards, to be considered independent, a director must be determined to have no material relationship with Medtronic, other than as a director. The Board of

Directors has determined that the following directors, comprising all of our non-management directors, are independent under the New York Stock Exchange Corporate Governance Standards: Messrs. Anderson, Arnold, Donnelly, Hogan, Lenehan, Powell and

Pozen, Dr. Jackson, Dr. Nabel, Governor Leavitt and Mses. O’Leary and Reddy. In making this determination, the Board considered any current or proposed relationships that could interfere with a director’s ability to exercise

independent judgment, including those identified by Medtronic’s Standards for Director Independence, which correspond to the New York Stock Exchange standards on independence. These standards identify certain types of relationships that are

categorically immaterial and do not, by themselves, preclude the directors from being independent. The types of relationships and the directors who have had such relationships include:

| |

➤ |

|

being a current employee, or having an immediate family member who is an executive officer, of an entity that has made or is expected to make immaterial payments

to, or that has received or is expected to receive immaterial payments from, Medtronic for property or services, and each such relationship with Medtronic, through the relevant entity, is transactional in nature and is not a material transactional

relationship (Messrs. Anderson, Arnold, Donnelly, Hogan, Lenehan, Powell and Pozen, Dr. Jackson, Dr. Nabel, Governor Leavitt and Ms. Reddy); |

| |

➤ |

|

Governor Leavitt’s anticipated relationship with Medtronic will relate to limited consulting services and will not be a material relationship; and

|

| |

➤ |

|

being an employee or executive officer of a non-profit organization to which Medtronic or The Medtronic Foundation has made immaterial contributions (Mr. Pozen,

Dr. Jackson and Dr. Nabel). |

All of the relationships of the types listed above were entered into, and

payments were made or received, by Medtronic in the ordinary course of business and on competitive terms, and no director participated in negotiations regarding, nor approved, any such purchases or sales. Aggregate payments to, transactions with or

discretionary charitable contributions to each of the relevant organizations did not exceed the greater of $1,000,000 or 2% of that organization’s consolidated gross revenues for any of that organization’s last three fiscal years. The

Board reviewed the transactions with each of these organizations and determined that they were made in the ordinary course of business, the directors had no role with respect to the Company’s decision to make any of the purchases or sales, the

nature and amount of payments involved in the transactions would not influence the directors’ objectivity in the

8 Medtronic Proxy Statement and Notice of 2015 Annual General Meeting of Shareholders

PROPOSAL 1 — ELECTION OF DIRECTORS

boardroom or have a meaningful impact on any such director’s ability to satisfy his or her fiduciary standards on behalf of Medtronic’s shareholders.

In the course of fulfilling its duties, the Board of Directors also considered relationships in which the director had a further removed

relationship with the relevant third party, such as being a director (rather than an employee or executive officer) of an organization that engages in a business relationship with Medtronic or receives discretionary charitable contributions from

Medtronic or its affiliates. The Board determined that no such further removed relationships impact the independence of its directors.

The Board of Directors also considered a director’s spouse who provided non-professional services to, but was not an employee of, The

Medtronic Foundation where payments to the spouse did not exceed $120,000, and the employment of a director’s daughter by Medtronic. The Board of Directors determined that none of the relationships were material and that their existence would

not influence the director’s objectivity in the boardroom or have a meaningful impact on the director’s ability to satisfy fiduciary standards on behalf of Medtronic’s shareholders.

During fiscal year 2015, Medtronic entered into a consulting services agreement with Leavitt Partners, LLC, of which Michael O. Leavitt, a current

director of Medtronic, is the founder, chairman and less than 50% equity owner. Under the consulting agreement, which ran from July 11, 2014 through October 10, 2014, Medtronic paid Leavitt Partners, LLC an aggregate of approximately

$90,000, plus reimbursable incidental expenses incurred in connection with the delivery of services thereunder. In addition, effective via a third-party’s contract assignment to Leavitt Partners, LLC dated January 1, 2014, Medtronic and

Leavitt Partners, LLC maintain a separate consulting agreement pursuant to which Medtronic paid to Leavitt Partners, LLC an aggregate of approximately $30,000 as of the date of this proxy statement, plus reimbursable incidental expenses incurred in

connection with the delivery of services thereunder. Medtronic anticipates maintaining this relationship for the foreseeable future at a cost of $5,000 per month plus incidental fees. During the 2015 fiscal year, Leavitt Partners, LLC also assisted

Medtronic with arranging certain conference speakers. In connection with these services, Leavitt Partners, LLC received an aggregate of approximately $5,000, which was a portion of the aggregate speakers’ fees of $25,000.

Related Transactions and Other Matters

The Board of Directors of Medtronic has adopted written related party transaction policies and procedures. The policies require that all “interested transactions” (as defined below) between Medtronic and

a “related party” (as defined below) are subject to approval or ratification by the Nominating and Corporate Governance Committee. In determining whether to approve or ratify such transactions, the Nominating and Corporate Governance

Committee will take into account, among other factors it deems appropriate, whether the interested transaction is on the same terms as are generally available to an unaffiliated third-party under the same or similar circumstances and the extent of

the related person’s interest in the transaction. In addition, the Nominating and Corporate Governance Committee has reviewed a list of interested transactions and deemed them to be pre-approved or ratified. Also, the Board of Directors has

delegated to the chair of the Nominating and Corporate Governance Committee the authority to pre-approve or ratify any interested transaction in which the aggregate amount is expected to be less than $1 million. Finally, the policies provide that no

director shall participate in any discussion or approval of an interested transaction for which he or she is a related party, except that the director shall provide all material information concerning the interested transaction to the Nominating and

Corporate Governance Committee.

Under the policies, an “interested transaction” is defined as any transaction, arrangement or

relationship or series of similar transactions, arrangements or relationships (including any indebtedness or any guarantee of indebtedness) in which:

| |

†

|

|

the aggregate amount involved will or may be expected to exceed $120,000 in any twelve-month period; |

| |

†

|

|

Medtronic is a participant; and |

| |

†

|

|

any related party has or will have a direct or indirect interest (other than solely as a result of being a director or a less than ten percent beneficial owner

of another entity). |

Medtronic Proxy Statement and Notice of 2015 Annual General Meeting of Shareholders 9

PROPOSAL 1 — ELECTION OF DIRECTORS

A “related party” is defined as any:

| |

†

|

|

person who is or was (since the beginning of the last fiscal year for which Medtronic has filed a Form 10-K and proxy statement, even if they do not presently

serve in that role) an executive officer, director or nominee for election as a director; |

| |

†

|

|

greater than five percent beneficial owner of Medtronic’s ordinary shares; or |

| |

†

|

|

immediate family member of any of the foregoing. |

During fiscal year 2015, Sarah Powell, a daughter of director Kendall J. Powell, became employed by Medtronic as a Senior Leadership Development Rotation Program Associate. The Leadership Development Rotation

Program is a three year program designed to place high-potential, high-performing graduates of an MBA program in two 18 month placements in different business units of Medtronic. The aggregate value of the compensation paid to Ms. Sarah Powell

during fiscal year 2015 was approximately $158,200, which includes salary, bonus and incentive payments and stock options. In addition, Ms. Powell received the standard benefits provided to other non-executive Medtronic employees for her

services during fiscal year 2015. Ms. Sarah Powell is not an executive officer of, and does not have a key strategic role within, Medtronic.

10 Medtronic Proxy Statement and Notice of 2015 Annual General Meeting of Shareholders

GOVERNANCE OF MEDTRONIC

Our Corporate Governance Principles

The Board of

Directors has adopted Principles of Corporate Governance (the “Governance Principles”), last amended January 2015. The Governance Principles describe Medtronic’s corporate governance practices and policies, and provide a framework for

the governance of Medtronic. Among other things, the Governance Principles include the provisions below.

| |

†

|

|

A majority of the members of the Board must be independent directors and no more than two directors may be Medtronic employees. Currently one director,

Medtronic’s Chairman and Chief Executive Officer, is not independent. |

| |

†

|

|

Medtronic maintains Audit, Compensation, Finance, Nominating and Corporate Governance and Quality and Technology Committees, which consist entirely of

independent directors. |

| |

†

|

|

The Nominating and Corporate Governance Committee consists of all independent directors and oversees an annual evaluation of the Board.

|

Our Governance Principles, the charters of our Audit, Compensation, Finance, Nominating and Corporate Governance and

Quality and Technology Committees and our codes of conduct are published on our website at www.medtronic.com/corporate-governance/index.htm. These materials are available in print to any shareholder upon request. From time to time, the Board

reviews and updates these documents as it deems necessary and appropriate.

Lead Director and Chairman;

Executive Sessions

Mr. Ishrak, our Chief Executive Officer, also serves as Chairman of the Board. The Board believes that it is

appropriate for Mr. Ishrak to serve as Chairman of the Board due to his extensive knowledge of and experience in the global health care industry generally and in the medical device industry specifically. This knowledge and experience will be

critical in identifying strategic priorities and providing unified leadership in the execution of strategy.

Our designated “Lead

Director” is Richard H. Anderson, and he presides as chair at regularly scheduled meetings of the independent directors. Mr. Anderson suggests agenda items for Board meetings and reviews and approves the agendas for each meeting of the

Board of Directors and its Committees. He presides over the directors’ annual evaluation of the Board and advises Mr. Ishrak on the conduct of Board meetings, facilitating teamwork and communications between the non-management directors

and management, serving as a liaison between the two. As Lead Director, Mr. Anderson also receives all committee materials in addition to those committees upon which he serves. In addition, Mr. Anderson acts as the focal point on the Board

concerning issues such as corporate governance and suggestions from non-management directors, especially on sensitive issues.

Six

regular meetings of our Board were held in fiscal year 2015 and beginning in fiscal year 2016, four regular meetings of our Board will be held each year. At each Board meeting, our independent directors will meet in executive session with no Company

management present.

Board Role in Risk Oversight

Our Board of Directors, in exercising its overall responsibility to oversee the management of our business, considers risks when reviewing the

Company’s strategic plan, financial results, merger and acquisition related activities, legal and regulatory matters and its public filings with the Securities and Exchange Commission. The Board is also deeply engaged in the Company’s

Enterprise Risk Management (“ERM”) program and has received briefings on the outcomes of the ERM program and the steps the Company is taking to mitigate risks identified through the ERM program. The Board’s oversight of risk

management includes full and open communications with management to review the adequacy and functionality of the risk management processes used by management. In addition, the Board of Directors uses its committees to assist in its risk oversight

responsibility as follows:

| |

†

|

|

The Audit Committee assists the Board of Directors in its oversight of the integrity of the financial reporting of the Company and its compliance with applicable

legal and regulatory requirements. It also oversees our internal controls and compliance activities. The Audit Committee periodically discusses policies with respect |

Medtronic Proxy Statement and Notice of 2015 Annual General Meeting of Shareholders 11

GOVERNANCE OF MEDTRONIC

| |

to risk assessment and risk management, including appropriate guidelines and policies to govern the process, as well as the Company’s major financial and business risk exposures and certain

contingent liabilities and the steps management has undertaken to monitor and control such exposures. It also meets privately with representatives from the Company’s independent registered public accounting firm. |

| |

†

|

|

The Finance Committee assists the Board of Directors in its oversight of risk relating to the Company’s assessment of its significant financial risks and

certain contingent liabilities. |

| |

†

|

|

The Compensation Committee assists the Board of Directors in its oversight of risk relating to the Company’s assessment of its compensation policies and

practices. |

| |

†

|

|

The Quality and Technology Committee assists the Board of Directors in its oversight of risk relating to product quality and safety and research.

|

Committees of the Board and Meetings

Our five standing Board committees — Audit, Compensation, Finance, Nominating and Corporate Governance and Quality and

Technology — consist solely of independent directors, as defined in the New York Stock Exchange Corporate Governance Standards. The Audit Committee was established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”). Each director attended 75% or more of the total Board and Board committee meetings on which the director served in fiscal year 2015. In addition, it has been the longstanding practice of Medtronic

for all directors to attend the Annual General Meeting of Shareholders. All directors attended the last Annual General Meeting.

The

following table summarizes the current membership of the Board and each of its standing committees and the number of times each standing committee met during fiscal year 2015.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Board |

|

Audit |

|

Compensation |

|

Finance |

|

Nominating and

Corporate

Governance |

|

Quality and

Technology |

| Mr. Anderson |

|

X |

|

|

|

X |

|

|

|

Chair |

|

|

| Mr. Arnold |

|

X |

|

|

|

X |

|

|

|

X |

|

|

| Mr. Donnelly |

|

X |

|

X |

|

X |

|

|

|

|

|

X |

| Mr. Hogan |

|

X |

|

X |

|

|

|

X |

|

|

|

|

| Mr. Ishrak |

|

Chair |

|

|

|

|

|

|

|

|

|

|

| Dr. Jackson |

|

X |

|

Chair |

|

|

|

|

|

X |

|

|

| Gov. Leavitt |

|

X |

|

|

|

|

|

X |

|

|

|

X |

| Mr. Lenehan |

|

X |

|

|

|

|

|

X |

|

|

|

Chair |

| Dr. Nabel |

|

X |

|

|

|

|

|

|

|

X |

|

X |

| Ms. O’Leary |

|

X |

|

|

|

X |

|

X |

|

|

|

|

| Mr. Powell |

|

X |

|

X |

|

Chair |

|

|

|

X |

|

|

| Mr. Pozen |

|

X |

|

X |

|

|

|

Chair |

|

|

|

|

| Ms. Reddy |

|

X |

|

|

|

|

|

X |

|

|

|

X |

| Number of fiscal year 2015 meetings |

|

13 |

|

12 |

|

8 |

|

4 |

|

2 |

|

5 |

The

principal functions of our five standing committees — the Audit Committee, the Compensation Committee, the Finance Committee, the Nominating and Corporate Governance Committee, and the Quality and Technology Committee — are

described below.

12 Medtronic Proxy Statement and Notice of 2015 Annual General Meeting of Shareholders

GOVERNANCE OF MEDTRONIC

Audit Committee

Shirley Ann Jackson, Ph.D. (Chair)

Scott C. Donnelly

Randall J. Hogan, III

Kendall J. Powell

Robert C. Pozen

The functions of the Audit Committee include:

| |

†

|

|

Overseeing the integrity of Medtronic’s financial reporting |

| |

†

|

|

Overseeing the independence, qualifications and performance of Medtronic’s external independent registered public accounting firm and the performance of

Medtronic’s internal auditors |

| |

†

|

|

Overseeing Medtronic’s compliance with applicable legal and regulatory requirements, including overseeing Medtronic’s engagements with, and payments to

physicians and other health care providers |

| |

†

|

|

Reviewing with the General Counsel and independent registered public accounting firm: legal matters that may have a material impact on the financial statements;

any fraud involving management or other employees who have a significant role in Medtronic’s internal controls; compliance policies; and any material reports or inquiries received that raise material issues regarding Medtronic’s financial

statements and accounting or compliance policies |

| |

†

|

|

Reviewing annual audited financial statements with management and Medtronic’s independent registered public accounting firm and recommending to the Board

whether the financial statements should be included in Medtronic’s Annual Report on Form 10-K |

| |

†

|

|

Reviewing and discussing with management and Medtronic’s independent registered public accounting firm quarterly financial statements and earnings releases

|

| |

†

|

|

Reviewing major issues and changes to Medtronic’s accounting and auditing principles and practices, including analyses of the effects of alternative GAAP

methods on the financial statements, and the effect of regulatory and accounting initiatives, as well as off-balance sheet structures, on the financial statements of Medtronic |

| |

†

|

|

Discussing policies with respect to risk assessment and risk management, as well as the major financial and business risk exposures and the steps management has

undertaken to monitor and control such exposures |

| |

†

|

|

Undertaking the appointment, compensation, retention and oversight of the independent registered public accounting firm, which reports directly to the Audit

Committee |

| |

†

|

|

Pre-approving all audit and permitted non-audit services to be provided by the independent registered public accounting firm |

| |

†

|

|

Reviewing, at least annually, a report by the independent registered public accounting firm describing its internal quality-control procedures and any material

issues raised by the most recent internal quality-control review, and any steps taken to deal with any such issues, and all relationships between the independent registered public accounting firm and Medtronic |

| |

†

|

|

Reviewing the experience and qualifications of the lead partner of the independent registered public accounting firm each year and considering whether there

should be rotation of the lead partner or the independent auditor itself |

| |

†

|

|

Establishing clear policies for hiring current and former employees of the independent registered public accounting firm |

| |

†

|

|

Preparing the Report of the Audit Committee |

| |

†

|

|

Meeting with the independent registered public accounting firm prior to the audit to review the scope and planning of the audit |

| |

†

|

|

Reviewing the results of the annual audit examination |

Medtronic Proxy Statement and Notice of 2015 Annual General Meeting of Shareholders 13

GOVERNANCE OF MEDTRONIC

| |

†

|

|

Considering, at least annually, the independence of the independent registered public accounting firm |

| |

†

|

|

Reviewing the adequacy and effectiveness of Medtronic’s internal control over financial reporting and disclosure controls and procedures

|

| |

†

|

|