UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): July 17, 2015

MEDTRONIC PUBLIC LIMITED COMPANY

(Exact name of Registrant as Specified in its Charter)

|

|

|

|

|

| Ireland |

|

1-36820 |

|

98-1183488 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

20 On Hatch, Lower Hatch Street

Dublin 2, Ireland

(Address of principal executive offices)

(Registrant’s telephone number, including area code): +353 1 438-1700

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

On January 26, 2015, pursuant to a transaction agreement dated as of June 15,

2014, Medtronic, Inc., a Minnesota corporation (“Medtronic, Inc.”) and Covidien public limited company, a public limited company organized under the laws of Ireland (now known as Covidien Limited) (“Covidien”) became subsidiaries

of Medtronic Public Limited Company, a public limited company organized under the laws of Ireland (the “Company”). The Company is filing this Current Report on Form 8-K to file certain supplemental pro forma financial information in

anticipation of filing a registration statement on Form S-4 to register debt securities that were issued by Medtronic, Inc., and that are guaranteed by the Company and Medtronic Global Holdings S.C.A., an entity organized under the laws of

Luxembourg and a subsidiary of the Company.

| Item 9.01. |

Financial Statements and Exhibits. |

(b) Pro Forma Financial Information

The unaudited pro forma condensed consolidated statements of income of the Company for the fiscal year ended April 24, 2015 that give effect to the

acquisition of Covidien are filed as Exhibit 99.1 hereto and are incorporated herein by reference.

(d) Exhibits

|

|

|

Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Unaudited pro forma condensed consolidated statements of income of the Company for the fiscal year ended April 24, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

MEDTRONIC PUBLIC LIMITED COMPANY |

|

|

|

|

|

|

|

|

By |

|

/s/ Gary L. Ellis |

| Date: July 17, 2015 |

|

|

|

|

|

Gary L. Ellis |

|

|

|

|

|

|

Executive Vice President and Chief Financial

Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Unaudited pro forma condensed consolidated statements of income of the Company for the fiscal year ended April 24, 2015. |

Exhibit 99.1

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF INCOME

On January 26, 2015, Medtronic plc (Medtronic or the Company), formerly known as Medtronic Limited, Medtronic Holdings Limited and Kalani I Limited, and

the successor registrant to Medtronic, Inc., acquired Covidien plc (Covidien) pursuant to the transaction agreement dated June 15, 2014. At the close of the Transactions (as defined in Note 1), Medtronic, Inc. and Covidien became subsidiaries

of Medtronic. See Note 1 to this unaudited pro forma condensed combined statement of income for additional information on the Transactions.

The unaudited

pro forma condensed combined statement of income is presented to illustrate the effects of the acquisition of Covidien by Medtronic and the contemporaneous financing transactions.

The unaudited pro forma condensed combined statement of income is presented as if the Transactions had occurred on April 26, 2014, which is the first day

of Medtronic’s fiscal year ended April 24, 2015. An unaudited pro forma condensed combined balance sheet as of April 24, 2015 has not been presented herein because Medtronic’s balance sheet as of April 24, 2015, included in

Medtronic’s Form 10-K for the fiscal year ended April 24, 2015, reflects the balance sheet results of the Transactions as of April 24, 2015.

The unaudited pro forma condensed combined statement of income for the twelve months ended April 24, 2015 should be read in conjunction with the

accompanying notes and assumptions as well as the historical audited financial statements of Medtronic (which are available in Medtronic’s Form 10-K for the fiscal year ended April 24, 2015), the historical audited financial statements of

Covidien (which are available in Covidien’s Form 10-K for the fiscal year ended September 26, 2014) and the historical unaudited financial statements of Covidien (which are available in Covidien’s Form 10-Q for the fiscal quarter

ended December 26, 2014).

The acquisition of Covidien was accounted for as a business combination using the acquisition method of accounting under

the provisions of Accounting Standards Codification (ASC) 805, “Business Combinations” (ASC 805). The unaudited pro forma condensed combined statement of income set forth below gives effect to the following:

| |

• |

|

the closing of the Transactions through the issuance of Medtronic ordinary shares, with each Covidien shareholder receiving (a) $35.19 in cash per share and (b) 0.956 of a newly issued Medtronic ordinary share

for each Covidien share; |

| |

• |

|

the incurrence of approximately $17 billion in debt by Medtronic, Inc. to finance, together with $3.0 billion in borrowings under the Term Loan Credit Agreement (as defined in Note 1), the cash component of the

acquisition consideration, including the payment of certain transaction and financing expenses and for working capital and general corporate purposes, which may include repayment of indebtedness. |

The pro forma adjustments are based upon available information and certain assumptions which management believes are reasonable under the circumstances and

which are described in the accompanying notes to the unaudited pro forma condensed combined statement of income. Actual results may differ materially from the assumptions within the accompanying unaudited pro forma condensed combined statement of

income. Management believes the preliminary fair values recognized for the assets acquired and liabilities assumed are based on reasonable estimates and assumptions.

The unaudited pro forma condensed combined statement of income has been prepared by management in accordance with the regulations of the Securities and

Exchange Commission (SEC) and is not necessarily indicative of the results of operations that Medtronic will experience after the Transactions. In addition, the accompanying unaudited pro forma condensed combined statement of income does not include

any expected cost savings, operating synergies, or revenue enhancements, that may be realized subsequent to the Transactions. No material transactions existed between Medtronic and Covidien during the pro forma period.

1

Unaudited Pro Forma Condensed Combined Statement of Income

For the Fiscal Year Ended April 24, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In millions except per share data) |

|

Historical

Medtronic

(as reported) |

|

|

Historical

Covidien(1) |

|

|

Reclassification

Adjustments |

|

|

Footnote

Reference |

|

|

Acquisition

Adjustments |

|

|

Footnote

Reference |

|

|

Financing

Adjustments |

|

|

Footnote

Reference |

|

|

Pro Forma |

|

| Net sales |

|

$ |

20,261 |

|

|

$ |

7,966 |

|

|

$ |

— |

|

|

|

|

|

|

$ |

— |

|

|

|

|

|

|

$ |

— |

|

|

|

|

|

|

$ |

28,227 |

|

| Cost of products sold |

|

|

6,309 |

|

|

|

3,181 |

|

|

|

(127 |

) |

|

|

4 |

(b) |

|

|

(623 |

) |

|

|

3 |

(a) |

|

|

— |

|

|

|

|

|

|

|

8,598 |

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

4 |

(c) |

|

|

8 |

|

|

|

3 |

(f) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

4 |

(d) |

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(124 |

) |

|

|

4 |

(e) |

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(38 |

) |

|

|

4 |

(f) |

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

| Selling, general, and administrative expense |

|

|

7,695 |

|

|

|

3,313 |

|

|

|

(48 |

) |

|

|

4 |

(a) |

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

10,325 |

|

|

|

|

|

|

|

|

|

|

|

|

(66 |

) |

|

|

4 |

(b) |

|

|

7 |

|

|

|

3 |

(f) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3 |

) |

|

|

4 |

(c) |

|

|

(688 |

) |

|

|

3 |

(g) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(9 |

) |

|

|

4 |

(d) |

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

124 |

|

|

|

4 |

(e) |

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

| Research and development expense |

|

|

1,640 |

|

|

|

426 |

|

|

|

2 |

|

|

|

4 |

(d) |

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

2,068 |

|

| Amortization of intangible assets |

|

|

733 |

|

|

|

— |

|

|

|

193 |

|

|

|

4 |

(b) |

|

|

984 |

|

|

|

3 |

(e) |

|

|

— |

|

|

|

|

|

|

|

1,910 |

|

| Interest expense, net |

|

|

280 |

|

|

|

136 |

|

|

|

— |

|

|

|

|

|

|

|

(3 |

) |

|

|

3 |

(d) |

|

|

419 |

|

|

|

3 |

(b) |

|

|

771 |

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

(61 |

) |

|

|

3 |

(c) |

|

|

|

|

| Other expense, net |

|

|

118 |

|

|

|

123 |

|

|

|

48 |

|

|

|

4 |

(a) |

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

325 |

|

|

|

|

|

|

|

|

|

|

|

|

(2 |

) |

|

|

4 |

(c) |

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38 |

|

|

|

4 |

(f) |

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations before income taxes |

|

|

3,486 |

|

|

|

787 |

|

|

|

— |

|

|

|

|

|

|

|

315 |

|

|

|

|

|

|

|

(358 |

) |

|

|

|

|

|

|

4,230 |

|

| Provision for income taxes |

|

|

811 |

|

|

|

(179 |

) |

|

|

— |

|

|

|

|

|

|

|

47 |

|

|

|

3 |

(h) |

|

|

(133 |

) |

|

|

3 |

(h) |

|

|

546 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations |

|

$ |

2,675 |

|

|

$ |

966 |

|

|

$ |

— |

|

|

|

|

|

|

$ |

268 |

|

|

|

|

|

|

$ |

(225 |

) |

|

|

|

|

|

$ |

3,684 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings from continuing operations per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

2.44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

2.59 |

|

| Diluted |

|

$ |

2.41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

2.56 |

|

| Weighted average shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

1,095.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,422.3 |

|

| Diluted |

|

|

1,109.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,438.4 |

|

| (1) |

for the period from April 26, 2014 to January 26, 2015 |

2

1. Description of Transactions

On January 26, 2015, pursuant to the transaction agreement, dated as of June 15, 2014 (the Transaction Agreement), by and among Medtronic, Inc.,

Covidien, Medtronic plc (formerly known as Medtronic Limited, Medtronic Holdings Limited and Kalani I Limited), Makani II Limited, a private limited company organized under the laws of Ireland and a wholly-owned subsidiary of Medtronic (IrSub),

Aviation Acquisition Co., Inc., a Minnesota corporation (U.S. AcquisitionCo), and Aviation Merger Sub, LLC, a Minnesota limited liability company and a wholly-owned subsidiary of U.S. AcquisitionCo (MergerSub), (i) Medtronic and IrSub acquired

Covidien (the Acquisition) pursuant to the Irish Scheme of Arrangement under Section 201 (the Arrangement), and a capital reduction under Sections 72 and 74, of the Irish Companies Act of 1963 and (ii) MergerSub merged with and into

Medtronic, Inc., with Medtronic, Inc. as the surviving corporation in the merger (the Merger and, together with the Acquisition, the Transactions). Following the consummation of the Transactions on January 26, 2015, Medtronic, Inc. and Covidien

became subsidiaries of Medtronic. In connection with the consummation of the Transactions, Medtronic re-registered as a public limited company organized under the laws of Ireland.

On January 26, 2015, (a) each Covidien ordinary share was converted into the right to receive $35.19 in cash and 0.956 of a newly issued Medtronic

share (the Arrangement Consideration) in exchange for each Covidien share held by such shareholders, and (b) each share of Medtronic, Inc. common stock was converted into the right to receive one Medtronic ordinary share.

The issuance of Medtronic ordinary shares in connection with the Transactions was registered under the Securities Act of 1933, as amended (the Securities

Act), pursuant to Medtronic’s registration statement on Form S-4 (File No. 333-197406) (the Registration Statement) filed with the SEC and declared effective on November 20, 2014. The definitive joint proxy statement/prospectus of

Medtronic and Covidien, dated November 20, 2014, that forms a part of the Registration Statement contains additional information about the Transactions and the other transactions contemplated by the Transaction Agreement, including a

description of the treatment of equity awards and information concerning the interests of directors, executive officers and affiliates of Medtronic and Covidien in the Transactions.

In connection with the Transactions, the following financing transactions were entered into:

| |

• |

|

On November 7, 2014, Medtronic, Inc. entered into the 364-day senior unsecured bridge credit agreement (the Bridge Credit Agreement), among Medtronic, Inc., Medtronic, Medtronic Global Holdings S.C.A., an entity

organized under the laws of Luxembourg (Medtronic Luxco), the lenders from time to time party thereto and Bank of America, N.A., as administrative agent. Under the Bridge Credit Agreement, the lenders party thereto had committed to provide

Medtronic, Inc. with unsecured bridge financing in an aggregate principal amount of up to $11.3 billion. The $11.3 billion available under the Bridge Credit Agreement was not drawn by Medtronic, Inc. and the Bridge Credit Agreement was subsequently

terminated on December 10, 2014. |

| |

• |

|

On November 7, 2014, Medtronic, Inc. also entered into the three-year senior unsecured term loan credit agreement (the Term Loan Credit Agreement) among Medtronic, Inc., Medtronic, Medtronic Luxco, the lenders from

time to time party thereto and Bank of America, N.A., as administrative agent. Under the Term Loan Credit Agreement, the lenders party thereto committed to provide Medtronic, Inc. with unsecured term loan financing in an aggregate principal amount

of up to $5.0 billion. On January 26, 2015, Medtronic, Inc. borrowed $3.0 billion under the Term Loan Credit Agreement for a term of three years. Medtronic, Inc. used the proceeds from the issuance of the Senior Notes (as defined below) and the

borrowings under the Term Loan Credit Agreement to finance the cash component of the Arrangement Consideration, including the payment of certain transaction and financing expenses, and for working capital and general corporate purposes, which may

include repayment of indebtedness. |

| |

• |

|

Medtronic and Medtronic Luxco have guaranteed the obligations of Medtronic, Inc. under the Senior Notes (as defined below) and the Term Loan Credit Agreement. |

| |

• |

|

On December 10, 2014, Medtronic issued $17 billion unsecured senior notes consisting of $500 million of floating rate senior notes due 2020, $1.0 billion of 1.500% senior notes due 2018, $2.5 billion of 2.500%

senior notes due 2020, $2.5 billion of 3.150% senior notes due 2022, $4.0 billion of 3.500% senior notes due 2025, $2.5 billion of 4.375% senior notes due 2035, and $4.0 billion of 4.625% senior notes due 2045 (collectively, the Senior Notes). On

January 26, 2015, Medtronic and Medtronic Luxco each provided a full and unconditional guarantee of the Senior Notes obligations of Medtronic, Inc., as well as under certain of Medtronic, Inc. and Covidien’s other outstanding indebtedness.

|

3

2. Basis of Presentation

The unaudited pro forma condensed combined statement of income includes the effects of the acquisition of Covidien as if the acquisition occurred on

April 26, 2014, which is the first day of Medtronic’s fiscal year ended April 24, 2015. The unaudited pro forma condensed combined statement of income combine the historical results for Medtronic for the 52-week period ended

April 24, 2015 and for Covidien for the period from April 26, 2014 to January 26, 2015, the date of the Acquisition.

The consideration

transferred was based on Medtronic’s closing share price as of January 23, 2015 of $76.95 per share (the last business day prior to the close of the Transactions). The fair value of ordinary shares, options and share awards converted was

also based on Medtronic’s closing share price as of January 23, 2015 of $76.95 per share.

3. Unaudited Pro Forma Condensed Combined

Statement of Income Adjustments

| (a) |

To eliminate the amortization from the step-up in fair value of inventory acquired as this is a non-recurring item. |

| (b) |

To record pro forma incremental interest expense, net of $419 million, including incremental interest expense of $406 million and incremental debt issuance costs amortization expense of $13 million from debt financing

obtained by Medtronic, Inc. Prior to the Transactions closing, Medtronic, Inc. obtained $17 billion of debt financing across a range of maturities and a weighted average contractual interest rate of 3.60 percent. |

| (c) |

To recognize accretion of the pro forma debt premium of $61 million from Medtronic’s assumption of Covidien’s existing long-term debt. The premium to adjust assumed Covidien debt to fair market value is

amortized over the remaining maturity of the debt as a credit to pro forma interest expense, net. |

| (d) |

To eliminate deferred financing costs amortization expense of $3 million. Deferred financing costs of Covidien are eliminated as assumed debt is measured and recorded at fair value. |

| (e) |

To record estimated pro forma amortization expense of $984 million on the portion of the consideration transferred allocated to definite-lived intangible assets of $26 billion. The estimated pro forma amortization

expense is based on the incremental increase in fair value above Covidien’s definite-lived intangible assets, straight-lined over an estimated weighted average useful life of 16.5 years. |

| (f) |

To record estimated pro forma depreciation expense of $15 million on the portion of the consideration transferred allocated to property, plant, and equipment. The estimated pro forma depreciation expense adjustments are

based on the incremental increase in fair value above net book value calculated over an estimated weighted average useful life of 14.5 years. |

| (g) |

Acquisition-related transaction costs have been expensed in Medtronic’s and Covidien’s historical consolidated financial statements. As acquisition-related transaction costs are non-recurring items, they have

not been reflected in the unaudited pro forma condensed combined statement of income. A pro forma adjustment totaling $688 million has been reflected to remove acquisition-related transaction costs expensed in Medtronic’s and Covidien’s

historical consolidated financial statements of $533 million and $155 million, respectively. |

| (h) |

The statutory tax rate was applied, as appropriate, to each adjustment based on the jurisdiction in which the adjustment was expected to occur. In situations where jurisdictional detail was not available, a weighted

average rate of 24.5 percent was applied to the adjustment. This estimated rate represents an adjusted overall effective tax rate for the on-going operations of Covidien. |

Although not reflected in the pro forma financial statements, the effective tax rate of the combined company could be significantly different

depending on post-acquisition activities, such as the geographical mix of taxable income affecting state and foreign taxes, among other factors.

A tax rate of 36.0 percent was used in relation to interest expense and financing fees associated with the debt financing as this debt will

reside in the U.S.

4. Pro Forma Reclassification Adjustments

Certain reclassifications have been made to Covidien’s historical financial statements to conform to Medtronic’s presentation, as follows:

| (a) |

To reclassify Covidien’s medical device excise tax from selling, general, and administrative expense to other expense, net. |

| (b) |

To reclassify Covidien’s amortization of definite-lived intangible assets from cost of products sold and selling, general, and administrative expense to amortization of intangible assets. |

4

| (c) |

To reclassify Covidien’s net gains and losses on foreign currency contracts from cost of products sold and selling, general, and administrative expense to other expense, net. |

| (d) |

To reclassify certain of Covidien’s stock-based compensation expense from selling, general, and administrative expense to cost of products sold and research and development expense. |

| (e) |

To reclassify certain of Covidien’s shipping and handling costs from cost of products sold to selling, general, and administrative expense. |

| (f) |

To reclassify Covidien’s royalty expense from cost of products sold to other expense, net. |

5

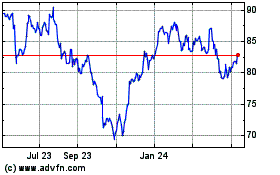

Medtronic (NYSE:MDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

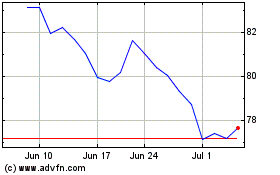

Medtronic (NYSE:MDT)

Historical Stock Chart

From Apr 2023 to Apr 2024