This is

a correction of the announcement from 07:30 19.05.2015 CDT. Reason

for the correction: Link to Revenue tables were incorrect.

-

Preliminary Q4 Worldwide

Revenue of Approximately $7.3 Billion Grew 7% on a Comparable,

Constant Currency Basis; 60% as Reported

-

Preliminary Q4 U.S. Revenue of

Approximately $4.1 Billion Grew 8% on a Comparable Basis; 67% as

Reported

-

Preliminary FY15 GAAP Revenue

of Approximately $20.3 Billion Grew 19% as Reported, or 6% on a Comparable, Constant Currency Basis

-

Company Tightens Fourth Quarter

Adjusted EPS Expectations

DUBLIN - May 19, 2015 -

Medtronic plc (NYSE: MDT) today announced its preliminary revenue

results for the fourth quarter and fiscal year 2015, which ended

April 24, 2015. As this is the first quarter where the

company is reporting results that include its recent acquisition of

Covidien, full financial results are expected to be reported on

June 2, 2015, two weeks later than the company's normal reporting

date.

Unless otherwise noted, all comparisons and growth

rates in this press release are stated on a comparable, constant

currency basis, which includes Covidien plc in the prior year

comparison and aligns Covidien's prior year monthly revenue to

Medtronic's fiscal quarters. Aligning historic Covidien

revenue to Medtronic's fiscal quarters is different than the pro

forma revenue information previously included within certain SEC

filings, which combined revenues from the closest historical

reported quarters of both companies. Management believes that

referring to comparable, constant currency growth rates is a more

useful way to evaluate the underlying performance of Medtronic's

revenue. For additional revenue detail and the reconciliation

of these revenue amounts and growth rates to the most directly

comparable GAAP financial measures, please refer to the link at the

end of this release.

The company announced preliminary fourth quarter

worldwide revenue of approximately $7.302 billion, compared to

$7.257 billion on a comparable basis in the fourth quarter of

fiscal year 2014, an increase of 7 percent after adjusting for an

approximately $482 million negative foreign currency impact.

As reported, revenue increased 60 percent when compared to

the $4.566 billion reported by Medtronic, Inc. in the fourth

quarter of fiscal year 2014.

Fourth quarter U.S. revenue of approximately

$4.055 billion increased 8 percent, or 67 percent as

reported. Fourth quarter non-U.S. developed market revenue of

approximately $2.320 billion increased 5 percent, or 48 percent as

reported. Fourth quarter emerging market revenue of

approximately $927 million increased 11 percent, or 62 percent as

reported, and represented approximately 13 percent of company

revenue.

As reported, Medtronic's fiscal year 2015 revenue

of approximately $20.259 billion, increased 19 percent, or 6

percent on a comparable, constant currency basis.

"I am very encouraged by our strong preliminary

fourth quarter revenue performance especially as it is the first

quarter that reflects the combined results of Medtronic and

Covidien," said Omar Ishrak, Medtronic chairman and chief executive

officer. "In addition to making solid progress on our integration

of Covidien, these preliminary revenue results reflect disciplined

execution across our three core strategies of therapy innovation,

globalization, and economic value."

Cardiac and Vascular

Group

The Cardiac and Vascular Group (CVG) includes the Cardiac Rhythm

& Heart Failure, Coronary & Structural Heart, and Aortic

& Peripheral Vascular divisions. CVG had worldwide

revenue in the quarter of approximately $2.596 billion,

representing an increase of 10 percent on both a comparable,

constant currency basis and as reported. CVG revenue

performance was driven by strong balanced growth across all three

divisions.

Fourth quarter CVG U.S. revenue of approximately

$1.301 billion increased 15 percent, or 28 percent as

reported. Fourth quarter CVG non-U.S. developed market

revenue of approximately $903 million increased 5 percent, or

decreased 7 percent as reported. Fourth quarter CVG emerging

market revenue of approximately $392 million increased 11 percent,

or 4 percent as reported.

Cardiac Rhythm & Heart Failure (CRHF) revenue

of approximately $1.398 billion grew 11 percent, or 4 percent as

reported. CRHF performance this quarter was driven by

low-teens growth in Low Power, mid-single digit growth in High

Power and strong growth of over 30 percent in AF Solutions.

Geographically, the CRHF division benefitted from mid-teens

growth in the U.S. and Japan. Low Power results were driven

by the continued ongoing acceptance of the Reveal LINQTM insertable

cardiac monitor and solid performance in the U.S. Pacing business,

which grew in the upper-single digits. High Power results

were driven by mid-single digit growth in the U.S. and double-digit

growth in Japan. The VivaTM XT CRT-D

with its AdaptivCRT® algorithm and

Attain®

PerformaTM Quadripolar

Lead continue to show strong market acceptance. AF Solutions

results were driven by continued robust growth of our Arctic Front

Advance® CryoAblation

System.

Coronary & Structural Heart (CSH) revenue of

approximately $792 million increased 9 percent, or 1 percent as

reported. CSH performance was driven by upper-teens growth in

Structural Heart and low-single digit growth in Coronary.

Structural Heart grew in the upper-teens globally and approximately

30 percent in the U.S. driven by Transcatheter Valves, which grew

approximately 50 percent globally based on the ongoing success of

CoreValve® in the U.S.,

and the launch of the CoreValve®

EvolutTM R

recapturable system in international markets. Coronary

benefitted from mid-single digit Drug Eluting Stent (DES) growth

driven by the recent launch of Resolute OnyxTM in

Europe and the continued acceptance of Resolute

Integrity® DES in the

U.S. The business also had low-double digit growth in

balloons as a result of the recent launch of the company's

differentiated EuphoraTM SC balloon

dilatation catheter.

Aortic & Peripheral Vascular (APV) revenue of

approximately $406 million increased 9 percent, or 69 percent as

reported. APV performance was driven by very strong mid-teens

growth in the Peripheral business, which is comprised of the legacy

Medtronic peripheral business and a portion of the legacy Covidien

Peripheral business, and low-single digit growth in Aortic.

Growth in the Peripheral business was driven by the

IN.PACT®

Admiral® drug-coated

balloon, which was launched at the beginning of the fiscal fourth

quarter. The company estimates it now has the leading

position in the U.S. Drug Coated Balloon market. This

leadership position was attained without the benefit of having a

full quarter of a combined Medtronic and legacy Covidien peripheral

salesforce. Peripheral was also driven by strong double-digit

growth in Chronic Venous Insufficiency (CVI) reflecting the

continued acceptance of ClosureFastTM in

Japan.

Minimally Invasive Therapies

Group

The Minimally Invasive Therapies Group (MITG), formerly referred to

as the Covidien Group following completion of the Covidien

acquisition, includes both the Surgical Solutions division and the

Patient Monitoring & Recovery division, formerly referred to as

Medical Care Solutions by Covidien prior to the acquisition.

The group had worldwide sales in the quarter of approximately

$2.385 billion, representing an increase of 6 percent.

Incremental revenue from acquisitions contributed just over 1

percent to consolidated growth. MITG revenue performance was

driven by strong double-digit growth in Surgical Solutions and

low-single digit growth in Patient Monitoring & Recovery.

Fourth quarter MITG revenue in the U.S. of

approximately $1.228 billion increased 6 percent. Fourth

quarter MITG non-U.S. developed market revenue of approximately

$852 million increased 4 percent. Fourth quarter MITG

emerging market revenue of approximately $305 million increased 11

percent.

Surgical Solutions revenue of approximately $1.293

billion increased 10 percent. Surgical Solutions performance

this quarter was driven by high-single digit growth in Advanced

Surgical and low-single digit growth in General Surgical.

Advanced Surgical results were driven by balanced low-double digit

growth in both Stapling and Energy coupled with growth of over 40

percent in Early Technologies, which benefitted significantly from

acquisitions. Stapling growth reflected continued strong

market adoption in the U.S. of new product introductions including

the Endo GIATM Reinforced

Reload. Energy results were driven by continued robust

procedural growth in Vessel Sealing. Early Technologies

results included strong growth across all three product lines: GI

Solutions, Advanced Ablation, and Interventional Lung

Solutions.

Patient Monitoring & Recovery (PMR) revenue of

approximately $1.092 billion increased 2 percent. Patient

Monitoring grew in the mid-single digits, and both Airway &

Ventilation and Nursing Care grew in the low-single digits,

offsetting low-single digit declines in Patient Care. The

strong U.S. flu season drove pulse oximetry sales.

Restorative Therapies

Group

The Restorative Therapies Group (RTG) includes the Spine,

Neuromodulation, Surgical Technologies, and Neurovascular

divisions. The group had worldwide revenue in the quarter of

approximately $1.854 billion, representing an increase of 5

percent, or 7 percent as reported. Group revenue performance

was driven by growth in Surgical Technologies, Neuromodulation, and

Neurovascular, partially offset by declines in Spine.

Fourth quarter RTG U.S. revenue of approximately

$1.233 billion increased 4 percent, or 8 percent as reported.

Fourth quarter RTG non-U.S. developed market revenue of

approximately $426 million increased 4 percent, or declined 4

percent as reported. Fourth quarter RTG emerging market

revenue of approximately $195 million increased 12 percent, or 25

percent as reported.

Spine revenue of approximately $743 million

declined 2 percent, or 5 percent as reported. Core Spine and

Interventional revenue both declined in the low-single digits,

offsetting low-single digit growth in Bone Morphogenetic Protein

(BMP). The Core Spine business is focused on differentiating

itself from the competition over the long-term through its leading

technology and procedural innovation, enhanced by its Surgical

Synergy(TM) program of enabling technologies, including imaging,

navigation, and powered surgical instruments.

Neuromodulation revenue of approximately $518

million grew 6 percent, or 1 percent as reported.

Neuromodulation performance was driven by mid-teens growth in

Gastro/Uro and double-digit growth in Deep Brain Stimulation (DBS).

Pain Stim was flat in the quarter, in-line with the

market. Geographically, the Neuromodulation business

benefitted from strong growth of over 30 percent in emerging

markets, low-single digit growth in the U.S., and mid-single digit

growth in Europe.

Surgical Technologies revenue of approximately

$461 million grew 9 percent, or 5 percent as reported.

Surgical Technologies' performance was driven by solid, balanced

growth across all three businesses. Neurosurgery grew in the

mid-single digits reflecting record worldwide O-arm®

surgical imaging unit sales, continued strength in

StealthStation® navigation

service revenue, and the contribution of Visualase®

MRI-guided laser ablation. ENT low-double digit growth

reflected continued strong StraightShot® M5

Microdebrider and NuVent(TM) sinus balloon penetration offset

partially by a divestiture in the Surgical Technolgies division,

which occurred in the third quarter of fiscal year 2015.

Advanced Energy grew in the upper-teens driven by the

continued adoption of PEAK PlasmaBlade®.

Geographically, the business had low-teens growth in the U.S.

on the strength of new products.

Neurovascular revenue of approximately $132

million increased 23 percent. The business, formerly part of

legacy Covidien, posted strong double-digit growth across coils,

stents, flow diversion, and access product lines. Robust

growth in neurovascular stents was driven by the

SolitaireTM FR

revascularization device following the publication of several

positive clinical studies in the New England Journal of Medicine,

including SWIFT PRIME. Flow diversion growth benefitted from

the third quarter U.S. launch of the PipelineTM Flex

embolization device.

Diabetes Group

The Diabetes Group includes the Intensive Insulin Management,

Non-Intensive Diabetes Therapies, and Diabetes Services &

Solutions divisions. The group had worldwide revenue in the

quarter of approximately $467 million, representing an increase of

8 percent, or 2 percent as reported.

Fourth quarter Diabetes U.S. revenue of

approximately $293 million increased 8 percent on both a

comparable, constant currency basis and as reported. Fourth

quarter Diabetes non-U.S. developed market revenue of approximately

$139 million increased 8 percent, or decreased 9 percent as

reported. Fourth quarter Diabetes emerging market revenue of

approximately $35 million increased 5 percent, or decreased 5

percent as reported.

Diabetes Group revenue in the quarter was driven

by continued strong adoption in the U.S. of the MiniMed®

530G System with Enlite® CGM sensor

and its proprietary Threshold Suspend technology. Growth was

also driven by the continued international launch of the

next-generation MiniMed® 640G System

with a new insulin pump design, user interface, the Enhanced

Enlite® CGM sensor

and SmartGuardTM technology,

a proprietary algorithm that can automatically suspend insulin

delivery when sensor glucose levels are predicted to approach a low

limit and resume insulin delivery once sensor glucose levels

recover. The Intensive Insulin Management division continued

to progress toward the development of an artificial pancreas

system, with a minority investment in, and licensing of the DreaMed

algorithm for a next generation closed loop system. The group

continues to grow its Diabetes Services & Solutions

division as evidenced by the recently announced partnership with

IBM Watson Health and its minority investment in Glooko. The

recent Diabeter acquisition also marks an important first move into

the diabetes integrated care service space in the pediatric Type 1

population.

Fourth Quarter Earnings

Expectations and Fiscal Year 2016 Perspective

Based on preliminary revenue and operating results, the company

today updated its expectation that fourth quarter adjusted cash

earnings per share would be at the upper half of the previously

communicated range of $1.08 to $1.13. However, it is

important to note that adjusted cash earnings per share for the

fourth quarter exclude a number of significant charges, including,

but not limited to, amortization of intangible assets, net

restructuring charges, acquisition related items, the impact of

inventory purchase price step-up, and certain tax adjustments.

"As we look ahead to fiscal year 2016, we feel

increasingly confident about our business outlook on an operational

basis." said Gary Ellis, Medtronic executive vice president and

chief financial officer. "However, foreign exchange continues

to represent a significant headwind to many multinational

companies, including Medtronic. While recently the U.S.

dollar has weakened, it is important to note that the foreign

exchange rates in our fourth quarter were below the rates assumed

in the outlook we forecasted on our third quarter earnings call in

February."

Webcast Information

Medtronic will report its fourth quarter and full-year financial

results on Tuesday, June 2, 2015, and intends to provide its

initial fiscal year 2016 EPS guidance and revenue outlook at that

time. A news release will be issued at approximately 6:15

a.m. Central Daylight Time and will be available at

newsroom.medtronic.com. Medtronic will host a webcast at 7:00

a.m. Central Daylight Time to provide information about its

businesses for the public, analysts, and news media. The

webcast can be accessed by clicking on the Investors link on the

Medtronic website at www.medtronic.com/newsroom on June 2,

2015. Within 24 hours of the webcast, a replay of the

webcast and transcript of the company's prepared remarks will be

available by clicking on the Investor Events link through the

Investors section of the Medtronic website.

Revenue Schedules

To view the preliminary fourth quarter and fiscal year revenue

schedules, click here or visit

www.medtronic.com/newsroom.

About Medtronic

Medtronic plc, headquartered in Dublin, Ireland, is the global

leader in medical technology - alleviating pain, restoring health,

and extending life for millions of people around the world.

This press release contains

forward-looking statements related to product growth drivers,

market position, strategies for growth, and Medtronic's future

results of operations, which are subject to risks and

uncertainties, such as competitive factors, difficulties and delays

inherent in the development, manufacturing, marketing and sale of

medical products, government regulation and general economic

conditions and other risks and uncertainties described in

Medtronic's periodic reports on file with the U.S. Securities and

Exchange Commission (the "SEC"). Actual results may differ

materially from anticipated results. Medtronic does not

undertake to update its forward-looking statements or any of the

information contained in this press release. Certain

information in this press release includes calculations or figures

that have been prepared internally and have not been reviewed or

audited by our independent registered public accounting firm,

including but not limited to, certain information in the financial

schedules accompanying this press release. Use of different

methods for preparing, calculating or presenting information may

lead to differences and such differences may be material.

The financial results presented

in this news release are preliminary and may change. This

preliminary financial information has been prepared by management,

and the company's independent accountants have not completed their

audit or review of such financial information. There can be

no assurance that the company's actual results for the periods

presented herein will not differ from the preliminary financial

data presented herein and such changes could be material.

This preliminary financial data should not be viewed as a

substitute for full financial statements prepared in accordance

with GAAP and is not necessarily indicative of the results to be

achieved for any future periods.

Unless otherwise noted, all

revenue amounts given in this news release are on a GAAP basis, and

all comparisons and growth rates made in this news release are

stated on a "comparable, constant currency basis" and not an as

reported basis. References to quarterly figures increasing or

decreasing are in comparison to the fourth quarter of fiscal year

2014. References to annual figures increasing or decreasing

are in comparison to fiscal year 2014.

NON-GAAP FINANCIAL

MEASURES

This press release contains

financial measures, including revenue on a comparable, constant

currency basis and comparable, constant currency growth rates which

are considered "non-GAAP" financial measures under applicable SEC

rules and regulations.

These non-GAAP financial measures

should be considered supplemental to and not a substitute for

financial information prepared in accordance with generally

accepted accounting principles (GAAP). The company's definition of

these non-GAAP measures may not be the same or similar to measures

presented by other companies.

Medtronic management believes

that in order to properly understand its short-term and long-term

financial trends, investors may find it useful to consider the

impact of aligning historical Covidien revenues to Medtronic's

fiscal calendar and excluding specified items that can be highly

variable or difficult to predict. The company generally uses these

non-GAAP financial measures to facilitate management's review of

the operational performance of the company and as a basis for

strategic planning. Management believes that the resulting non-GAAP

financial measures provide useful information to investors

regarding the underlying business trends and performance of the

company's ongoing operations and is useful for period over period

comparisons of such operations. These non-GAAP financial measures

reflect an additional way of viewing aspects of the company's

operations that, when viewed with GAAP results and the

reconciliations to corresponding GAAP financial measures, may

provide a more complete understanding of factors and trends

affecting Medtronic's business.

Because non-GAAP financial

measures exclude the effect of items that will increase or decrease

the company's reported results of operations, management strongly

encourages investors to review the company's consolidated financial

statements and publicly filed reports in their entirety.

Reconciliations of the non-GAAP financial measures to the most

directly comparable GAAP financial measures are included in the

financial schedules accompanying this press release.

-end-

View FY15 Fourth Quarter Preliminary Revenue

Schedules

Contacts:

Cindy Resman

Public Relations

+1-763-505-0291

Jeff Warren

Investor Relations

+1-763-505-2696

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Medtronic plc via Globenewswire

HUG#1922538

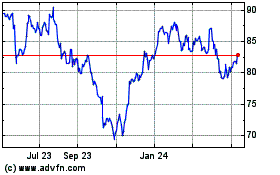

Medtronic (NYSE:MDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

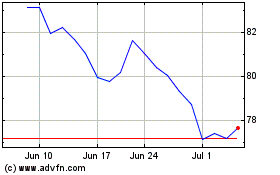

Medtronic (NYSE:MDT)

Historical Stock Chart

From Apr 2023 to Apr 2024