ADP Private Payrolls Rise by 173,000 in May

June 02 2016 - 9:21AM

Dow Jones News

By Lisa Beilfuss

Private-sector hiring rose in May, the latest sign that the U.S.

job market remains solid.

Private payrolls across the U.S. rose by 173,000 last month,

said payroll processor Automatic Data Processing Inc. and

forecasting firm Moody's Analytics. Economists surveyed by The Wall

Street Journal expected an increase of 170,000.

The April increase, meanwhile, was revised up to 166,000 from an

initially-reported 156,000.

While job creation has moderated in recent months, as energy

companies and manufacturers shed jobs and as the market tightens

for skilled labor, "job growth remains strong enough to reduce

underemployment," said Mark Zandi, chief economist of Moody's

Analytics.

Service-sector firms continued to propel job growth in May,

upping hiring slightly from April to add 175,000 workers. The

increase offset a small decline in head counts at goods-producing

firms, dragged by another decline in manufacturing hiring. The

service sector comprises most American jobs.

Small firms continued to hire at a better clip than bigger

businesses more affected to the global economic slowdown and

currency headwinds. America's smallest companies added 76,000

workers last month, down from an upwardly revised 101,000 in April

but outpacing the 63,000 hired by medium firms and 34,000 added by

large businesses.

The ADP report precedes the Bureau of Labor Statistics's May

employment-situation report, due out Friday morning and the last

one before the Federal Reserve's June 15 rate decision. ADP lags

behind the government's initial private payroll estimate by a

month, and it doesn't aim to replicate the nonfarm payrolls

survey.

In its report released yesterday on regional economic

conditions, known as the beige book, the Fed said "tight labor

markets were widely noted in most districts." Recent data including

the jobless benefit claims and monthly layoff plans have continued

to illustrate a solid labor market, and Fed Chairwoman Janet Yellen

has said a rate increase would be appropriate "probably in the

coming months" if the economy and labor market continue to

strengthen.

Economists polled by The Wall Street Journal expect the BLS to

report an increase of 158,000 nonfarm payrolls, little changed from

April. The unemployment rate is expected to hold steady at 5%.

Many economists expect that the seven-week strike at Verizon

Communications Inc. hurt May payrolls. The strike affected some

36,000 workers who returned to work Wednesday. According to a

representative, Verizon doesn't use ADP as a payroll processor. ADP

didn't indicate that the strike affected its May tally.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

June 02, 2016 09:06 ET (13:06 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

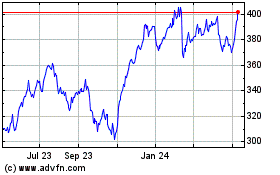

Moodys (NYSE:MCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

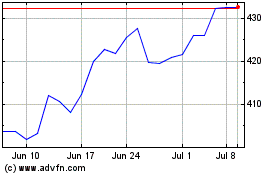

Moodys (NYSE:MCO)

Historical Stock Chart

From Apr 2023 to Apr 2024