- 1Q16 revenue of $816.1 million down 6%

from 1Q15

- 1Q16 EPS of $0.93 down 16% from

1Q15

- FY 2016 EPS guidance now $4.55 to

$4.65, including $0.02 dilution from the acquisition of GGY

Moody’s Corporation (NYSE:MCO) today announced results for the

first quarter of 2016 and updated its outlook for full year

2016.

“Reduced global bond issuance in the first quarter weighed on

Moody’s financial performance despite strong results at Moody’s

Analytics, which is not sensitive to debt issuance activity,” said

Raymond McDaniel, President and Chief Executive Officer of Moody’s.

“Given market conditions, we have scaled back our revenue and

earnings expectations for full year 2016, and are managing our cost

base accordingly.”

FIRST QUARTER 2016

HIGHLIGHTS

Moody’s Corporation reported revenue of $816.1 million for the

three months ended March 31, 2016, down 6% from $865.6 million for

the same period of 2015.

Operating expense totaled $512.0 million, up 4% from $494.3

million, and operating income was $304.1 million, down 18% from

$371.3 million. Adjusted operating income (operating income before

depreciation and amortization) was $334.0 million, down 16% from

$399.9 million in the prior-year period. Operating margin for the

first quarter of 2016 was 37.3% and adjusted operating margin was

40.9%.

EPS of $0.93 was down 16% from the first quarter of 2015.

MCO FIRST QUARTER 2016 REVENUE DOWN

6%

Moody’s Corporation reported global revenue of $816.1 million

for the first quarter of 2016, down 6% from the first quarter of

2015. Foreign currency translation unfavorably impacted revenue by

2%.

US revenue was $480.0 million, down 4% from $499.8 million,

while non-US revenue was $336.1 million, down 8% from $365.8

million. Revenue generated outside the US constituted 41% of total

revenue, versus 42% in the prior-year period.

MIS First Quarter Revenue Down

13%

Global revenue for Moody’s Investors Service (MIS) for the first

quarter of 2016 was $525.1 million, down 13% from $602.3 million in

the prior-year period. Foreign currency translation unfavorably

impacted MIS revenue by 1%. US revenue was $336.0 million, down

10%, while non-US revenue was $189.1 million, down 18%.

Global corporate finance revenue was $240.3 million, down 20%

from the prior-year period. This result reflected lower levels of

global speculative-grade issuance as well as a decline in the

number of investment-grade bond offerings. US corporate finance

revenue decreased 10%, while non-US revenue decreased 36%.

Global structured finance revenue totaled $90.6 million, down

11% from a year earlier, as US securitization activity slowed,

primarily within the CMBS and CLO markets. US structured finance

revenue was down 15%, while non-US revenue was flat.

Global financial institutions revenue was $94.9 million, up 1%

compared to the prior-year period. US financial institutions

revenue was down 3%, while non-US revenue was up 4%.

Global public, project and infrastructure finance revenue was

$91.5 million, down 9% from the prior-year period as US project

finance activity and European infrastructure-related issuance fell

amid choppy market conditions. US public, project and

infrastructure finance revenue was down 6%, while non-US revenue

was down 14%.

MA First Quarter Revenue Up

11%

Global revenue for Moody’s Analytics (MA) for the first quarter

of 2016 was $291.0 million, up 11% from the first quarter of 2015.

Foreign currency translation unfavorably impacted MA revenue by 2%.

MA’s US revenue was $144.0 million, up 12%, and its non-US revenue

was $147.0 million, up 9%.

Global revenue from research, data and analytics (RD&A) was

$164.9 million, up 10% from the prior-year period. Growth was

mainly due to strong new sales of research and data as well as

record customer retention. US RD&A revenue was up 14%, while

non-US revenue was up 5%.

Global enterprise risk solutions (ERS) revenue of $89.5 million

was up 16%, primarily from accelerated project deliveries. US ERS

revenue was up 14%, while non-US revenue was up 17%.

Global revenue from professional services of $36.6 million was

flat to the prior-year period. US professional services revenue was

down 6%, while non-US revenue was up 3%.

FIRST QUARTER 2016 EXPENSE UP

4%

Expenses for the first quarter of 2016 were $512.0 million, up

4% from the prior-year period. The increase was primarily due to

higher compensation costs in MA, reflecting additional headcount

required to support business growth, as well as Moody’s ongoing

technology investments. Expenses in MIS were down slightly compared

to the prior-year period. Foreign currency translation favorably

impacted expense by 2%.

Operating income was $304.1 million, down 18% from $371.3

million. The impact of foreign currency translation on operating

income was negligible. Adjusted operating income of $334.0 million

was down 16% from the prior-year period. The operating margin was

37.3%, down from 42.9%. The adjusted operating margin was 40.9%,

down from 46.2%.

Moody’s effective tax rate was 32.3% for first quarter of 2016,

compared with 32.9% for the prior-year period.

2016 CAPITAL ALLOCATION AND

LIQUIDITY

$334 Million Returned to Shareholders

in First Quarter

During the first quarter of 2016, Moody’s repurchased 2.9

million shares at a total cost of $262.1 million, or an average

cost of $89.83 per share, and issued 1.6 million shares under its

annual employee stock-based compensation plans. Moody’s also paid

$72.1 million in dividends during the quarter.

Outstanding shares as of March 31, 2016 totaled 194.3 million,

down 4% from the prior year. As of March 31, 2016, Moody’s had $1.2

billion of share repurchase authority remaining.

At quarter-end, Moody’s had $3.4 billion of outstanding debt and

$1.0 billion of additional debt capacity available under its

revolving credit facility. Total cash, cash equivalents and

short-term investments at quarter-end were $2.1 billion. Free cash

flow in the first three months of 2016 was $211.0 million, down 13%

from the first three months of 2015, primarily due to the

year-over-year decline in net income and changes in working

capital.

ASSUMPTIONS AND OUTLOOK FOR FULL YEAR

2016

Moody’s outlook for 2016 is based on assumptions about many

macroeconomic and capital market factors, including interest rates,

foreign currency exchange rates, corporate profitability and

business investment spending, mergers and acquisitions, consumer

borrowing and securitization and the amount of debt issued. These

assumptions are subject to uncertainty, and results for the year

could differ materially from our current outlook. Our guidance

assumes foreign currency translation at end-of-quarter exchange

rates. Specifically, our forecast reflects exchange rates for the

British pound (£) of $1.44 to £1 and for the euro (€) of $1.14 to

€1.

MCO Full Year 2016

Outlook

Moody’s full year 2016 revenue is now expected to increase in

the low-single-digit percent range.

In response to this revised revenue outlook, Moody’s has reduced

its projected base business spending for the year by approximately

$50 million through expense management actions and reduced

incentive compensation. These savings allow the Company to maintain

guidance for operating expenses to increase in the mid-single-digit

percent range despite the addition of GGY’s operating expenses and

the negative impact of foreign currency translation.

Moody’s now projects an operating margin of approximately 41%,

while adjusted operating margin is still expected to be

approximately 45%. The effective tax rate is still expected to be

32% to 32.5%.

The Company now expects 2016 EPS of $4.55 to $4.65, inclusive of

$0.02 dilution from the March 2016 acquisition of GGY.

Free cash flow is now expected to be approximately $1 billion.

Moody’s still expects share repurchases to be approximately $1

billion, subject to available cash, market conditions and other

ongoing capital allocation decisions. Capital expenditures are now

expected to be approximately $125 million. Depreciation and

amortization expense is still expected to be approximately $130

million.

MIS Full Year 2016

Outlook

For MIS, Moody’s now expects 2016 revenue to be approximately

flat. US revenue is now expected to decrease in the

low-single-digit percent range, while non-US revenue is now

expected to increase in the low-single-digit percent range.

Corporate finance revenue is now expected to decrease in the

low-single-digit percent range.

Structured finance revenue is now expected to decrease in the

mid-single-digit percent range as a result of continued challenges

to US securitization activity.

Financial institutions revenue is still expected to increase in

the mid-single-digit percent range.

Public, project and infrastructure finance revenue is now also

expected to increase in the mid-single-digit percent range.

MA Full Year 2016

Outlook

For MA, 2016 revenue is now expected to increase in the

high-single-digit percent range. US revenue is now expected to

increase in the low-double-digit percent range, while non-US

revenue is now expected to increase in the mid-single-digit percent

range.

Research, data and analytics revenue is now expected to increase

in the high-single-digit percent range.

Enterprise risk solutions revenue is now expected to increase in

the high-single-digit percent range, including revenue associated

with the March 2016 acquisition of GGY.

Professional services revenue is still expected to decrease in

the low-single-digit percent range.

CONFERENCE CALL

Moody’s will hold a conference call to discuss its first quarter

of 2016 results and its updated 2016 outlook on April 29, 2016 at

11:30 a.m. EST. Individuals within the US and Canada can access the

call by dialing +1-877-400-0505. Other callers should dial

+1-719-234-7477. Please dial into the call by 11:20 a.m. EST. The

passcode for the call is “Moody’s Corporation.”

The teleconference will also be webcast with an accompanying

slide presentation which can be accessed through Moody's Investor

Relations website, http://ir.moodys.com under “Events &

Presentations”. The webcast will be available until 3:30 p.m. EST

on May 28, 2016.

A replay of the teleconference will be available from 3:30 p.m.

EST, April 29, 2016 until 3:30 p.m. EST, May 28, 2016. The replay

can be accessed from within the United States and Canada by dialing

+1-888-203-1112. Other callers can access the replay at

+1-719-457-0820. The replay confirmation code is 2495047.

*****

ABOUT MOODY'S

CORPORATION

Moody's is an essential component of the global capital markets,

providing credit ratings, research, tools and analysis that

contribute to transparent and integrated financial markets. Moody’s

Corporation (NYSE: MCO) is the parent company of Moody's Investors

Service, which provides credit ratings and research covering debt

instruments and securities, and Moody's Analytics, which offers

leading-edge software, advisory services and research for credit

and economic analysis and financial risk management. The

corporation, which reported revenue of $3.5 billion in 2015,

employs approximately 10,800 people worldwide and maintains a

presence in 36 countries. Further information is available at

www.moodys.com.

“Safe Harbor” Statement under the

Private Securities Litigation Reform Act of 1995

Certain statements contained in this release are forward-looking

statements and are based on future expectations, plans and

prospects for Moody’s business and operations that involve a number

of risks and uncertainties. Moody’s outlook for 2016 and other

forward-looking statements in this release are made as of April 29,

2016, and the Company disclaims any duty to supplement, update or

revise such statements on a going-forward basis, whether as a

result of subsequent developments, changed expectations or

otherwise. In connection with the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995, the Company is

identifying certain factors that could cause actual results to

differ, perhaps materially, from those indicated by these

forward-looking statements. Those factors, risks and uncertainties

include, but are not limited to, the current world-wide credit

market disruptions and economic slowdown, which is affecting and

could continue to affect the volume of debt and other securities

issued in domestic and/or global capital markets; other matters

that could affect the volume of debt and other securities issued in

domestic and/or global capital markets, including credit quality

concerns, changes in interest rates and other volatility in the

financial markets; the level of merger and acquisition activity in

the US and abroad; the uncertain effectiveness and possible

collateral consequences of US and foreign government initiatives to

respond to the current world-wide credit market disruptions and

economic slowdown; concerns in the marketplace affecting Moody’s

credibility or otherwise affecting market perceptions of the

integrity or utility of independent credit agency ratings; the

introduction of competing products or technologies by other

companies; pricing pressure from competitors and/or customers; the

level of success of new product development and global expansion;

the impact of regulation as an NRSRO, the potential for new US,

state and local legislation and regulations, including provisions

in the Financial Reform Act and regulations resulting from that

Act; the potential for increased competition and regulation in the

EU and other foreign jurisdictions; exposure to litigation related

to Moody’s rating opinions, as well as any other litigation,

government and regulatory proceedings, investigations and inquiries

to which the Company may be subject from time to time; provisions

in the Financial Reform Act legislation modifying the pleading

standards, and EU regulations modifying the liability standards,

applicable to credit rating agencies in a manner adverse to credit

rating agencies; provisions of EU regulations imposing additional

procedural and substantive requirements on the pricing of services;

the possible loss of key employees; failures or malfunctions of

Moody’s operations and infrastructure; any vulnerabilities to cyber

threats or other cybersecurity concerns; the outcome of any review

by controlling tax authorities of the Company’s global tax planning

initiatives; the outcome of those Legacy Tax Matters and legal

contingencies that relate to the Company, its predecessors and

their affiliated companies for which Moody’s has assumed portions

of the financial responsibility; exposure to potential criminal

sanctions or civil remedies if the Company fails to comply with

foreign and US laws and regulations that are applicable in the

jurisdictions in which the Company operates, including sanctions

laws, anti-corruption laws and local laws prohibiting corrupt

payments to government officials; the impact of mergers,

acquisitions or other business combinations and the ability of the

Company to successfully integrate acquired businesses; currency and

foreign exchange volatility; the level of future cash flows; the

levels of capital investments; and a decline in the demand for

credit risk management tools by financial institutions; and other

risk factors as discussed in the Company’s annual report on Form

10-K for the year ended December 31, 2015 and in other filings made

by the Company from time to time with the Securities and Exchange

Commission.

Table 1 - Consolidated Statements of Operations

(Unaudited) Three Months

Ended March 31, 2016 2015 Amounts

in millions, except per share amounts

Revenue $ 816.1 $

865.6 Expenses: Operating 249.2 244.4 Selling,

general and administrative 232.9 221.3 Depreciation and

amortization 29.9 28.6

Total expenses

512.0 494.3

Operating income 304.1

371.3 Non-operating (expense) income, net Interest

expense, net (34.1) (29.3) Other non-operating income, net

5.6 2.5 Total non-operating expense, net (28.5)

(26.8)

Income before provision for income taxes

275.6 344.5 Provision for income taxes 89.0

113.2 Net income

186.6 231.3 Less: net

income attributable to noncontrolling interests 2.2

1.2

Net income attributable to Moody's

Corporation

$ 184.4 $ 230.1

Earnings per share

attributable to Moody's common shareholders Basic $ 0.95 $ 1.14

Diluted $ 0.93 $ 1.11

Weighted average

number of shares outstanding Basic 195.0 202.7 Diluted

197.9 206.5

Table 2-

Supplemental Revenue Information (Unaudited)

Three Months Ended March 31, Amounts in

millions

2016 2015

Moody's Investors Service Corporate Finance $

240.3 $ 298.7 Structured Finance 90.6 101.3 Financial Institutions

94.9 93.8 Public, Project and Infrastructure Finance 91.5 100.7 MIS

Other 7.8 7.8 Intersegment royalty 24.0 22.3

Sub-total MIS 549.1 624.6 Eliminations (24.0) (22.3)

Total MIS revenue 525.1 602.3

Moody's

Analytics Research, Data and Analytics 164.9 149.6 Enterprise

Risk Solutions 89.5 77.1 Professional Services 36.6 36.6

Intersegment revenue 2.8 3.3 Sub-total MA 293.8 266.6

Eliminations (2.8) (3.3) Total MA revenue

291.0 263.3

Total Moody's Corporation revenue

$ 816.1 $ 865.6

Moody's Corporation

revenue by geographic area United States $ 480.0 $ 499.8

International 336.1 365.8

$

816.1 $ 865.6 Table 3 -

Selected Consolidated Balance Sheet Data (Unaudited)

March 31, December 31,

2016 2015* Amounts in millions Cash and cash

equivalents $ 1,576.1 $ 1,757.4 Short-term investments 490.6 474.8

Total current assets 3,085.3 3,243.1 Non-current assets 2,029.6

1,859.9 Total assets 5,114.9 5,103.0 Total current liabilities

1,151.9 1,218.5

Total debt

3,428.6 3,380.6 Other long-term liabilities 885.9 836.9 Total

shareholders' (deficit) (351.5) (333.0) Total liabilities and

shareholders' equity 5,114.9 5,103.0 Actual number of shares

outstanding 194.3 196.1

*In the first quarter of 2016, the Company adopted a new accounting

update on a retrospective basis which requires debt issuance costs

to be presented as a reduction of debt rather than as an asset.

Accordingly, the Company reclassified debt issuance costs, which

were previously included in non-current assets, as a reduction of

total debt.

Table 4 - Selected Consolidated

Balance Sheet Data (Unaudited) Continued

Total debt consists of the following:

March 31, 2016

PrincipalAmount

Fair Value ofInterest Rate

Swap (1)

Unamortized(Discount)Premium

Unamortized DebtIssuance

Cost (2)

Carrying Value Notes Payable: 6.06% Series 2007-1

Notes due 2017

$ 300.0 $ - $

- $ (0.1) $ 299.9 5.50% 2010

Senior Notes, due 2020

500.0 22.1 (1.6)

(1.9) 518.6 4.50% 2012 Senior Notes, due 2022

500.0 - (2.7) (2.4) 494.9 4.875%

2013 Senior Notes, due 2024

500.0 - (2.2)

(3.0) 494.8 2.75% 2014 Senior Notes (5-Year), due

2019

450.0 10.2 (0.5) (2.2)

457.5 5.25% 2014 Senior Notes (30-Year), due 2044

600.0 - 3.4 (6.1) 597.3 1.75%

2015 Senior Notes, due 2027

569.8 -

- (4.2) 565.6 Total

long-term debt

$ 3,419.8 $ 32.3

$ (3.6) $ (19.9) $

3,428.6 December 31, 2015

PrincipalAmount

Fair Value ofInterest Rate

Swap (1)

Unamortized(Discount)Premium

Unamortized DebtIssuance

Cost (2)

Carrying Value Notes Payable: 6.06% Series 2007-1 Notes due

2017 $ 300.0 $ - $ - $ (0.2) $ 299.8 5.50% 2010 Senior Notes, due

2020 500.0 9.4 (1.6) (2.0) 505.8 4.50% 2012 Senior Notes, due 2022

500.0 - (2.8) (2.5) 494.7 4.875% 2013 Senior Notes, due 2024 500.0

- (2.3) (3.1) 494.6 2.75% 2014 Senior Notes (5-Year), due 2019

450.0 2.3 (0.5) (2.4) 449.4 5.25% 2014 Senior Notes (30-Year), due

2044 600.0 - 3.4 (6.2) 597.2 1.75% 2015 Senior Notes, due 2027

543.1 - - (4.0) 539.1 Total

long-term debt $ 3,393.1 $ 11.7 $ (3.8) $ (20.4) $ 3,380.6

(1) Reflects interest rate swaps on the 2010

Senior Notes and the 2014 Senior Notes (5-Year).

(2)

Pursuant to a new accounting update, unamortized debt issuance

costs are presented as a reduction to the carrying value of the

debt.

Table 5 - Non-operating (expense) income, net

Three Months Ended March 31,

Amounts in millions

2016

2015

Interest expense, net: Expense on borrowings

$

(34.6) $ (28.3) Income

2.9 1.9 UTPs and other tax

related liabilities

(2.8) (3.2) Interest capitalized

0.4 0.3

Total interest expense, net $

(34.1) $ (29.3)

Other non-operating (expense) income,

net: FX gain

$ 4.0 $ - Joint venture income

1.9 1.9 Other

(0.3) 0.6

Other

non-operating income, net 5.6 2.5

Total

non-operating expense, net $ (28.5) $ (26.8)

Table 6 - Financial Information by

Segment:

The table below presents revenue, adjusted operating income and

operating income by reportable segment. The Company defines

adjusted operating income as operating income excluding

depreciation and amortization.

Three Months

Ended March 31, 2016 2015

MIS MA

Eliminations Consolidated MIS

MA Eliminations

Consolidated Revenue

$ 549.1 $

293.8 $ (26.8) $ 816.1 $ 624.6 $

266.6 $ (25.6) $ 865.6

Operating, selling,general

andadministrativeexpense

278.6 230.3 (26.8)

482.1 281.3 210.0 (25.6) 465.7

Adjusted operatingincome

270.5 63.5 -

334.0 343.3 56.6 - 399.9

Depreciation andamortization

17.5

12.4

-

29.9

16.0

12.6

-

28.6

Operating income

$ 253.0 $ 51.1

$ - $ 304.1 $ 327.3 $ 44.0 $ - $ 371.3

Adjusted operatingmargin

49.3% 21.6% 40.9% 55.0% 21.2%

46.2% Operating margin

46.1% 17.4%

37.3% 52.4% 16.5% 42.9%

Table 7 - Transaction and Relationship

Revenue:

The tables below summarize the split between transaction and

relationship revenue. In the MIS segment, excluding MIS Other,

transaction revenue represents the initial rating of a new debt

issuance as well as other one-time fees while relationship revenue

represents the recurring monitoring of a rated debt obligation

and/or entities that issue such obligations, as well as revenue

from programs such as commercial paper, medium-term notes and shelf

registrations. In MIS Other, transaction revenue represents revenue

from professional services and outsourcing engagements and

relationship revenue represents subscription based revenues. In the

MA segment, relationship revenue represents subscription-based

revenues and software maintenance revenue. Transaction revenue in

MA represents software license fees and revenue from risk

management advisory projects, training and certification services,

and outsourced research and analytical engagements.

Three

Months Ended March 31, 2016 2015

Transaction Relationship Total

Transaction Relationship Total

Corporate Finance $151.0 $89.3 $240.3

$213.6 $85.1 $298.7 63% 37% 100% 72% 28% 100%

Structured Finance $49.8 $40.8 $90.6 $61.8 $39.5 $101.3 55% 45%

100% 61% 39% 100% Financial Institutions $37.0 $57.9 $94.9 $37.8

$56.0 $93.8 39% 61% 100% 40% 60% 100% Public, Project and

Infrastructure Finance $53.8 $37.7 $91.5 $64.4 $36.3 $100.7 59% 41%

100% 64% 36% 100% MIS Other $2.9 $4.9 $7.8 $3.3 $4.5 $7.8 37% 63%

100% 42% 58% 100%

Total MIS $294.5 $230.6

$525.1 $380.9 $221.4 $602.3

56% 44%

100% 63% 37% 100%

Moody's Analytics $69.3 $221.7

$291.0 $60.6 $202.7 $263.3

24% 76% 100%

23% 77% 100%

Total Moody's Corporation $363.8

$452.3 $816.1 $441.5 $424.1 $865.6

45%

55% 100% 51% 49% 100%

Non-GAAP Financial Measures:

The tables below reflect certain adjusted results that the SEC

defines as "non-GAAP financial measures" as well as a

reconciliation of each non-GAAP measure to its most directly

comparable GAAP measure. Management believes that such non-GAAP

financial measures, when read in conjunction with the Company's

reported results, can provide useful supplemental information for

investors analyzing period-to-period comparisons of the Company's

performance, facilitate comparisons to competitors' operating

results and to provide greater transparency to investors of

supplemental information used by management in its financial and

operational decision-making. These non-GAAP measures, as defined by

the Company, are not necessarily comparable to similarly defined

measures of other companies. Furthermore, these non-GAAP measures

should not be viewed in isolation or used as a substitute for other

GAAP measures in assessing the operating performance or cash flows

of the Company.

Table 8 - Adjusted Operating Income and

Adjusted Operating Margin:

The table below reflects a reconciliation of the Company’s

operating income and operating margin to adjusted operating income

and adjusted operating margin. The Company defines adjusted

operating income as operating income excluding depreciation and

amortization. The Company presents adjusted operating income

because management deems this metric to be a useful measure of

assessing the operating performance of Moody’s, measuring the

Company's ability to service debt, fund capital expenditures, and

expand its business. Adjusted operating income excludes

depreciation and amortization because companies utilize productive

assets of different ages and use different methods of both

acquiring and depreciating productive assets. Management believes

that the exclusion of this item, detailed in the reconciliation

below, allows for a more meaningful comparison of the Company’s

results from period to period and across companies. The Company

defines adjusted operating margin as adjusted operating income

divided by revenue.

Three Months Ended

March 31,

(amounts in millions)

2016 2015 Operating

income $

304.1 $ 371.3 Depreciation & amortization

29.9 28.6

Adjusted operating income $

334.0 $ 399.9

Operating margin 37.3% 42.9%

Adjusted operating margin 40.9% 46.2%

Year

Ended December 31, 2016 Operating margin guidance

Approximately 41% Depreciation & amortization

Approximately 4% Adjusted operating margin guidance

Approximately 45%

Table 9 - Free Cash Flow:

The table below reflects a reconciliation

of the Company’s net cash flows from operating activities to free

cash flow. The Company defines free cash flow as net cash provided

by operating activities minus payments for capital expenditures.

Management believes that free cash flow is a useful metric in

assessing the Company’s cash flows to service debt, pay dividends

and to fund acquisitions and share repurchases. Management deems

capital expenditures essential to the Company’s product and service

innovations and maintenance of Moody’s operational capabilities.

Accordingly, capital expenditures are deemed to be a recurring use

of Moody’s cash flow.

Three Months Ended

March 31,

(amounts in millions)

2016 2015

Net cash flows from operating activities $

237.3 $

261.8

Capital expenditures

(26.3) (19.0)

Free cash flow $

211.0 $ 242.8

Net cash used in investing activities $

(108.4) $ (49.3)

Net cash (used in) provided by financing

activities $

(339.2) $ 123.9

Year Ended

December 31,

2016

Net cash flows from operating activities guidance

Approximately $1.1 billion

Capital expenditures guidance

(Approximately $125 million) Free cash flow guidance

Approximately $1.0 billion

Table 10 - 2016 Outlook

Moody’s outlook for 2016 is based on

assumptions about many macroeconomic and capital market factors,

including interest rates, foreign currency exchange rates,

corporate profitability and business investment spending, merger

and acquisition activity, consumer borrowing and securitization and

the amount of debt issued. These assumptions are subject to

uncertainty and results for the year could differ materially from

our current outlook. Moody’s guidance assumes foreign currency

translation at end-of-quarter exchange rates. Specifically, our

forecast reflects exchange rates for the British pound (£) of $1.44

to £1 and for the euro (€) of $1.14 to €1.

Full-year 2016 Moody's Corporation guidance MOODY'S

CORPORATION Current guidance

Last publicly disclosed guidance on

February 5, 2016

Revenue increase in the low-single-digit percent

range growth in the mid-single-digit percent range

Operating expenses increase in the mid-single-digit percent range

NC Depreciation & amortization Approximately $130 million NC

Operating margin Approximately 41% Approximately 42% Adjusted

operating margin Approximately 45% NC Effective tax rate 32% -

32.5% NC EPS $4.55 to $4.65 $4.75 to $4.85 Capital expenditures

Approximately $125 million $125 - $135 million Free cash flow

Approximately $1 billion Approximately $1.1 billion Share

repurchases

Approximately $1 billion (subject to

available cash, marketconditions and other ongoing capital

allocation decisions)

NC

Full-year 2016

revenue guidance MIS Current

guidance

Last publicly disclosed guidance on

February 5, 2016

MIS global Approximately flat growth in the mid-single-digit

percent range MIS US decrease in the low-single-digit percent range

growth in the mid-single-digit percent range MIS non-US increase in

the low-single-digit percent range growth in the mid-single-digit

percent range CFG decrease in the low-single-digit percent range

flat SFG decrease in the mid-single-digit percent range growth in

the high-single-digit percent range FIG increase in the

mid-single-digit percent range NC PPIF increase in

the mid-single-digit percent range growth in the

high-single-digit percent range

MA

MA global increase in the high-single-digit

percent range growth in the mid-single-digit percent range MA US

increase in the low-double-digit percent range growth in the

high-single-digit percent range MA non-US increase in the

mid-single-digit percent range flat RD&A increase in the

high-single-digit percent range growth in the mid-single-digit

percent range ERS increase in the high-single-digit percent range

growth in the low-single-digit percent range PS

decrease in the low-single-digit percent range NC

NC- There is no difference between the Company's current

guidance and the last publicly disclosed guidance for this item.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160429005286/en/

Salli SchwartzGlobal Head of Investor Relations

andCommunications212.553.4862sallilyn.schwartz@moodys.comorKaterina

SoumilovaAssistant Vice PresidentCorporate

Communications212.553.1177katerina.soumilova@moodys.com

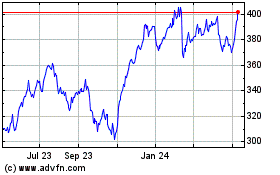

Moodys (NYSE:MCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

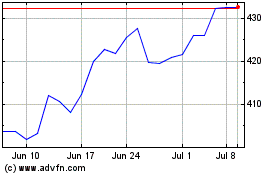

Moodys (NYSE:MCO)

Historical Stock Chart

From Apr 2023 to Apr 2024