Puerto Rico to Make Most Crucial of Debt Payments Due Jan. 1 -- Update

December 30 2015 - 5:13PM

Dow Jones News

By Aaron Kuriloff

Gov. Alejandro Garcia Padilla said Puerto Rico will make the

most crucial of its roughly $1 billion in bond payments due Jan. 1,

a strategy he said was aimed at staving off creditor lawsuits that

could exacerbate a financial crisis.

The U.S. commonwealth will pay about $330 million in general

obligation debt, which is guaranteed by the island's constitution,

after redirecting some money from bonds with weaker legal

protections, Mr. Padilla said in a conference call with

reporters.

The commonwealth's trustees will tap reserves to pay another

$383 million of the debt, including bonds from the highway and

convention center authorities. It will miss payment on about $37

million due on bonds from the Infrastructure Financing Authority

and the Public Finance Corp.

Those defaults are the latest from Puerto Rico, which owes

investors about $70 billion and has struggled with a decadelong

recession and a shrinking population that this year led Mr. Padilla

to declare its debts unpayable.

The government began missing bond payments in August and is

threatening to skip even more in the months ahead, possibly leading

to legal battles of increasing complexity as its coffers empty.

The payments are likely among the last Puerto Rico will make in

coming months, according to Mr. Padilla, who said on Wednesday that

the government's efforts would leave reserve accounts depleted.

The commonwealth will continue to pay bonds backed by sales

taxes, known by the Spanish acronym Cofina , but it doesn't have

access to that money to redirect it, Melba Acosta, president of the

island's Government Development Bank told reporters in the

conference call.

"What we've seen so far suggests a very strong desire to avoid

default on general obligation bonds and government-guaranteed

securities, and that's consistent with the knowledge that the

government will find itself in deep litigation as soon as it does,"

said Ted Hampton, an analyst at Moody's Investors Service, in an

interview last week.

Fear of expensive and expanding litigation has sent Puerto Rico

to the U.S. Congress asking for bankruptcy protection. The Obama

administration and congressional Democrats have called for Congress

to pass legislation that would allow the territory to restructure

its debt, but Republicans blocked an effort to grant such a

restructuring authority in the annual spending bill lawmakers

passed earlier this month.

Puerto Rico needs swift congressional action to create an

orderly restructuring process, a Treasury spokesman said on

Wednesday. "Puerto Rico is at a dead end, shifting funds from one

creditor to pay another and diverting money from already-depleted

pension funds to pay both current bills and debt service," he

said.

Efforts in Congress face opposition from some investors, who say

changing Puerto Rico's status isn't needed and sets a bad precedent

for states in financial distress. Several have argued for a

negotiated approach exemplified by talks involving the Puerto Rico

Electric Power Authority, which signed a deal with 70% of its

creditors that will see it make its scheduled payments.

The announced Jan. 1 defaults are "remarkably mild" given the

commonwealth's repeated warnings about its dwindling resources,

wrote Daniel Hanson, an analyst at the Washington-based investing

firm Height Securities, in a report on Wednesday. That could hurt

its credibility with the U.S. Congress, and because the island's

cash flows in 2015 have been higher than expected, "investors

should take the governor's claims about future bond payments with a

grain of salt," he said.

Joseph Rosenblum, director of municipal credit research at

AllianceBernstein, said the payment strategy only buys Puerto Rico

some time. "It does not say or do anything about their severe

liquidity crisis, their need to make future payments or the need to

continue to work on turning around their economy," he said.

Some Puerto Rico general obligation bonds maturing in 2035

traded at 73 cents on the dollar on Wednesday, up from about 71.75

cents on Tuesday.

Puerto Rico's economic problems have been compounded by

migration to the U.S. The Census Bureau reported last week that the

island's population fell by 1.7% in the year ended June. Its

population now stands nearly 10% below the level of July 2004.

Nick Timiraos and Lora Western contributed to this article.

Write to Aaron Kuriloff at aaron.kuriloff@wsj.com

(END) Dow Jones Newswires

December 30, 2015 16:58 ET (21:58 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

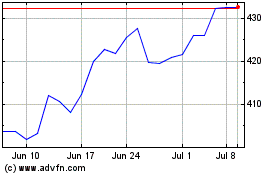

Moodys (NYSE:MCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

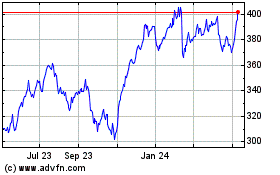

Moodys (NYSE:MCO)

Historical Stock Chart

From Apr 2023 to Apr 2024