Moody’s Analytics Launches AutoCycle™ Solution for Car Price Forecasting

July 20 2015 - 8:30AM

Business Wire

Moody’s Analytics, a leader in risk measurement and management,

today announced the launch of its AutoCycle solution, which allows

banks, auto finance companies, insurers, auto dealers and other

professionals to accurately forecast car values under a range of

economic scenarios.

Built on Moody’s Analytics’ extensive forecasting and modeling

expertise, the AutoCycle solution uses a transparent econometric

model to help banks meet their regulatory requirements and

objectively assess the value of their auto portfolios. In addition,

auto finance companies can project the residual and repossession

values of their vehicles, insurers can forecast payouts on

replacement claims, and auto dealers and car rental networks are

able to determine resale values.

“The growth of auto lending and leasing means banks, captive

financiers and other auto professionals have a greater equity stake

in the value of their vehicles,” says Tony Hughes, Managing

Director at Moody’s Analytics. “To manage risk in their auto

portfolios effectively, these professionals must identify long-term

influences on car prices and fully account for cyclical economic

factors that could affect their businesses and investments.”

The AutoCycle solution forecasts car prices using Moody’s

Analytics’ full range of alternative macroeconomic scenarios,

including the adverse and severely adverse economic scenarios set

by the US Federal Reserve for stress-testing purposes. These

scenarios are updated monthly and include more than 1,800 economic

variables, taking into account the effects of gasoline prices,

economic supply and demand, seasonal conditions and other factors

on the automotive industry.

Forecasts are available for nearly 1,000 vehicles by make,

model, mileage and year, based on historical pricing data for more

than 81 million vehicle transactions. The forecasts project vehicle

values over a 10-year horizon, covering 16 segments, such as

compact or utility; 18 body types, such as wagon, hatchback or

coupe; and six fuel types, such as gas, hybrid or diesel. Banks,

captive auto finance lenders and other institutions can also

produce custom forecasts using their own loan, lease and pricing

data.

For more information on Moody’s Analytics’ AutoCycle solution,

please visit http://www.economy.com/autocycle or

http://www.moodysanalytics.com/autocycle.

About Moody’s Analytics

Moody’s Analytics helps capital markets and risk management

professionals worldwide respond to an evolving marketplace with

confidence. The company offers unique tools and best practices for

measuring and managing risk through expertise and experience in

credit analysis, economic research and financial risk management.

By providing leading-edge software, advisory services and research,

including proprietary analyses from Moody’s Investors Service,

Moody’s Analytics integrates and customizes its offerings to

address specific business challenges. Moody's Analytics is a

subsidiary of Moody's Corporation (NYSE:MCO), which reported

revenue of $3.3 billion in 2014, employs approximately 10,000

people worldwide and has a presence in 33 countries. Further

information is available at www.moodysanalytics.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150720005110/en/

Moody’s AnalyticsPRANITA SOOKAI, 212-553-4181Associate

Communications Strategistpranita.sookai@moodys.com

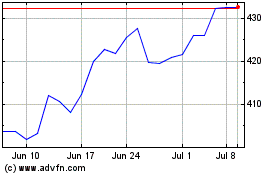

Moodys (NYSE:MCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

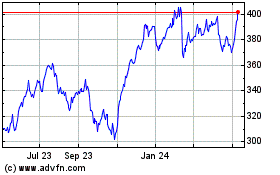

Moodys (NYSE:MCO)

Historical Stock Chart

From Apr 2023 to Apr 2024