Moody’s Analytics Adds Regulatory Calculations to Structured Finance Portal

March 10 2015 - 8:30AM

Business Wire

Moody's Analytics, a leader in risk measurement and management,

today announced the addition of a Regulatory Module to its

Structured Finance Portal. The web-based tool helps financial

institutions assess the potential accounting and regulatory

treatment of structured finance securities, including calculating

capital ratios and other portfolio metrics for the Comprehensive

Capital Analysis and Review (CCAR) and Dodd-Frank Act Stress Tests

(DFAST).

The module leverages the Structured Finance Portal’s library of

global structured finance data to help users measure the potential

accounting and regulatory impact on all securitized asset classes

in their portfolios through an easy-to-use and customizable

web-based interface. All metrics and analytics are based on Moody’s

Analytics’ proprietary credit models and cash flow engines.

“Measuring the accounting and regulatory impact on existing and

prospective structured finance holdings has become increasingly

challenging for financial institutions,” said Andrew Jacobs,

Director at Moody’s Analytics. “Our new regulatory module helps our

customers better understand this impact, while providing greater

transparency, efficiency and additional analytical

capabilities."

The new module applies the Federal Reserve’s macroeconomic

scenarios to forecast deal and tranche cash flows and to calculate

estimated OTTI (other than temporary impairment), simplified

supervisory formula approach (SSFA) metrics and SSFA projections.

It also incorporates the portal’s benchmarking capabilities,

comparative analytics, loan-level content and portfolio-level

reporting and analytics, while providing sensitivity analysis for

regulatory measures.

With the newly enhanced Structured Finance Portal, banks and

financial institutions can compare the regulatory impact on their

portfolios to custom cohorts or the broader structured finance

universe. They can also run model validations, exposure analyses

and cash-flow analytics, as well as point-in-time or forecast

analyses.

For more information, visit sfportal.moodysanalytics.com.

About Moody’s Analytics

Moody’s Analytics helps capital markets and risk management

professionals worldwide respond to an evolving marketplace with

confidence. The company offers unique tools and best practices for

measuring and managing risk through expertise and experience in

credit analysis, economic research and financial risk management.

By providing leading-edge software, advisory services and research,

including proprietary analyses from Moody’s Investors Service,

Moody’s Analytics integrates and customizes its offerings to

address specific business challenges. Moody's Analytics is a

subsidiary of Moody's Corporation (NYSE:MCO), which reported

revenue of $3.3 billion in 2014, employs approximately 9,900 people

worldwide and has a presence in 33 countries. Further information

is available at www.moodysanalytics.com.

Moody’s AnalyticsPranita Sookai, 212-553-4181Associate

Communications

StrategistCommunicationspranita.sookai@moodys.com

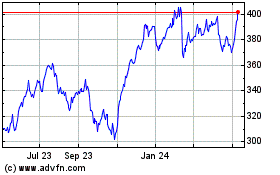

Moodys (NYSE:MCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

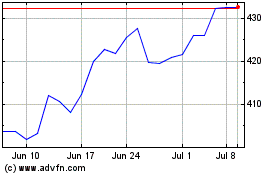

Moodys (NYSE:MCO)

Historical Stock Chart

From Apr 2023 to Apr 2024