William Ackman's large stake in Chipotle Mexican Grill Inc. adds

pressure to the struggling burrito chain that has faced

longstanding shareholder concerns about the board and executive

pay.

Judging from the stock bounce Wednesday morning, investors

welcome the move by Mr. Ackman, whose Pershing Square Capital

Management LP late Tuesday disclosed a 9.9% stake in the company.

Chipotle shares rose more than 5% in morning trading.

Chipotle is still reeling from a series of food-safety problems

last year, including a case of salmonella in Minnesota, E. coli in

several states, and norovirus in California and Boston. Its

strategy to lure back customers with free burritos and free

children's meals doesn't appear to be working, while its new

loyalty program hasn't kept restaurants full.

"Most of our loyal customers have returned but not at the same

frequency," Chief Financial Officer Jack Hartung told investors in

July, when the chain reported that same-store sales in the quarter

ended June 30 dropped 24%.

Chipotle's shares have fallen more than 40% in the past

year.

Mr. Ackman, who has previously taken stakes in well-known

consumer brands that fall on hard times said in the regulatory

filing Tuesday that he would seek talks with Chipotle about costs

and the board, among other topics, without being more specific.

Chipotle spokesman Chris Arnold said the company had its first

call with Mr. Ackman on Wednesday and that he expects a meeting

with him soon. "We certainly welcome the opportunity to engage in

conversation with Mr. Ackman, just as we do with all of our

investors," Mr. Arnold said.

Mr. Ackman's past involvement in restaurant companies has

revolved around financial and structural changes. He has also

called on other companies to shed noncore brands, which is

something analysts expect him to do at Chipotle, which owns a small

Asian chain called ShopHouse and has announced plans to open an

upscale burger chain.

In 2005, Mr. Ackman called on Wendy's Co. to spin off its Tim

Hortons coffee chain, which the company did the following year.

Also in 2005, he pressured McDonald's Corp. to separate its

company-owned stores from a holding company for real estate and

franchised restaurants. McDonald's franchised more stores and

bought back stock, but didn't sell its real estate.

Pershing Square helped private-equity firm 3G Capital take

Burger King public in 2012. In 2014, Burger King purchased Tim

Hortons with the help of Warren Buffett in a deal that lowered the

burger chain's tax basis.

Analysts and investors also expect Mr. Ackman to push for board

changes, including a possible seat for his firm. Chipotle's board

earlier this year was criticized for its directors' lack of

experience in dealing with the type of crises that can befall

restaurant companies.

Proxy advisory firm Institutional Shareholder Services in April

recommended that shareholders vote against the re-election of two

Chipotle board members, saying the chain's food safety problems

"exposed a flawed board succession process that has not allowed the

directors' skill sets to keep pace with the company's size and

complexity."

The board is made up of nine directors, five of whom have served

for 17 years or more. Three directors are over 70 years old. And it

is chaired by Chipotle founder and co-CEO Steve Ells.

At Chipotle's annual meeting in May, the targeted board members

were all re-elected, but shareholders approved a nonbinding

proxy-access proposal that would give an investor group that has

owned 3% or more of Chipotle's shares outstanding for at least

three years the ability to nominate its own board candidates. That

beat out Chipotle's more restrictive proxy-access proposal.

Mr. Arnold, the Chipotle spokesman, said Wednesday that Chipotle

may make additional changes to its board and that it is in the

process of adopting new proxy access provisions.

In his filing Tuesday, Mr. Ackman praised Chipotle for its

"visionary leadership," but some analysts don't think that means he

wants Mr. Ells to stay.

"No one can disagree that Steve is visionary, but it doesn't

mean he's right for the job going forward," Hedgeye Risk Management

analyst Howard Penney said.

Shareholder groups have been pushing for changes to executive

compensation for two years.

In 2014, 77% of Chipotle shareholders opposed the company's

compensation terms in a nonbinding say-on-pay referendum after CtW

Investment Group, a union-backed pension-fund firm, encouraged

shareholders to vote against a pay package of $49.5 million for its

two CEOs.

Chipotle pledged at the time to review its compensation

programs. Chipotle's compensation committee in March moved to tie

executive compensation more closely to its share performance,

dictating that shares would have to return to above $700 for 30

consecutive days to trigger new stock awards. The company also said

last month that it has begun looking for a new board member.

Total pay for co-chief executives Monty Moran and Mr. Ells last

year fell by more than 50% each to $13.3 million and $13.6 million,

respectively, and they didn't receive bonuses. But the declines in

compensation stem mostly from a lack of option awards in 2015.

Some shareholders don't think the company has gone far

enough.

"It's like a startup board, but the company has matured," said

Dieter Waizenegger, executive director of CtW Investment Group,

which represents pensions that collectively own about 55,000

Chipotle shares. "They should appoint an independent chairman to

the board and break out of their insularity."

Write to Julie Jargon at julie.jargon@wsj.com and David Benoit

at david.benoit@wsj.com

(END) Dow Jones Newswires

September 07, 2016 14:27 ET (18:27 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

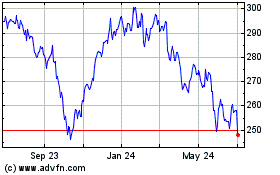

McDonalds (NYSE:MCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

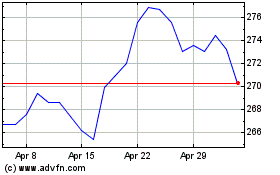

McDonalds (NYSE:MCD)

Historical Stock Chart

From Apr 2023 to Apr 2024