McDonald's Posts Lackluster Same-Store Sales Growth -- Update

July 26 2016 - 10:27AM

Dow Jones News

By Joshua Jamerson

McDonald's Corp. posted weaker-than-expected same-store sales

growth in its latest quarter, a sign that the boost from its

all-day breakfast offerings may be losing steam.

This was the fourth consecutive quarter of positive same-store

sales across all of McDonald's business segments, but in order to

go from turnaround mode to growth mode, the company needs some new

tricks.

McDonald's is testing various new products in different markets,

including Chicken McNuggets without the artificial preservatives

and bigger and smaller Big Macs. A Dallas franchisee's test of

Quarter Pounders made with fresh beef has generated the most

excitement, because switching to fresh beef could be a game-changer

for McDonald's. But franchisees also have expressed concern about

the company's ability to pull it off without posing food safety

risks and adding too much complexity to a system designed to store

frozen food.

The company cited softening growth in the restaurant industry as

a reason for its results. Consumers have been pulling back as a

result of economic uncertainties at a time when the gap between

restaurant and grocery store prices has widened.

McDonald's said it expects to get another lift from all day

breakfast in the second half of the year as it makes more breakfast

items available all day. The company also stated that it will make

more product and operational improvements.

The company has struggled to find a value menu that resonates

with budget-conscious customers while not eating into franchisees'

profits. McDonald's has moved away from its dollar menu and

experimented with other offers, including the latest offer of two

items for $2. RBC Capital Markets analyst David Palmer said "the

chain continues to wrestle with 'Dollar Menu hangover' as prices

for its premium items are perhaps too high for their perceived

quality."

Sales at existing stores rose 3.1% in the period, just below the

consensus estimate of 3.6% growth in a survey of analysts by

Consensus Metrix. But in the U.S., comparable sales rose 1.8% in

the U.S., far below the 3.2% growth anticipated by analysts.

International sales rose 2.6%, meeting analysts' views.

Since taking the helm last March, Chief Executive Steve

Easterbrook has moved to bolster the company's sales by paring down

its menu, offering more transparency about how its food is made and

launching all-day breakfast at many of its domestic restaurants. He

has said the initial boost from the expanded breakfast menu hours

would eventually moderate.

McDonald's reported a profit of $1.09 billion, or $1.25 a share

in the three months ended in June, compared with $1.2 billion, or

$1.26 cents, a year earlier. Excluding items, the company earned

$1.45 a share. Analysts had projected $1.38 in per-share

earnings.

Revenue fell 4% to $6.27 billion, meeting analysts'

expectations.

Shares fell 3.5% to $122.97 in early trading.

Write to Julie Jargon at julie.jargon@wsj.com and Joshua

Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

July 26, 2016 10:12 ET (14:12 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

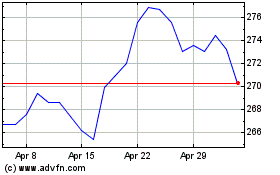

McDonalds (NYSE:MCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

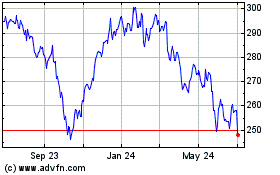

McDonalds (NYSE:MCD)

Historical Stock Chart

From Apr 2023 to Apr 2024