McDonald's Posts Lackluster Same-Store Sales Growth

July 26 2016 - 9:20AM

Dow Jones News

McDonald's Corp. posted weaker-than-expected same-store sales in

its latest quarter, a sign that the boost from its all-day

breakfast offerings may be receding.

Shares fell 3% to $123.6 in premarket trading.

Sales at existing stores rose 3.1% in the period, just below the

consensus estimate of 3.6% growth in a survey of analysts by

Consensus Metrix. But in the U.S., comparable sales rose 1.8% in

the U.S., far below the 3.2% growth anticipated by analysts.

All-day breakfast continued to power domestic sales, but the

company said it faced "softening industry growth" in the period.

International sales rose 2.6%, meeting analysts' views.

Since taking the helm last March, Chief Executive Steve

Easterbrook has moved to bolster the company's sales by paring down

its menu, offering more transparency about how its food is made and

launching all-day breakfast at many of its domestic

restaurants.

The CEO has previously said the initial boost from the expanded

breakfast menu hours would eventually moderate, and investors are

eager to hear what else McDonald's has up its sleeve.

Over all for the three months ended in June, McDonald's reported

a profit of $1.09 billion, or $1.25 a share, compared with $1.2

billion, or $1.26 cents, a year earlier. Excluding items, the

company earned $1.45 a share. Analysts had projected $1.38 in

per-share earnings.

Revenue fell 4% to $6.27 billion, meeting analysts'

expectations.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

July 26, 2016 09:05 ET (13:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

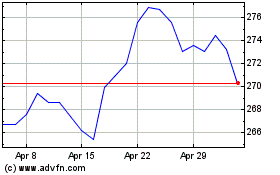

McDonalds (NYSE:MCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

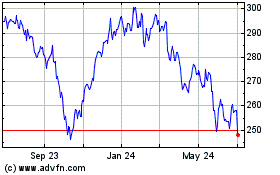

McDonalds (NYSE:MCD)

Historical Stock Chart

From Apr 2023 to Apr 2024