Starbucks Widens Workers' Health-Insurance Options

July 18 2016 - 11:40AM

Dow Jones News

Starbucks Corp. said it would be offering employees new

health-insurance choices as part of an effort to make the coffee

chain a more attractive employer.

The company on Monday is expected to announce details of a plan

to offer U.S. employees who work 20 hours or more a week the chance

to shop for health insurance on a private exchange.

Instead of the one health insurer and three medical coverage

levels they have now, employees from Chief Executive Howard Schultz

to store baristas will be able to choose from up to six national

and regional carriers, and five levels of medical plans, starting

Oct. 1.

Private exchanges, which are essentially online marketplaces

where employers can have workers choose health plans, haven't

caught on as quickly as insurers once expected. Consulting firm

Accenture PLC once estimated that 40 million Americans would be

getting insurance through private exchanges by 2020, but only about

eight million people are on such exchanges now.

The move by Starbucks comes as retailers are facing a tight

labor market and various state and local minimum-wage

increases.

Last week, the company said it would raise wages for all U.S.

store employees by at least 5% starting Oct. 3 and double the

annual stock award for Starbucks employees who have worked for the

company for two consecutive years. Starbucks employs roughly

157,000 people in the U.S., but doesn't break down how many work 20

hours a week or more.

Starbucks wouldn't disclose its employee turnover rate. Ron

Crawford, Starbucks vice president of global benefits, said

offering more insurance options eliminates a concern employees

often have about switching jobs and losing the health coverage they

were used to. "People intuitively like choice," he said.

Other restaurant companies have beefed up efforts to attract and

retain workers.

Last year, before Chipotle Mexican Grill Inc. experienced a

series of food-safety problems, it hired 4,000 new employees during

a one-day event and expanded college-tuition reimbursement to all

hourly workers, added paid sick days and increased the amount of

paid vacation it offers. McDonald's Corp. and Cheesecake Factory

Inc. raised employee wages last year.

Private exchanges can be beneficial to employees, said Paul

Fronstin, director of health research at the nonprofit Employee

Benefit Research Institute.

"The traditional model is your employer picked your insurance

and you could take it or leave it," he said.

The ultimate impact on employees may depend on the way their

employer structures its benefits. Generally, the employer gives

employees a set sum of money that they can apply toward their

insurance and if they choose a pricier plan, they pay more out of

their own pocket for the coverage.

But if employers don't ramp up the sums they contribute each

year as health coverage gets more expensive, employees can find

themselves paying out more.

Starbucks, which has historically paid 70% of the cost of a

relatively rich plan, said it has always adjusted its contribution

upward as health-care costs have risen, and that it will continue

to do so.

Mr. Crawford said Starbucks doesn't expect to save any money by

switching to the exchange operated by consulting firm Aon Hewitt, a

unit of Aon PLC.

"In fact we've structured it so that we won't," he said.

The company's standard and most commonly used "silver" plan,

which carries a relatively low deductible, will remain much the

same and continue to cost single employees $27 a paycheck and

employees with families $153 a paycheck.

The company is adding a slightly richer lower-tier plan called

"bronze-plus" as well as a more expensive "platinum" option.

Still, when employees are presented with a number of options,

many, particularly those who are younger, healthier and have lower

incomes, tend to opt for plans with relatively inexpensive monthly

costs and higher out-of-pocket bills when they need care.

Write to Julie Jargon at julie.jargon@wsj.com and Anna Wilde

Mathews at anna.mathews@wsj.com

(END) Dow Jones Newswires

July 18, 2016 11:25 ET (15:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

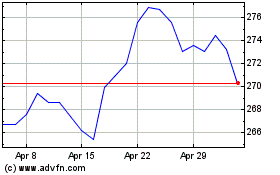

McDonalds (NYSE:MCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

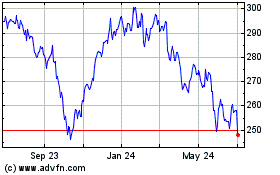

McDonalds (NYSE:MCD)

Historical Stock Chart

From Apr 2023 to Apr 2024