EU to Propose Multinationals Disclose More Tax Details

April 08 2016 - 2:50PM

Dow Jones News

BRUSSELS—Large multinational companies such as Google Inc., IKEA

and Amazon Inc. will be forced to publish profits and tax bills

from European Union countries in which they operate, under plans

the bloc's executive will bring forward next week.

The proposal to open up so-called country-by-country reporting

will be presented Tuesday and forms part of a broader effort by the

European Commission to ensure companies don't skimp on their taxes.

Similar rules already apply to EU banks.

Under the plan, EU companies with annual revenue of more than

€750 million ($856 million) will have to publish a report on income

and tax information that will be made accessible to the public. The

rules will also apply to medium and large subsidiaries of non-EU

companies operating within the 28-country bloc.

In January, the commission proposed a series of rules aimed at

stopping large-scale corporate tax avoidance in Europe, where

governments are struggling to close budget gaps in the wake of the

financial crisis. Those proposals included country-by-country

reporting for large companies but limited the information to tax

authorities.

The push to make the detailed reports public came after

newspapers around the world uncovered thousands of offshore

accounts allegedly held by officials, executives and celebrities.

The trove of emails and data on the accounts were allegedly leaked

from the Panamanian law firm Mossack Fonseca.

"After the Panama papers, there must not be a single hesitation

from anybody that we need a public country-by-country reporting,"

said Pierre Moscovici, the EU's taxation commissioner.

Around 6,500 companies world-wide could be covered by the

proposed rules, 2,000 of which are based in Europe, according to EU

officials.

The proposed disclosures, however, don't cover multinationals'

operations in countries outside the EU. That has drawn fire from

tax transparency campaigners, who argue that tax havens, where many

companies shift their profits, should fall under the new rules.

Instead, companies would publish data on their activities outside

the EU as an aggregate and not broken down by country.

"It would be very embarrassing for the commission if its new

flagship tax-transparency rules will still allow companies to get

away with the kind of dodgy practices exposed by the Panama

Papers," said Elena Gaita, a policy officer for corporate

transparency at Transparency International, the global

anticorruption group.

Mr. Moscovici signaled that there could be some last-minute

tweaks to the plan to account for operations in tax havens. "After

the Panama papers we will have the political capacity to go

further," he said.

EU authorities are still reeling from revelations in 2014 that

many multinational companies struck sweetheart deals in countries

such as Luxembourg that allowed them to pay little tax in the bloc.

The commission has launched a series of investigations into special

tax deals for multinationals, which it said could amount to illegal

state subsidies.

The European Parliamentary Research Service estimated corporate

tax-avoidance costs EU countries between €50 billion and €70

billion in revenue each year.

Still, tax-transparency campaigners said next week's proposal

should be more ambitious, because the €750 million revenue

threshold lets too many multinationals off the hook. EU officials

argue the threshold covers all the companies that can afford

"aggressive tax planning," which takes advantage of loopholes and

mismatches in different tax systems to reduce bills.

Transparency campaigners also said the proposal doesn't ask

companies to publish enough information. But EU officials and

companies said asking companies to divulge potentially commercially

sensitive information could put them in a weaker position compared

with competitors operating elsewhere.

Irene Yates, McDonald's Corp.'s vice president for corporate

tax, told European lawmakers last month that it would be better to

keep country-by-country tax and profit reports out of the public

eye. It is important "to keep information confidential when sharing

between tax authorities," she said.

The proposal will still have to be agreed by EU governments and

the European Parliament before becoming law, a process which could

take months.

Natalia Drozdiak contributed to this article.

Write to Viktoria Dendrinou at viktoria.dendrinou@wsj.com

(END) Dow Jones Newswires

April 08, 2016 14:35 ET (18:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

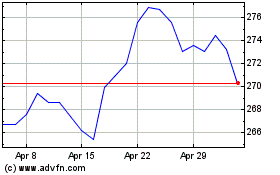

McDonalds (NYSE:MCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

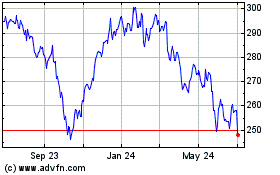

McDonalds (NYSE:MCD)

Historical Stock Chart

From Apr 2023 to Apr 2024