McDonald's Earnings Climb on U.S. Strength -- 2nd Update

January 25 2016 - 10:51AM

Dow Jones News

By Julie Jargon

McDonald's Corp.'s fourth-quarter profit and revenue soundly

beat analysts' expectations, as the company's move to all-day

breakfast helped drive the best quarterly results in the U.S. in

nearly four years.

Signs that a turnaround under Chief Executive Steve Easterbrook

was beginning to take hold emerged in the third quarter, when

McDonald's U.S. division posted its first quarterly increase in

same-store sales in two years. That momentum continued into the

fourth quarter with the launch of breakfast all day in early

October--the company's biggest strategic change since it rolled out

McCafe beverages nationwide in 2009.

Investors expected all-day breakfast to boost sales, but not

this much. Sales at U.S. restaurants open at least 13 months jumped

5.7% in the fourth quarter--far above the 2.7% growth analysts were

expecting and the best same-store sales results in the U.S. in 15

quarters. Globally, same-store sales rose 5%, while analysts were

expecting growth of 3.2%.

McDonald's shares rose 1.8% to $120.51 in early trading.

Mr. Easterbrook called the fourth-quarter results "a testament

to the swift changes we made and the early impact of our turnaround

efforts" and said he expects the momentum to continue.

Mr. Easterbrook, who became CEO last March, has enacted numerous

changes at a burger chain that had been struggling to remain

relevant with consumers. He has pared down the menu, provided

customers with more transparency about how its food is made, raised

wages for workers at company-owned stores and announced that the

company will switch to antibiotic-free chicken and cage-free eggs

in the U.S. He also has made structural and management changes

aimed at giving local markets more autonomy over the food they

serve so they can meet local taste preferences.

Mr. Easterbrook also staved off pressure to spin off the Oak

Brook, Ill., company's vast real estate holdings, announcing plans

instead to return more cash to shareholders, reduce spending and

sell about 4,000 company-owned restaurants to franchisees by the

end of 2018.

Earlier this month, the company introduced a new value menu that

it expects to help solve problems it's had finding the right price

offerings for customers. Its new "McPick 2" menu allows customers

to pick a pair of items for a total of $2 from among four choices:

mozzarella sticks, small fries and the McDouble and McChicken

sandwiches.

"McDonald's U.S. business begins 2016 as a customer-led

organization focused on delivering outstanding customer service

through comprehensive simplification efforts, core menu

enhancements and a compelling everyday national value platform.

Generating sustained, positive guest traffic remains a top priority

for the segment," the company said.

Overall, McDonald's posted a profit of $1.21 billion, or $1.31 a

share, up from $1.1 billion, or $1.13 a share, a year earlier.

Revenue declined 3.5% to $6.34 billion.

Analysts projected $1.23 in per-share profit on $6.22 billion in

revenue, according to Thomson Reuters.

Lisa Beilfuss contributed to this article.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

January 25, 2016 10:36 ET (15:36 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

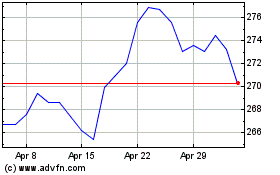

McDonalds (NYSE:MCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

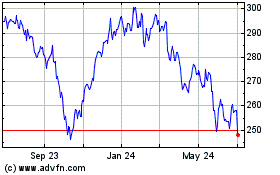

McDonalds (NYSE:MCD)

Historical Stock Chart

From Apr 2023 to Apr 2024