McDonald's Still Offers A Treat -- Ahead Of The Tape

January 25 2016 - 3:02AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 1/25/16)

By Steven Russolillo

McDonald's Corp. chief Steve Easterbrook has accomplished a lot

nearly one year into the job. There is reason to believe the

positive momentum can continue.

From all-day breakfast and other menu changes to improved

operations and better customer service, a number of Mr.

Easterbrook's changes have been well received, while pleasantly

surprising Wall Street.

For instance, analysts a year ago sported an average 12-month

price target on McDonald's of $95. Only one-fifth of them had buy

ratings.

Much has changed. The stock now trades near $120 after surging

26% last year. And nearly half of analysts rate it a buy.

The rally caught fire in October as investors cheered a strong

showing from U.S. restaurants. That contributed to a 4% gain in

global same-store sales, the best for McDonald's in more than three

years.

More good news is expected for the quarter ended in December.

Analysts polled by FactSet forecast fourth-quarter earnings of

$1.23 a share, up 9% from a year ago. That has been raised from

$1.17 in September.

Global same-store sales are expected to rise 3.2%, thanks in

part to the early success of all-day breakfast.

In a study published last month, NPD Group Inc. found about

one-third of customers who purchased breakfast items in the

afternoon or later hadn't actually been to a McDonald's prior to

the all-day breakfast launch.

Furthermore, many competitors are struggling at a time when the

Golden Arches are bouncing back.Chipotle Mexican Grill Inc.'s

difficulties are well documented. Yum Brands Inc., which operates

KFC and Pizza Hut, has lost a quarter of its market value since May

as it embarks on splitting off its China unit.

Even relative upstarts such as Potbelly Corp. and Noodles &

Co., which were expected to eat many of the larger chains' lunch,

have struggled recently.

And while McDonald's shares aren't cheap, they still trade at a

discount relative to many of its competitors, including Wendy's

Co., Panera Bread Co. and Chipotle.

For McDonald's investors, there's still golden in them thar

arches.

(END) Dow Jones Newswires

January 25, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

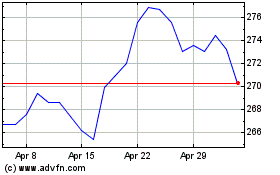

McDonalds (NYSE:MCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

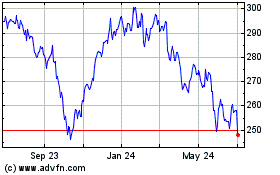

McDonalds (NYSE:MCD)

Historical Stock Chart

From Apr 2023 to Apr 2024