Key Highlights

- Sales for the third quarter increased 2

percent to $1.9 billion; in local currencies, sales increased 3

percent

- Operating profit grew 4 percent to $269

million; adjusted operating profit grew 7 percent to $275

million

- Operating profit margin for the quarter

increased to 14.3 percent, a 30 basis point expansion; adjusted

operating profit margin increased to 14.7 percent, a 70 basis point

expansion

- Earnings per share for the quarter grew

25 percent to $0.40 per common share; adjusted earnings per share

grew 21 percent to $0.41 per common share (both figures included

the negative effect of a $21 million warranty reserve increase in

our Windows and Other Specialty Products segment, which reduced

earnings per share by approximately $0.04 per common share)

Masco Corporation (NYSE: MAS), one of the world’s leading

manufacturers of branded home improvement and building products,

reported strong net sales and operating profit growth in the third

quarter of 2016.

“Our performance in the third quarter reflects our continued

execution against our strategic initiatives,” said Masco’s

President and CEO, Keith Allman. “We invested in our industry

leading brands to drive growth, and continued to improve

profitability by leveraging our operations and selectively exiting

lower margin business in our Cabinetry segment. Additionally, we

continued our disciplined capital allocation by returning

approximately $110 million to shareholders through dividends and

share repurchases during the quarter.”

2016 Third Quarter

Commentary

- On a reported basis, compared to third

quarter 2015:

- Net sales from continuing operations

increased 2 percent to $1.9 billion

- In local currency, North American sales

increased 2 percent and international sales increased 6

percent

- Gross margins improved to 32.7 percent

from 32.0 percent

- Operating margins improved to 14.3

percent from 14.0 percent

- Income from continuing operations was

$0.40 per common share compared to $0.32 per common share

- Compared to third quarter 2015, results

for key financial measures, as adjusted for certain items (see

Exhibit A) and with a normalized tax rate of 36 percent, were as

follows:

- Gross margins improved to 32.9 percent

compared to 31.9 percent

- Operating margins improved to 14.7

percent compared to 14.0 percent

- Income from continuing operations was

$0.41 per common share compared to $0.34 per common share

- Liquidity at the end of the third

quarter was approximately $1.2 billion

- 2.3 million shares were repurchased in

the third quarter

2016 Third Quarter Operating Segment

Highlights

- Plumbing Products’ net sales increased

5 percent (6 percent excluding the impact of foreign currency

translation), driven by growth in North America and

internationally

- Decorative Architectural Products’ net

sales increased 2 percent with growth from paints and other coating

products partially offset by the timing and amount of

promotions

- Cabinetry Products’ net sales decreased

6 percent due to the exit of lower margin business in the builder

channel, which was partially offset by growth in the retail and

dealer channels

- Windows and Other Specialty Products’

net sales decreased 1 percent. Excluding the impact of foreign

currency translation, net sales increased 2 percent, led by our

North American windows business

Outlook

“Consumer demand for our market-leading products remains strong,

as the fundamentals for long-term demand in both repair and remodel

and new home construction continue to be positive,” said Allman.

“By leveraging our brand portfolio, our industry-leading positions

and our Masco Operating System, we will continue to successfully

execute against these positive industry fundamentals to achieve our

long-term growth strategies.”

About Masco

Headquartered in Taylor, Michigan, Masco Corporation is a global

leader in the design, manufacture and distribution of branded home

improvement and building products. Our portfolio of

industry-leading brands includes Behr® paint; Delta® and Hansgrohe®

faucets, bath and shower fixtures; KraftMaid® and Merillat®

cabinets; Milgard® windows and doors; and Hot Spring® spas. We

leverage our powerful brands across product categories, sales

channels and geographies to create value for our customers and

shareholders. For more information about Masco Corporation, visit

www.masco.com.

The 2016 third quarter supplemental material, including a

presentation in PDF format, is available on the Company’s website

at www.masco.com.

Conference Call Details

A conference call regarding items contained in this release is

scheduled for Tuesday, October 25, 2016 at 8:00 a.m. ET.

Participants in the call are asked to register five to ten minutes

prior to the scheduled start time by dialing (855) 226-2726

(855-22MASCO) and from outside the U.S. at (706) 679-3614. Please

use the conference identification number 86755759. The conference

call will be webcast simultaneously and in its entirety through the

Company’s website. Shareholders, media representatives and others

interested in Masco may participate in the webcast by registering

through the Investor Relations section on the Company’s

website.

A replay of the call will be available on Masco’s website or by

phone by dialing (855) 859-2056 and from outside the U.S. at (404)

537-3406. Please use the conference identification number 86755759.

The telephone replay will be available approximately two hours

after the end of the call and continue through November 25,

2016.

Safe Harbor Statement

This press release contains statements that reflect our views

about our future performance and constitute “forward-looking

statements” under the Private Securities Litigation Reform Act of

1995. Forward-looking statements can be identified by words such as

“believe,” “anticipate,” “appear,” “may,” “will,” “should,”

“intend,” “plan,” “estimate,” “expect,” “assume,” “seek,”

“forecast,” and similar references to future periods. Our views

about future performance involve risks and uncertainties that are

difficult to predict and, accordingly, our actual results may

differ materially from the results discussed in our forward-looking

statements. We caution you against relying on any of these

forward-looking statements.

Our future performance may be affected by the levels of home

improvement activity and new home construction, our ability to

maintain our strong brands and to develop and introduce new and

improved products, our ability to maintain our competitive position

in our industries, our reliance on key customers, our ability to

achieve the anticipated benefits of our strategic initiatives, our

ability to sustain the performance of our cabinetry businesses, the

cost and availability of raw materials, our dependence on third

party suppliers, and risks associated with international operations

and global strategies. These and other factors are discussed in

detail in Item 1A, “Risk Factors” in our most recent Annual Report

on Form 10-K, as well as in our Quarterly Reports on Form 10-Q and

in other filings we make with the Securities and Exchange

Commission. The forward-looking statements in this press release

speak only as of the date of this press release. Factors or events

that could cause our actual results to differ may emerge from time

to time, and it is not possible for us to predict all of them.

Unless required by law, we undertake no obligation to update

publicly any forward-looking statements as a result of new

information, future events or otherwise.

MASCO CORPORATION Condensed Consolidated

Statements of Operations - Unaudited For the Three Months

and Nine Months Ended September 30, 2016 and 2015

(in millions, except per common share

data)

Three Months Ended Nine Months Ended

September 30, September 30, 2016

2015 2016 2015 Net sales $ 1,877 $

1,839 $ 5,598 $ 5,427 Cost of sales 1,263 1,250 3,715

3,706 Gross profit 614 589 1,883 1,721

Selling, general and administrative expenses 345 331

1,045 1,019 Operating profit 269 258 838 702

Other income (expense), net: Interest expense (43 ) (54 ) (186 )

(171 ) Other, net 1 (6 ) 5 (2 ) (42 ) (60 ) (181 )

(173 ) Income from continuing operations before income taxes 227

198 657 529 Income tax expense (81 ) (77 ) (229 ) (219 )

Income from continuing operations 146 121 428 310 Loss from

discontinued operations, net — — — (1 ) Net

income 146 121 428 309 Less: Net income attributable to

noncontrolling interest 12 10 35 29 Net

income attributable to Masco Corporation $ 134 $ 111

$ 393 $ 280 Income per common share

attributable to Masco Corporation (diluted): Income from continuing

operations $ 0.40 $ 0.32 $ 1.17 $ 0.81 Loss from discontinued

operations, net — — — — Net income $

0.40 $ 0.32 $ 1.17 $ 0.80

Average diluted common shares outstanding 329 338 332

344 Amounts attributable to Masco Corporation:

Income from continuing operations $ 134 $ 111 $ 393 $ 281 Loss from

discontinued operations, net — — — (1 ) Net

income attributable to Masco Corporation $ 134 $ 111

$ 393 $ 280

Historical information is available on our website.

MASCO CORPORATION Exhibit A:

Reconciliations - Unaudited For the Three Months and Nine

Months Ended September 30, 2016 and 2015

(in millions, except per common share

data)

Three Months Ended Nine Months Ended

September 30, September 30, 2016

2015 2016 2015

Gross Profit,

Selling, General and Administrative Expenses, and Operating Profit

Reconciliations

Net sales $ 1,877 $

1,839 $ 5,598 $

5,427 Gross profit, as reported

$ 614 $ 589 $ 1,883

$ 1,721 Rationalization charges 4 1 10 2 (Gain) on

sale of property and equipment — (3 ) — (3 )

Gross

profit, as adjusted $ 618 $

587 $ 1,893 $

1,720 Gross margin, as reported 32.7 % 32.0 %

33.6 % 31.7 % Gross margin, as adjusted 32.9 % 31.9 % 33.8 % 31.7 %

Selling, general and administrative expenses, as

reported $ 345 $ 331 $

1,045 $ 1,019 Rationalization charges 2

1 6 7

Selling, general and administrative

expenses, as adjusted $ 343 $

330 $ 1,039 $

1,012 Selling, general and administrative

expenses as percent of net sales, as reported 18.4 % 18.0 % 18.7 %

18.8 % Selling, general and administrative expenses as percent of

net sales, as adjusted 18.3 % 17.9 % 18.6 % 18.6 %

Operating profit, as reported $ 269 $

258 $ 838 $ 702 Rationalization

charges 6 2 16 9 (Gain) on sale of property and equipment —

(3 ) — (3 )

Operating profit, as adjusted $

275 $ 257 $ 854

$ 708 Operating margin, as

reported 14.3 % 14.0 % 15.0 % 12.9 % Operating margin, as adjusted

14.7 % 14.0 % 15.3 % 13.0 %

Earnings Per

Common Share Reconciliation

Income from continuing operations before income taxes, as

reported $ 227 $ 198 $

657 $ 529 Rationalization charges 6 2 16 9

(Gain) on sale of property and equipment — (3 ) — (3 ) (Gain) from

auction rate securities — — (1 ) — (Gains) from private equity

funds, net (1 ) (1 ) (2 ) (5 ) (Earnings) from equity investments,

net — — (1 ) (2 )

Income from continuing

operations before income taxes, as adjusted 232

196 669 528 Tax at 36% rate (84 ) (71 ) (241 )

(190 ) Less: Net income attributable to noncontrolling interest 12

10 35 29

Income from continuing

operations, as adjusted $ 136 $

115 $ 393 $ 309

Income per common share, as adjusted $

0.41 $ 0.34 $ 1.18

$ 0.90 Average diluted common

shares outstanding 329 338 332 344

Historical information is available on our website.

MASCO CORPORATION Condensed Consolidated

Balance Sheets and Other Financial Data - Unaudited

(dollars in millions)

September 30, December 31, 2016

2015 Balance Sheet Assets Current Assets: Cash

and cash investments $ 1,041 $ 1,468 Short-term bank deposits 182

248 Receivables 1,054 853 Inventories 758 687 Prepaid expenses and

other 87 72 Total Current Assets 3,122 3,328 Property

and equipment, net 1,049 1,027 Goodwill 841 839 Other intangible

assets, net 155 160 Other assets 206 310 Total Assets $

5,373 $ 5,664

Liabilities Current Liabilities:

Accounts payable $ 866 $ 749 Notes payable 3 1,004 Accrued

liabilities 642 650 Total Current Liabilities 1,511 2,403

Long-term debt 2,993 2,403 Other liabilities 766 800

Total Liabilities 5,270 5,606

Equity 103 58

Total Liabilities and Equity $ 5,373 $ 5,664

As

of September 30, September 30, 2016

2015 Other Financial Data Working Capital Days

Receivable days 50 49 Inventory days 56 56 Payable days 72 71

Working capital $ 946 $ 928 Working capital as a % of sales (LTM)

12.9 % 13.1 %

Historical information is available on our website.

MASCO CORPORATION Condensed Consolidated

Statements of Cash Flows and Other Financial Data -

Unaudited

(dollars in millions)

Nine Months Ended September 30, 2016

2015 Cash Flows From (For) Operating

Activities: Cash provided by operating activities $ 569 $ 581

Working capital changes (187 ) (159 ) Net cash from operating

activities 382 422

Cash Flows From (For)

Financing Activities: Retirement of notes (1,300 ) (500 )

Purchase of Company common stock (242 ) (407 ) Cash dividends paid

(95 ) (94 ) Dividend paid to noncontrolling interest (31 ) (36 )

Cash distributed to TopBuild Corp. — (63 ) Issuance of TopBuild

Corp. debt — 200 Issuance of notes, net of issuance costs 889 497

Issuance of Company common stock 1 2 Excess tax benefit from

stock-based compensation 21 32 Credit Agreement and other financing

costs — (3 ) Decrease in debt, net (2 ) (1 ) Net cash for financing

activities (759 ) (373 )

Cash Flows From (For) Investing

Activities: Capital expenditures (117 ) (112 ) Other, net 77

(32 ) Net cash for investing activities (40 ) (144 )

Effect of exchange rate changes on cash and cash investments (10 )

(9 )

Cash and Cash Investments: Decrease for the

period (427 ) (104 ) At January 1 1,468 1,383 At

September 30 $ 1,041 $ 1,279

As of

September 30, 2016 2015 Liquidity

Cash and cash investments $ 1,041 $ 1,279 Short-term bank deposits

182 255

Total Liquidity $ 1,223 $ 1,534

Historical information is available on our website.

MASCO CORPORATION Segment

Data - Unaudited For the Three Months and Nine Months Ended

September 30, 2016 and 2015

(dollars in millions)

Three Months Ended Nine Months Ended

September 30, September 30, 2016

2015 Change 2016 2015

Change Plumbing Products Net sales $ 899 $ 853

5 % $ 2,635 $ 2,495 6 % Operating

profit, as reported $ 174 $ 137 $ 491 $ 386 Operating margin, as

reported 19.4 % 16.1 % 18.6 % 15.5 % Rationalization charges

5 1 11 2 Operating profit, as adjusted

179 138 502 388 Operating margin, as adjusted 19.9 % 16.2 % 19.1 %

15.6 % Depreciation and amortization 14 14 42

42 EBITDA, as adjusted $ 193 $ 152

$ 544 $ 430

Decorative Architectural

Products Net sales $ 536 $ 527 2 % $ 1,649

$ 1,600 3 % Operating profit, as reported $ 111 $ 102

$ 355 $ 318 Operating margin, as reported 20.7 % 19.4 % 21.5 % 19.9

% Depreciation and amortization 4 4 12

12 EBITDA $ 115 $ 106 $ 367 $

330

Cabinetry Products Net sales $ 239

$ 253 (6 )% $ 736 $ 771 (5 )% Operating

profit, as reported $ 19 $ 21 $ 77 $ 32 Operating margin, as

reported 7.9 % 8.3 % 10.5 % 4.2 % Rationalization charges 1

1 5 3 (Gain) on sale of property and equipment — (3 ) —

(3 ) Operating profit, as adjusted 20 19 82 32 Operating

margin, as adjusted 8.4 % 7.5 % 11.1 % 4.2 % Depreciation

and amortization 5 5 15 18

EBITDA, as adjusted $ 25 $ 24 $ 97 $ 50

Historical information is available on our website.

MASCO CORPORATION

Segment Data - Unaudited

For the Three Months and Nine Months

Ended September 30, 2016 and 2015

(dollars in millions)

Three Months Ended Nine Months Ended

September 30, September 30, 2016

2015 Change 2016 2015

Change Windows and Other Specialty Products Net sales

$ 203 $ 206 (1 )% $ 578 $ 561 3 %

Operating (loss) profit, as reported $ (10 ) $ 23 $ (9 ) $

50

Operating margin, as reported

(4.9 )% 11.2 % (1.6 )% 8.9 % Depreciation and amortization 6

5 16 13 EBITDA $ (4 ) $ 28

$ 7 $ 63

Total Net sales $ 1,877

$ 1,839 2 % $ 5,598 $ 5,427 3 %

Operating profit, as reported - segment $ 294 $ 283 $ 914 $ 786

General corporate expense, net (GCE) (25 ) (25 ) (76 ) (84 )

Operating profit, as reported 269 258 838 702 Operating margin, as

reported 14.3 % 14.0 % 15.0 % 12.9 % Rationalization charges

- segment 6 2 16 5 Rationalization charges - GCE — — — 4 (Gain) on

sale of property and equipment — (3 ) — (3 )

Operating profit, as adjusted 275 257 854 708 Operating margin, as

adjusted 14.7 % 14.0 % 15.3 % 13.0 % Depreciation and

amortization - segment 29 28 85 85 Depreciation and amortization -

non-operating 5 4 15 9 EBITDA,

as adjusted $ 309 $ 289 $ 954 $ 802

Historical information is available on our website.

MASCO CORPORATION North

American and International Data - Unaudited For the Three

Months and Nine Months Ended September 30, 2016 and 2015

(dollars in millions) Three Months

Ended Nine Months Ended September 30,

September 30, 2016 2015 Change

2016 2015 Change North American

Net sales $ 1,497 $ 1,462 2 % $ 4,445 $ 4,298

3 % Operating profit, as reported $ 235 $ 234 $ 749 $

645 Operating margin, as reported 15.7 % 16.0 % 16.9 % 15.0 %

Rationalization charges 5 2 12 4 (Gain) on sale of property

and equipment — (3 ) — (3 ) Operating profit, as

adjusted 240 233 761 646 Operating margin, as adjusted 16.0 % 15.9

% 17.1 % 15.0 % Depreciation and amortization 20 19

58 58 EBITDA, as adjusted $ 260

$ 252 $ 819 $ 704

International

Net sales $ 380 $ 377 1 % $ 1,153 $ 1,129

2 % Operating profit, as reported $ 59 $ 49 $ 165 $

141 Operating margin, as reported 15.5 % 13.0 % 14.3 % 12.5 %

Rationalization charges 1 — 4 1

Operating profit, as adjusted 60 49 169 142 Operating margin, as

adjusted 15.8 % 13.0 % 14.7 % 12.6 % Depreciation and

amortization 9 9 27 27 EBITDA,

as adjusted $ 69 $ 58 $ 196 $ 169

Total Net sales $ 1,877 $ 1,839 2 % $

5,598 $ 5,427 3 % Operating profit, as

reported - segment $ 294 $ 283 $ 914 $ 786 General corporate

expense, net (GCE) (25 ) (25 ) (76 ) (84 ) Operating profit, as

reported 269 258 838 702 Operating margin, as reported 14.3 % 14.0

% 15.0 % 12.9 % Rationalization charges - segment 6 2 16 5

Rationalization charges - GCE — — — 4 (Gain) on sale of property

and equipment — (3 ) — (3 ) Operating profit, as

adjusted 275 257 854 708 Operating margin, as adjusted 14.7 % 14.0

% 15.3 % 13.0 % Depreciation and amortization - segment 29

28 85 85 Depreciation and amortization - non-operating 5 4

15 9 EBITDA, as adjusted $ 309 $

289 $ 954 $ 802

Historical information is available on our website.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161025005358/en/

Masco CorporationInvestor

ContactDavid ChaikaVice President, Treasurer and

Investor Relations313.792.5500david_chaika@mascohq.com

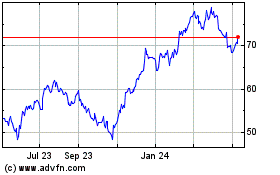

Masco (NYSE:MAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

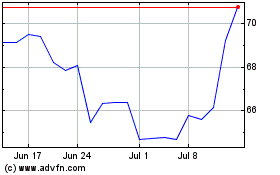

Masco (NYSE:MAS)

Historical Stock Chart

From Apr 2023 to Apr 2024