UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): June 11, 2015

Masco Corporation

(Exact name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

1-5794 |

|

38-1794485 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

|

|

|

|

| 21001 Van Born Road,

Taylor, Michigan |

|

48180 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(313) 274-7400

Registrant’s telephone number, including area code

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

Masco Corporation (the “Company”) entered into an agreement dated

June 11, 2015 with Gerald Volas, the Company’s Group President, North American Diversified Businesses, in connection with his becoming the Chief Executive Officer of TopBuild Corp. (“TopBuild”) as of the effective date of

TopBuild’s spin-off from the Company (the “Effective Date”). The agreement will be assigned to TopBuild as of the Effective Date pursuant to the terms of the Employee Matters Agreement to be entered into between the Company and

TopBuild. The agreement provides for certain severance benefits if Mr. Volas is terminated by TopBuild without Cause or if he resigns with Good Reason on or before August 3, 2019, as such terms are defined in the agreement. The severance

benefits include lump sum payments equal to (i) 1.5 times his base salary for the year in which the termination occurred; (ii) 1.5 times his annual target bonus for the year in which the termination occurred; and (iii) the fully

vested value of restricted stock awards he would have received for the prior year under TopBuild’s equity program. In the event of such termination, Mr. Volas’ unvested restricted stock awards will continue to vest and he will have

the right to exercise the vested portion of his stock options for 90 days (subject to the maximum term for the option). Mr. Volas will also be entitled to reimbursement for up to 18 months for his cost for COBRA coverage.

The foregoing description is qualified in its entirety by the agreement attached as Exhibit 10 hereto and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

| 10 |

|

Agreement dated as of June 11, 2015 between Gerald Volas and Masco Corporation |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

|

|

|

|

|

| MASCO CORPORATION |

|

|

| By: |

|

/s/ JOHN G. SZNEWAJS |

| Name: |

|

John G. Sznewajs |

| Title: |

|

Vice President, Treasurer and Chief

Financial Officer |

June 15, 2015

3

EXHIBIT INDEX

|

|

|

| 10 |

|

Agreement dated as of June 11, 2015 between Gerald Volas and Masco Corporation |

4

EXHIBIT 10

June 11, 2015

Mr. Gerald Volas

21001 Van Born Road

Taylor, MI 48180

Dear Mr. Volas:

I am pleased that you have

agreed to become the Chief Executive Officer of TopBuild Corp. as of the effective date of the spin-off of Services Business from Masco Corporation (the “Company”). In connection with your accepting this position, I also am pleased to

offer on behalf of the Company the severance payments as set forth below if you are terminated by TopBuild after the effective date of the spin-off (“Effective Date”). These payments are subject to the terms and conditions set forth in

this letter agreement (“Agreement”).

Severance Benefits. If you are terminated by TopBuild without Cause or

otherwise resign from TopBuild with Good Reason (as these terms are defined in Exhibit A) after the Effective Date and through and including August 3, 2019 (the date of such termination being your “Termination Date”), and conditioned

upon your compliance with the release and other requirements of this Agreement and its Exhibits, you will be entitled to the following benefits (“Severance Benefits”):

| |

1. |

Severance Payments: You will be entitled to the following Severance Payments: |

| |

a. |

a lump sum payment in an amount equal to 1.5 times your annual base salary for the year in which your Termination Date occurs; |

| |

b. |

a lump sum payment equal to 1.5 times your annual target bonus for the year in which your Termination Date occurs; and |

| |

c. |

if your Termination Date is between January 1 and the date that annual awards of restricted stock are made for the prior year, or if your

Termination Date is after the date such awards are made but you were ineligible for such award as a result of being notified of your termination without Cause or your resignation for Good Reason, a lump sum payment equivalent to the fully vested

value of such award you would have been entitled to receive for the prior year, as determined by TopBuild’s Organization and Compensation Committee consistent with the applicable award program, will be paid as if your employment had not

terminated, TopBuild had not notified you of such termination, or you had not resigned for Good Reason, as the case may be. |

Mr. Gerald Volas

June 11, 2015

Page

2

| |

Subject to the provisions in the “Conditions of Severance; Exclusive Remedy” section below, the Severance Payments will be payable within 15 days following your Termination Date, provided that if the

expiration of the Revocation Period (as hereinafter defined) occurs within the last two months of a calendar year, the Severance Payments will be payable in the following calendar year, but in no case later than January 15 of such following

calendar year. |

| |

2. |

COBRA Payments: On the conditions that you timely elect continued coverage under COBRA and there is no tax penalty to the Company for doing so, you will be entitled to an amount (a “Continuation

Payment”) equal to your premium for continued group medical coverage for yourself and eligible dependents covered under the Company medical plan for the period you continue COBRA coverage (up to a maximum of 18 months following your Termination

Date). The Company’s obligation to make such Continuation Payments will cease if you become eligible for medical coverage under the health plan of another employer or the Company ceases to offer group medical coverage to its active executive

employees or otherwise is under no obligation to offer you COBRA continuation coverage. You are required to advise the Company immediately upon becoming eligible for coverage under the health plan of another employer. |

| |

3. |

Equity Awards. If, as of the Termination Date, you hold stock options that are outstanding and vested under the 2015 TopBuild Long Term Stock Incentive Plan, as amended, (the “Plan”) or hold restricted

stock awards under the Plan that are outstanding and unvested (together, your “Outstanding Awards”), to the extent the following is inconsistent with the award agreements evidencing the Outstanding Awards, you and the Company agree to

amend each such award agreements to reflect the following: |

As of the Termination Date (i) the vested portion of each

option award will be exercisable for 90 days thereafter, or any longer period specified in the Plan or the applicable option award agreement, subject to the maximum term applicable to such option, and the unvested portion of all option awards shall

be forfeited to the Company, and (ii) with respect to unvested restricted stock awards, all restrictions on unvested shares shall continue to lapse as if your termination had not occurred.

This Agreement does not modify the Plan, nor (other than described herein) any other provision of any Outstanding Awards.

Notwithstanding any other provision in this Agreement, you will not be entitled to, and you will not receive any payments under this Agreement

(a) if your employment with TopBuild is terminated with Cause, (b) if you voluntarily resign from your employment with with TopBuild without Good Reason, (c) if your employment terminates due to your death, disability, or retirement,

or (d) if immediately after your employment by TopBuild terminates, you become

Mr. Gerald Volas

June 11, 2015

Page

3

a consultant or employee of TopBuild or any of its respective subsidiaries or affiliates. Simply because a Change in Control (as defined in Exhibit A) or other corporate reorganization, merger,

asset sale or purchase or other transaction may occur following the Effective Date, you will not thereby be entitled to any payments under this Agreement unless prior to August 3, 2019 you shall also have been terminated from TopBuild without

Cause or you resign with Good Reason.

Conditions of Severance; Exclusive Remedy. The Company’s obligation to provide

any Severance Benefits specified in this Agreement is conditioned on (1) your executing a full release of any and all claims in a form substantially as attached hereto in Exhibit B within a period which can be as long as 21 days following the

time such release is first provided to you, and you do not revoke this release; to be effective, such revocation must be in writing and received by Company’s General Counsel within seven days following the date you signed the release (the

“Revocation Period”); (2) your compliance with your obligations under your Masco Corporation Proprietary Confidential Information And Invention Assignment Agreement signed by you on July 10, 1998 (“Masco Confidentiality

Agreement”) or similar agreement into which you may enter with TopBuild ; (3) your compliance with non-competition and remedy covenants substantially in the form attached hereto in Exhibit C for a period of three years following your

Termination Date and (4) your continued compliance with the terms of your Outstanding Awards, including the non-competition provisions thereof, for so long as vesting continues with respect to any unvested restricted stock awards and for the

period following the final vesting thereof as provided in the Plan and any Outstanding Award. No payments hereunder shall be paid prior to the expiration of the Revocation Period (or, if applicable, the six-month delay required under Code

Section 409A as described below under “Responsibility for Taxes”) at which time any payments so delayed shall be paid retroactively without interest. You agree that the Severance Benefits specified in this Agreement will constitute

the exclusive and sole remedy for any termination of your employment and you covenant not to assert or pursue any other remedies, at law or in equity, with respect to your termination and/or employment. To the extent not covered by the dispute or

claim procedures under the Plan or in applicable benefit plans of TopBuild, and with respect to any dispute or claim which you may have concerning this Agreement, the provisions of the Company Dispute Resolution Policy shall apply so as to effect a

full and final resolution of such dispute or claim.

Tax Matters. The Company will withhold required federal, state and

local taxes from any and all Severance Benefits. Other than the Company’s obligation and right to withhold federal, state and local taxes, you will be responsible for any and all taxes, interest, and penalties that may be imposed with respect

to the Severance Benefits, including, but not limited to, those imposed under Internal Revenue Code Section 409A (“Section 409A”). To the extent that this Agreement is subject to Section 409A, you and the Company agree that the

terms and conditions of this Agreement will be construed and interpreted to the maximum extent reasonably possible to comply with and avoid the imputation of any tax, penalty or interest under Section 409A.

Notwithstanding any provision of this Agreement to the contrary, if you are a “specified employee” as defined in Section 409A,

and if any payments hereunder are considered deferred compensation subject to Section 409A, you will not be entitled to any payments in connection

Mr. Gerald Volas

June 11, 2015

Page

4

with the termination of your employment until the date which is six months and one day after your Termination Date (or, if earlier, the date of your death) and any payment otherwise due in such

period will be made within the 30 day period following the six month anniversary of your Termination Date (or, if earlier, within the 30 day period after the date of your death). The provisions of this paragraph will only apply if, and to the

extent, required to comply with Section 409A. For purposes of Section 409A, each payment made under this letter is designated as a “separate payment” within the meaning of Section 409A. Payments with respect to

reimbursements of expenses, including COBRA premiums, shall be made or provided in accordance with the requirements of Section 409A, including, where applicable, the requirement that the reimbursement be made on or before the last day of the

calendar year following the calendar year in which the relevant expense is incurred. The amount of expenses eligible for reimbursement during a calendar year may not affect the expenses eligible for reimbursement in any other calendar year.

Amendment. This Agreement may be amended only by a written agreement signed by both you and by an authorized officer of the

Company.

Entire Agreement. This Agreement together with its Exhibits constitutes the entire agreement between you and the

Company with respect to the subject matter hereof and supersedes any and all prior or contemporaneous oral or written representations, understandings, agreements or communications between you and the Company concerning such subject matter. With

respect to your employment with Masco and its termination upon the Effective Date, neither this Agreement nor its assignment shall affect in any way your benefits accrued under the benefit plans maintained by Masco, including by way of illustration,

that certain SERP agreement between you and Masco, initially effective December 4, 2007, as from time to time amended, and your rights (as pro-rated) under the 2013-2015, 2014-2016, and 2015-2017 Long Term Cash Incentive Programs.

At-Will Employment and Applicable Law. Nothing in this Agreement alters the at-will nature of your employment relationship with

the Company or creates a contract for employment for a specified period of time. Either you or the Company may terminate the employment relationship at any time, with or without cause and with or without advance notice. This Agreement shall be

governed and interpreted under the laws of the State of Michigan, to the extent not preempted by federal law.

Assignment and

Consent to Assignment. The parties agree that, upon the occurrence of the spinoff of the Services Businesses at the Effective Date, this Agreement thereupon shall be assigned to TopBuild Corp., and you and TopBuild by your execution hereof

agree to accept such assignment as of the Effective Date. Upon the effectiveness of such assignment (i) all references herein to the obligations of the “Company” shall be deemed to become obligations of TopBuild Corp., (ii) the

foregoing reference to applicable law shall be deemed to be changed to Florida, (iii) Masco shall have no further obligations to you hereunder, and (iv) your obligations to Masco under the Masco Confidentiality Agreement shall continue

without modification.

Mr. Gerald Volas

June 11, 2015

Page

5

If this Agreement is acceptable, please sign and return the enclosed duplicate copy to the

undersigned.

|

|

|

| Sincerely, |

|

| MASCO CORPORATION |

|

|

| By: |

|

/s/ RENEE STRABER |

|

|

Renee Straber |

|

|

Vice President, Chief Human Resource Officer |

I accept and agree to the provisions of this Agreement and its Exhibits.

|

|

|

|

|

|

|

|

|

|

|

|

|

| /s/ GERALD VOLAS |

|

|

|

June 11, 2015 |

| Gerald Volas |

|

|

|

Date |

Agreed to take the assignment of this Agreement upon the Effective Date.

|

|

|

|

| TOPBUILD CORP. |

|

|

| By: |

|

/s/ JOHN G. SZNEWAJS |

|

|

John G. Sznewajs, President and Treasurer |

Mr. Gerald Volas

June 11, 2015

Page

6

ASSIGNMENT AND ASSUMPTION

For value received, Masco Corporation does hereby assign all of its right, title and interest, and all of its obligations under the foregoing Agreement on the

Effective Date to TopBuild Corp., all as provided hereinabove; and Gerald Volas and TopBuild Corp. by its duly authorized officer do hereby accept such assignment and hereby release any and all of their respective claims hereunder, whether known or

unknown, against Masco Corporation.

|

|

|

|

|

|

|

|

|

|

|

|

|

| MASCO CORPORATION |

|

|

|

TOPBUILD CORP. |

|

|

|

|

|

|

|

|

|

|

|

| By |

|

|

|

|

|

By |

|

|

|

|

|

|

|

|

Renee Straber, Vice President, |

|

|

|

|

|

John G. Sznewajs, President |

|

|

|

Gerald Volas |

|

|

Chief Human Resource Officer |

|

|

|

|

|

and Treasurer |

|

|

|

|

Effective June 30, 2015.

EXHIBIT A

“Cause” is defined as (i) your willful failure or refusal to satisfactorily perform your duties or obligations in

connection with your employment, (ii) your having engaged in willful misconduct, gross negligence or a breach of fiduciary duty, or your material breach of this Agreement or of any Company policy, (iii) your conviction of, or a plea of

nolo contendere to, (x) a felony or (y) any other criminal offense involving moral turpitude, fraud or dishonesty, (iv) your unlawful use or possession of illegal drugs on the Company’s premises or while performing your duties

and responsibilities hereunder or (v) your commission of an act of fraud, embezzlement or misappropriation, in each case, against the Company or any of its subsidiaries or affiliates; provided, concerning matters arising under the

foregoing clauses (i) and (ii) the Company shall provide you with written notice specifying the circumstances alleged to constitute Cause, and, if such circumstances are susceptible to cure, you shall have 30 days following receipt of such

notice to cure such circumstances.

“Change in Control” shall mean at any time during a period of twenty-four consecutive

calendar months, a change in the composition of the Company’s Board such that the individuals who at the beginning of such period constitute the Company’s Board, and any new directors (other than Excluded Directors, as hereinafter

defined), whose election by such Board or nomination for election by stockholders was approved by a vote of at least two-thirds of the members of such Board who were either directors on such Board at the beginning of the period or whose election or

nomination for election as directors was previously so approved, for any reason cease to constitute at least a majority of the members thereof. For purposes hereof, “Excluded Directors” are directors whose (i) election by the Board or

approval by the Board for stockholder election occurred within one year after any “person” or “group of persons,” as such terms are used in Sections 13(d) and 14(d) of the Exchange Act, commence a tender offer for, or become

the beneficial owner of, voting securities representing 25 percent or more of the combined voting power of all outstanding voting securities of the Company, other than pursuant to a tender offer approved by the Board prior to its commencement

or pursuant to stock acquisitions approved by the Board prior to their representing 25 percent or more of such combined voting power or (ii) initial assumption of office occurs as a result of either an actual or threatened election contest

(as such terms are used in Rule 14a-11 or Regulation 14A promulgated under the Exchange Act) or other actual or threatened solicitation of proxies or consents by or on behalf of an individual, corporation, partnership, group, associate or

other entity or “person” other than the Board.

“Good Reason” describes a resignation which must occur within

24 months following the initial existence of one or more of the following good reason triggers arising without your consent: (a) a significant diminution in your base salary; (b) a significant diminution in your authority, duties or

responsibilities: or (c) a change of more than 50 miles in the Company’s headquarters location or your principal office location (whichever is applicable to you, unless such relocation of the Company is initiated, authorized or approved by

you). The amount, time and form of payment on account of the Good Reason resignation must be substantially identical to that which would be paid due to an actual involuntary termination, to the extent such a right exists. You are required to notify

the Company that one of the Good Reason resignation triggers described above exists within a period not to exceed 90 days of the time the trigger first existed and the Company must have no less than 30 days from such notice to cure the problem, and

you must terminate employment within 30 days following the expiration of such cure period if cure is not effected.

EXHIBIT B

RELEASE

(a) In

consideration of the payments to be made and the agreements and consideration provided by the Company hereunder, Employee, on Employee’s own behalf and on behalf of Employee’s heirs, executors, agents, successors and assigns, releases and

forever discharges the Company and Masco Corporation and their affiliates and their respective directors, officers, agents, current and former employees, successors, predecessors and assigns and any other person, firm, corporation or legal entity in

any way related to the Company or Masco Corporation or their affiliates (the “Released Parties”), of and from all claims, demands, actions, causes of action, statutory rights, duties, debts, sums of money, suits, reckonings, contracts,

agreements, controversies, promises, damages, obligations, responsibilities, liabilities and accounts of whatsoever kind, nature or description, direct or indirect, in law or in equity, in contract or in tort or otherwise, which Employee ever had or

which Employee now has or hereafter can, shall or may have, against any of the Released Parties, for or by reason of any matter, cause, or thing whatsoever up to the present time, whether known or unknown, suspected or unsuspected at the present

time, or which may be based upon pre-existing acts, claims or events occurring at any time up to the date hereof which may result in future damages, including without limitation all direct or indirect claims either for direct or consequential

damages of any kind whatsoever and rights or claims arising under Title VII, any state civil-rights legislation, claims of handicap or disability discrimination, claims relating to the termination of employment as referred to herein, and claims

of age discrimination under the Age Discrimination in Employment Act of 1967, as amended (ADEA), against any of the Released Parties, other than (a) claims arising under the express provisions of this Agreement, (b) the right to

receive benefits accrued through the end of the employment period under the Company’s benefit plans and (c) claims arising under any applicable worker’s compensation statute. It is the intention of the parties that this general

release by the Employee will be construed as broadly as possible.

(b) Employee has: (i) the sole right, title, and interest to the

claims released under this Agreement, (ii) neither assigned or transferred, nor purported to assign or transfer, to any person or entity, any claim released by this Agreement, and (iii) neither assigned or transferred, nor purported to

assign or transfer, to any person or entity, the right to the monies, in whole or in part, being paid pursuant to this Agreement.

(c)

Employee affirms that as of the date Employee signs this Agreement, (i) Employee is not Medicare eligible (i.e., is not 65 years of age or older; is not suffering from end-stage renal failure; has not received Social Security Disability

Insurance benefits for 24 months or longer, etc.) or (ii) if eligible, Employee has no outstanding claims for Medicare benefits. Nonetheless, if the Centers for Medicare & Medicaid Services (the “CMS”) (this term

includes any related agency representing Medicare’s interests) determines that Medicare has an interest in the payment to Employee under this Agreement, Employee agrees to indemnify, defend and hold the Company harmless from any action by the

CMS relating to medical expenses of Employee. Employee agrees to reasonably cooperate with the Company upon request with respect to any claim the CMS may make and for which Employee is required to indemnify the Company under this paragraph.

Further, Employee agrees to waive any and all future actions against the Company for any private cause of action for damages pursuant to 42 U.S.C. § 1395y(b)(3)(A).

EXHIBIT C

NON-COMPETITION

In order to protect Masco and TopBuild and their affiliates from the Employee’s competitive use of the substantial Proprietary

Information and goodwill gained by the Employee in employment with Masco, TopBuild and their affiliates, the Employee agrees that during the three-year period following the Termination Date the Employee shall not, directly or indirectly:

| |

(a) |

Engage in or assist in the design, development, evaluation, planning, manufacture, sale, or marketing of any products, technologies, or services that compete with or could displace those designed, sold, manufactured,

evaluated, marketed, planned or developed by Masco or TopBuild (whether solely or in conjunction with other affiliates of either of them or their employees) at any time during the Employee’s employment with Masco Corporation, TopBuild or any of

their affiliates (the “Business Activities”), whether such engagement is as an officer, director, proprietor, employee, partner, investor (other than as a holder of less than 1% of the outstanding capital stock of a publicly traded

corporation), consultant, advisor, agent or otherwise in any geographic areas in which the products, technologies, or services of Masco, TopBuild or any of their affiliates, are at that time distributed or planned to be distributed. Business

Activities, include, but are not limited to (i) Masco’s design, development, evaluation, manufacture, sale, planning and marketing of all products, technologies and services offered or sold by Masco or any of its affiliates and

(ii) TopBuild’s design, development, evaluation, manufacture, sale, planning and marketing of all products, technologies and services offered or sold by TopBuild or any of its affiliates; |

| |

(b) |

Be engaged, other than as may be agreed by Masco or TopBuild, whether as an officer, director, proprietor, employee, partner, investor (other than as a holder of less than 1% of the outstanding capital stock of a

publicly traded corporation), consultant, advisor, agent or otherwise, (i) as a supplier to any customer of Masco or TopBuild or any of their affiliates has done business during Employee’s employment Masco or TopBuild or any of their

affiliates; or (ii) on behalf of any customer of, or supplier to, Masco or TopBuild or any of their affiliates, with Masco or TopBuild or any of their affiliates has done business during Employee’s employment with Masco or TopBuild or any

of their affiliates in any capacity as an employee, contractor, consultant, or in any other business relationship, whether as an officer, director, proprietor, employee, partner, investor (other than as a holder of less than 1% of the outstanding

capital stock of a publicly traded corporation), in any geographic areas in which the products or services of Masco or TopBuild are distributed. |

| |

(c) |

Assist others in engaging in any of the Business Activities in the manner prohibited to the Employee; |

| |

(d) |

Induce employees of Masco or TopBuild or any of their affiliates to engage in any activities that are prohibited to the Employee; or |

| |

(e) |

Induce employees of Masco or TopBuild or any of their affiliates to terminate their employment. |

It is expressly understood and agreed that although the Employee, Masco and TopBuild consider the

restrictions contained in each of clauses (a) through (e) above reasonable for the purpose of preserving for Masco and TopBuild and their affiliates their goodwill, trade secrets, proprietary rights and ongoing business value, if a final

judicial determination is made by a court having jurisdiction that the time, territory, activities (i.e., type of employment or line of business), or any other restriction contained in this Exhibit C is an unenforceable restriction on the activities

of the Employee, the provisions of this Exhibit C shall not be rendered void but shall be deemed amended to apply as to such maximum time, territory and activities as such court may judicially determine or indicate to be reasonable. Alternatively,

if the court referred to above finds that any restriction contained in clauses (a) through (e) is an unenforceable restriction on the activities of the Employee, and such restrictions cannot be amended so as to make it enforceable, such

finding shall not affect the enforceability of any of the other restrictions contained in this Agreement.

Prior to engaging in any

activity under subparagraphs (a) through (e), Employee may request permission to engage in such activities by a written communication to the General Counsel of the Company (or, if the request pertains to the Business Activities of Masco, to the

General Counsel of Masco) setting forth: a) the specific company, customer, supplier or wholesaler involved; and b) a detailed explanation of how the Employee’s proposed activities will not violate the terms of the Agreement. The Company (or

Masco, as the case may be) through its Chief Executive Officer (“CEO”) will consider the request and, in the sole determination of the CEO, will make a good faith determination if the request will be granted in whole or in part and such

permission will be set forth in writing by the CEO. However, Employee agrees that any permission granted under this Exhibit C will not be used in any future proceedings to directly or indirectly challenge or call into question the enforceability of

this Exhibit C. Employee also agrees that in the event permission is granted, in whole or in part, to engage in the requested activities, then Employee will immediately notify the General Counsel in writing if and when the nature of the

Employee’s participation is altered, the nature of the business engaged by the entity changes, or the activities engaged in by the Employee may become injurious to the Company (or any affiliate of the Company or Masco, as the case may be) or

otherwise violate the terms of this Agreement. Employee agrees that any permission that may be granted pursuant to this Exhibit C does not in any way limit the right of the Company (or Masco) to further limit or revoke such permission and Employee

will not use any such permission in any future proceedings, directly or indirectly, to claim estoppel, or to otherwise challenge or call into question the enforceability of this Agreement or Exhibit C.

Remedies. The Employee acknowledges and agrees that Masco’s or TopBuild’s remedy at law for a breach or threatened

breach of any of the foregoing non-competition provisions would be inadequate and, in recognition of this fact, in the event of a breach by the Employee of any of the foregoing non-competition provisions, the Employee agrees that, in addition to the

Company’s or Masco’s other remedies at law, at the Company’s or Masco’s option, all rights of the Employee under this Agreement, the Plan and Outstanding Awards may be terminated, and the Company or Masco shall be entitled

without posting any bond to obtain, and the Employee agrees not to oppose (except to the extent that Employee maintains that the Employee did not, in fact, engage in any activity in breach of this Agreement) a request for, equitable relief in the

form of specific performance, temporary restraining order, temporary or permanent injunction or any other equitable remedy which may then be available, relating to the conduct prohibited under this Exhibit C. The Employee acknowledges that the

granting of a temporary injunction,

temporary restraining order or permanent injunction merely prohibiting the use of Proprietary Information would not be an adequate remedy upon breach or threatened breach hereof. Nothing herein

contained shall be construed as prohibiting the Company or Masco from pursuing, in addition, any other remedies available to it for such (or any other) breach or threatened breach.

In addition to the remedies set forth herein or available to the Company or Masco, if Employee, in the Company’s or Masco’s good

faith judgment, reasonably exercised, at any time during the three-year period following the Termination Date, breaches any obligation under this Agreement, the Plan and Outstanding Awards, the Company or Masco may immediately terminate any

remaining payments and the provision of any other benefits which might otherwise be required this Agreement, the Plan and Outstanding Awards, or otherwise due Employee. Upon any breach, the Company or Masco may also recover from the Employee any

Severance Benefits paid, together with any proceeds from exercise of any options or sale of restricted stock for which restrictions have lapsed at any time within two years following the Termination Date, in each case (cash and stock) net of any

state and federal income taxes paid by Employee. The Company or Masco may also recover all costs and expenses incurred in any efforts to enforce its rights under this Agreement. The Company or Masco shall have the right to set off any amount owed to

Employee against any amount owed by Employee hereunder.

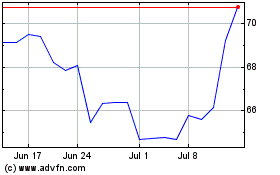

Masco (NYSE:MAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

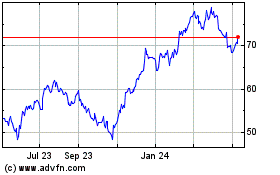

Masco (NYSE:MAS)

Historical Stock Chart

From Apr 2023 to Apr 2024