Focused Execution Continues to Deliver Results for Masco in the First Quarter 2015

April 28 2015 - 7:00AM

Business Wire

Key Highlights

- Sales increased 3 percent to $2 billion

and increased 7 percent excluding the effects of foreign currency

translation

- North American sales increased 5

percent; International sales increased 10 percent in local

currency

- Adjusted operating profit increased 15

percent to $181 million

- Adjusted EPS increased 43 percent to

$.20 per common share

Masco Corporation (NYSE: MAS), one of the world’s leading

manufacturers of branded building products, reported net sales and

operating profit growth in the first quarter of 2015 with all

segments reporting increased sales in local currency. Adjusted

operating profit margin rose to 9 percent, reflecting the Company’s

focused execution and commitment to cost control.

“The momentum we built over the past several years carried into

the first quarter as we realized top- and bottom- line growth as

well as margin expansion. Our customer-focused innovation and

leading brands drove consumer demand across the segments,” said

Masco’s President and CEO Keith Allman. “In local currency, both

Delta Faucet and Hansgrohe achieved their highest sales quarters

ever. Our focus on the pro painter and new products drove sales in

the Decorative Architectural segment. The Other Specialty segment’s

ongoing commitment to innovation led to strengthened results. The

Installation segment continues to perform well, benefiting from

strategic diversification into commercial construction and a

recovering housing environment. In the Cabinets and Related

Products segment, our efforts to improve execution are paying off

as we increased sales to home centers and builders while improving

profitability.”

2015 First Quarter

Commentary

- Net sales from continuing operations

increased 3 percent to $2 billion. North American sales increased 5

percent and international sales decreased 8 percent in U.S. dollars

but increased 10 percent in local currency

- Compared to first quarter 2014, results

for key financial measures, as adjusted for certain items

(see Exhibit A) and with a normalized tax rate of 36 percent, were

as follows:

- Gross margins improved to 28.2 percent

compared to 28 percent

- Operating margins improved to 9 percent

compared to 8 percent

- Income from continuing operations was

$.20 per common share compared to $.14 per common share

- Income from continuing operations,

as reported, was $.18 per common share

- Liquidity at the end of the first

quarter was approximately $1.8 billion

- Approximately 4 million shares were

repurchased in the first quarter

2015 First Quarter Operating Segment

Highlights

- Plumbing Products’ net sales decreased

1 percent, but increased 8 percent excluding the effect of foreign

currency translation, fueled by continued strength in the wholesale

channel

- Decorative Architectural Products’ net

sales increased 2 percent driven by the pro paint initiative and

builders’ hardware program wins

- Cabinets and Related Products’ net

sales increased 5 percent, driven by continued growth with builders

as well as KraftMaid Cabinetry’s sales growth with home centers and

dealers

- Installation and Other Services’ net

sales increased 7 percent with growth across all channels

- Other Specialty Products’ net sales

increased 7 percent, led by a strong performance across all

channels and geographies

Outlook

“We are pleased with our solid start to the year. Our businesses

are performing well and executing as planned,” continued Mr.

Allman. “Our repair and remodel business is growing, with

increasing demand for our products across all price points. We

remain focused on driving shareholder value and returning cash to

shareholders, as evidenced by approximately $135 million we

returned to shareholders in the first quarter through dividends and

share repurchases. Our outlook for the year remains positive as we

anticipate increasing demand for our market-leading products and

services.”

About Masco

Headquartered in Taylor, Michigan, Masco Corporation is one of

the world’s leading manufacturers of branded building products, as

well as a leading provider of services that include the

installation of insulation and other building products.

The 2015 first quarter supplemental material, including a

presentation in PDF format, is available on the Company’s website

at www.masco.com.

Conference Call Details

A conference call regarding items contained in this release is

scheduled for Tuesday, April 28, 2015 at 8:00 a.m. ET. Participants

in the call are asked to register five to ten minutes prior to the

scheduled start time by dialing (855) 226-2726 (855-22MASCO) and

from outside the U.S. at (706) 679-3614. Please use the conference

identification number 15309385. The conference call will be webcast

simultaneously and in its entirety through the Company’s website.

Shareholders, media representatives and others interested in Masco

may participate in the webcast by registering through the Investor

Relations section on the Company’s website.

A replay of the call will be available on Masco’s website or by

phone by dialing (855) 859-2056 and from outside the U.S. at (404)

537-3406. Please use the conference identification number 15309385.

The telephone replay will be available approximately two hours

after the end of the call and continue through May 23, 2015.

Safe Harbor Statement

Statements contained in this press release that reflect our

views about our future performance constitute “forward-looking

statements” under the Private Securities Litigation Reform Act of

1995. Forward-looking statements can be identified by words such as

“believe,” “anticipate,” “appear,” “may,” “will,” “should,”

“intend,” “plan,” “estimate,” “expect,” “assume,” “seek,”

“forecast,” and similar references to future periods. These views

involve risks and uncertainties that are difficult to predict and,

accordingly, our actual results may differ materially from the

results discussed in our forward-looking statements. We caution you

against relying on any of these forward-looking statements. Our

future performance may be affected by our reliance on new home

construction and home improvement, our reliance on key customers,

the cost and availability of raw materials, uncertainty in the

international economy, shifts in consumer preferences and

purchasing practices, our ability to improve our underperforming

businesses, our ability to maintain our competitive position in our

industries, risks associated with the proposed spin-off of our

Services Business, our ability to realize the expected benefits of

the spin-off, the timing and terms of our share repurchase program,

and our ability to reduce corporate expense and simplify our

organizational structure. We discuss many of the risks we face in

Item 1A, “Risk Factors” in our most recent Annual Report on Form

10-K, as well as in our Quarterly Reports on Form 10-Q and in other

filings we make with the Securities and Exchange Commission. Our

forward-looking statements in this press release speak only as of

the date of this press release. Factors or events that could cause

our actual results to differ may emerge from time to time, and it

is not possible for us to predict all of them. Unless required by

law, we undertake no obligation to update publicly any

forward-looking statements as a result of new information, future

events or otherwise.

The Company believes that the non-GAAP performance measures and

ratios that are contained herein, used in managing the business,

may provide users of this financial information with additional

meaningful comparisons between current results and results in prior

periods. Non-GAAP performance measures and ratios should be viewed

in addition to, and not as an alternative for, the Company's

reported results under accounting principles generally accepted in

the United States. Additional information about the Company is

contained in the Company's filings with the Securities and Exchange

Commission and is available on Masco's website at

www.masco.com.

Masco CorporationInvestor

ContactIrene TasiDirector – Investor

Relations313.792.5500irene_tasi@mascohq.com

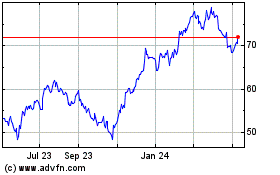

Masco (NYSE:MAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

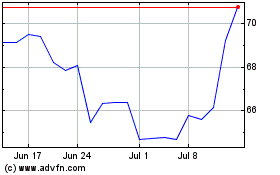

Masco (NYSE:MAS)

Historical Stock Chart

From Apr 2023 to Apr 2024