U.S. Supreme Court Won't Review Visa, Mastercard Fees Case -- 3rd Update

March 27 2017 - 4:43PM

Dow Jones News

By AnnaMaria Andriotis and Brent Kendall

The Supreme Court on Monday declined an invitation to rescue a

$7.25 billion antitrust settlement over fees between Visa Inc. and

Mastercard Inc. and retailers, effectively clearing the way for

merchants to sue for additional charges incurred in recent

years.

This raises the prospect that Visa and Mastercard could face

higher legal costs. Retailers such as Macy's Inc., Home Depot Inc.

and Target Corp. that had opted out of the settlement had brought

lawsuits against the card companies, but these covered fees from

before 2013. Now, the retailers may be able to sue over fees after

that period.

The Supreme Court decision also creates an opening for legal

action by merchants who want to challenge moves by Visa and

Mastercard to raise so-called credit-card swipe fees in the

future.

Those fees are at the heart of the long-running legal battle.

Whenever a consumer uses a credit card for a purchase, merchants

pay a swipe fee that is divided between a number of parties

including card companies and banks, among others.

Who has the power to set these fees doesn't directly affect

consumers. Rather, it revolves around the question of who has the

power to set the swipe fees, how high they will go and how they get

divvied up among the many behind-the-scenes players in a

credit-card transaction.

Visa declined to comment on the Supreme Court's action. A

Mastercard spokesman said the company "will continue to work with

all parties to ensure a proper resolution of this matter as it

moves forward" in federal courts.

The Supreme Court said in a brief order said it won't review a

federal appeals court decision from last June that invalidated the

settlement between the card companies and retailers. In that

ruling, the New York-based Second U.S. Circuit Court of Appeals

said the settlement was problematic because some groups of

merchants weren't adequately represented.

The appeals court found the settlement had problems because it

sought to cover two groups of plaintiffs with different interests:

One group of merchants that was in line to receive monetary damages

based on credit-card fees they paid in the past, and another group

who wanted changes to the card companies' rules in the future.

The appeals court found the deal shortchanged those merchants

who were focused on the future card rules.

The legal battle dates back to a class-action lawsuit originally

brought by a small group of merchants that argued Visa and

Mastercard charged inflated swipe fees.

Large merchants and trade groups opposed the $7.25 billion

settlement because they said the amount was too low and because of

a provision that said that merchants -- including those that opted

out of the settlement -- wouldn't be able to bring future lawsuits

related to credit-card swipe fees against Visa and Mastercard.

The Supreme Court's decision to stay out of the case leaves

legal uncertainty for Visa and Mastercard, which already have been

defending the case for a decade.

Merchants had challenged a series of card-industry rules as

being anticompetitive, including one referred to as the "honor all

cards" requirement. That rule meant stores had to accept all Visa

and Mastercard credit cards no matter the varying fees associated

with them. Other rules prohibited charging different prices for

different types of payment.

The Supreme Court's decision to reject the case also raises

questions about whether card networks could encounter more pressure

related to how they establish credit-card swipe fees. Retailers,

with backing by trade groups including the National Retail

Federation, have taken legal action to change the way credit-card

swipe fees are set.

Many retailers don't want Visa and Mastercard to set the fees

anymore. Rather, they would like to shift this to individual banks,

a move they argue would create more competition and result in lower

fees for retailers.

In the wake of the Supreme Court's action, the focus of the case

will shift back to the U.S. District Court for the Eastern District

of New York, where additional proceedings are ongoing. It is

possible the card companies and the two different groups of

plaintiffs could try to strike new settlements.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com and

Brent Kendall at brent.kendall@wsj.com

(END) Dow Jones Newswires

March 27, 2017 16:28 ET (20:28 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

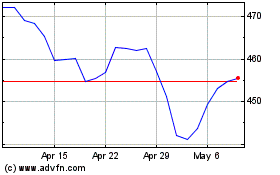

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024