RushCard, Mastercard Fined Over 2015 Customer Lockout -- Update

February 01 2017 - 5:03PM

Dow Jones News

By Yuka Hayashi

WASHINGTON -- UniRush LLC and a unit of Mastercard International

Inc. agreed to settle accusations that "preventable failures"

caused a 2015 debacle in which tens of thousands of customers lost

access to their money stored on prepaid cards, setting off a

cascade of unpaid bills and other personal-finance crunches.

The Consumer Financial Protection Bureau said Wednesday the two

companies are paying about $10 million to customers affected by the

temporary lockup of their accounts, triggered by a technical

glitch. The companies are also paying a civil penalty of $3

million.

UniRush is the parent company of RushCard, a major prepaid-card

business founded by hip-hop producer Russell Simmons . Mastercard

Payment Transaction Services, a unit of Mastercard International,

is RushCard's payment processor. The glitch occurred as RushCard

was switching to using Mastercard from another provider.

The settlement came two days after Green Dot Corp., a leading

prepaid-card company, said it reached a deal to buy UniRush for

$147 million.

The incident caused severe disruptions for customers, many of

whom use prepaid cards for basic financial services including

direct deposit of paychecks and government benefits as well as

making purchases and paying bills. As customers were shut out of

their accounts for days, and in some cases for weeks, some took to

social media to air their grievances, complaining that they didn't

have money to pay for basic necessities or they were hit with late

fees on unpaid bills. Many prepaid-card customers are "unbanked" or

"underbanked," meaning they have no or limited access to regular

banking services such as checking accounts and credit and debit

cards.

"All of this stemmed from a series of failures that should have

been anticipated and prevented," CFPB Director Richard Cordray said

on a conference call. These failures, he said, "caused serious

problems for the financial lives of many customers."

RushCard said it welcomed the settlement with the CFPB but it

didn't admit any wrongdoing. "Since the event in 2015, we believe

we have fully compensated all of our customers for any

inconvenience they may have suffered," a company representative

said. The company settled a class-action lawsuit with customers

last year that included reimbursement of $20 million. Mr. Simmons

described the incident as "the most challenging periods in my

professional career" and thanked customers for remaining loyal.

"We are pleased to bring this matter to a close, allowing us to

further enhance the best practices, policies and procedures for

prepaid cards," a Mastercard spokesman said. He added that the

company understands "the critical role prepaid cards play in how

people manage their money."

The RushCard settlement is part of the CFPB's scrutiny of the

prepaid-card industry, a segment that has grown rapidly in recent

years. The bureau last year finalized a new rule to bring oversight

of the sector closer to regulations covering banks.

New payment technologies have elevated prepaid cards into

popular financial-management tools rivaling bank checking accounts.

Nearly 10% of U.S. households used such cards in 2015, according to

a study by the Federal Deposit Insurance Corp.

The CFPB alleged that in October 2015, as RushCard was switching

to Mastercard as payment processor, UniRush failed to transfer all

customer accounts to Mastercard accurately and delayed processing

direct deposits for more than 45,000 consumers. It also failed to

provide customer service properly to those affected by the

lockup.

Mastercard, according to the CFPB, didn't make sure it was

sending accurate information about customers' accounts to

UniRush.

The RushCard settlement is the latest action in a spree of

enforcement activities by the CFPB in recent weeks, a move industry

experts attribute to the bureau's desire to get done as much work

as possible amid concern that the new Republican administration

will move to constrain its authority. Mr. Cordray said in an

interview last week at a WSJ Pro Financial Regulation event that

the bureau's enforcement work would continue at a "steady and

vigorous" pace, and warned some major cases were still in the

pipeline.

Since the beginning of January, the CFPB made eight

announcements of enforcement actions, including a high-profile

lawsuit filed against Navient Corp. , the nation's largest

student-loan servicer, for allegedly obstructing repayments from

customers. Navient denies the accusations.

Write to Yuka Hayashi at yuka.hayashi@wsj.com

(END) Dow Jones Newswires

February 01, 2017 16:48 ET (21:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

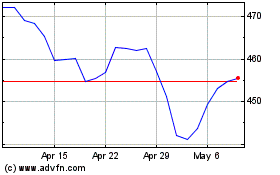

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024