PayPal Taps Citigroup For New Mobile Push

December 15 2016 - 8:14AM

Dow Jones News

By Telis Demos

PayPal Holdings Inc. has struck a new partnership with Citigroup

Inc. to make it easier for customers use mobile phones to pay at

the checkout register.

The pact between the New York bank and credit-card issuer

follows a decision by PayPal earlier this year to stop fighting

Visa Inc. and MasterCard Inc. As part of that agreement, the San

Jose, Calif.-firm agreed to stop steering its users away from debit

and credit cards, and in return got access to the two card

networks' store terminals where consumers can tap a phone to pay

with a card.

PayPal's strategy raised questions about whether the online

payments giant could grow usage enough to overcome the lost

fees.

But the company, led by CEO Daniel Schulman, promised it would

deliver deals with card issuers to encourage the use of in-store

payments.

"We talked about giving customers flexibility to pay how they

want, and now we are rolling out new experiences," said Jim Magats,

PayPal's head of global core payments, in an interview.

Citigroup, with 143 million customer accounts, and Fidelity

National Information Services Inc., known as FIS, a bank-technology

provider that connects to some 6,000 banks in the U.S., will in

2017 start letting customers who load their cards into their PayPal

accounts pay at the point-of-sale with a mobile swipe, according to

the companies.

In a statement, Citigroup card executive Ralph Andretta said

that the goal of the PayPal agreement was to continue a push to

"enable banking in the palm of our customers' hands."

As part of the deal with FIS, PayPal is also working with two

smaller banks, Avidia Bank and Wintrust Financial Corp.

The announcement, expected Thursday, is the latest in an

escalating race between banks like J.P. Morgan Chase & Co., and

technology players such as Apple Inc. to make it easier for

consumers to use their mobile phones to pay for everyday goods and

services.

Some argue that the range of choices are confusing customers and

slowing adoption. Only 16% of U.S. consumers have used a mobile

wallet to pay, according to a new survey by Fiserv Inc.

To encourage usage, PayPal and the banks also plan to explore a

way to enable people to pay via PayPal's app and payment buttons

with any money they might have with the banks, including their

checking accounts, credit lines, and even rewards points.

That could also pave the way for other financial management and

spending tools, PayPal said. Already PayPal's app offers the

ability to order at some restaurants, similar to a feature J.P.

Morgan this month announced for its Chase Pay app.

Doug Brown, general manager of FIS Mobile, said that while FIS's

banks enable customers to pay digitally with a variety of apps,

including Apple Pay, PayPal will be a major partner. The typical

FIS bank with $1 billion in customer assets has customers who make

roughly $50 million to $100 million worth of PayPal payments, he

said.

It isn't yet clear exactly how PayPal's mobile wallet will work.

The company hasn't yet announced any deals, for example, with Apple

Inc. or Samsung Electronics Co. to let its app work with the

near-field communication hardware in the phone to swipe at

terminals. PayPal says it is working on further tech

partnerships.

"It's in our strategy to be as ubiquitous as possible," said Mr.

Magats.

Write to Telis Demos at telis.demos@wsj.com

(END) Dow Jones Newswires

December 15, 2016 07:59 ET (12:59 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

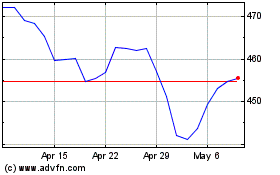

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024