Chip Reprieve at the Pump -- WSJ

December 02 2016 - 3:03AM

Dow Jones News

Visa and Mastercard give three extra years for industry to

install the new equipment

By Robin Sidel

Gas stations are getting a big break from the credit-card

industry.

Visa Inc. and Mastercard Inc. each announced Thursday that they

are giving gas stations three extra years to install equipment that

accepts the new generation of chip-embedded credit and debit cards

meant to reduce fraud.

The chip-card push creates a delicate balancing act for Visa and

Mastercard, which have clashed with merchants over many issues for

years. The networks want to reduce fraud, but they are also trying

to be sensitive to the gas-station industry after other merchants

last year faced similar delays in getting new equipment.

The move comes at a time when gas stations are struggling to

control fraud that occurs when criminals use counterfeit cards at

unattended gas pumps and install devices on them that skim card

information from unsuspecting consumers.

The card networks said they are extending the deadline for gas

stations due to multiple challenges facing pump owners. These

include equipment shortages and difficulties associated with

removing older gas pumps.

"While we remain committed to moving businesses to chip

technology as quickly as possible, we are also constantly

monitoring industry progress and attempting to proactively address

marketplace realities and known challenges wherever possible," Visa

said in a blog post on its website.

The card networks said gas stations will now face a deadline of

Oct. 1, 2020, for their pumps to accept chip-embedded cards. If a

customer uses a chip card at a pump that doesn't process chip

transactions after that date, the gas station will bear the costs

of fraud. The previous deadline had been Oct. 1, 2017.

The fraud-liability shift took effect last year for other types

of merchants, although millions of small and medium-size businesses

still haven't installed the equipment needed to process chip

transactions.

Currently, card-issuing banks pick up the cost of fraudulent

gas-station transactions tied to counterfeit cards made from stolen

numbers. But the gas stations are on the hook if the physical card

being used has been lost or stolen.

Cards embedded with a computer chip generate a unique code for

each transaction. This makes them more difficult to counterfeit

than traditional cards with a magnetic strip.

Representatives of the gas-station industry expressed relief

about the extension. Equipment upgrades can cost several thousand

dollars per fuel dispenser, according to industry members.

"There was just no way we were going to make the liability shift

date and it was through no fault of our own," said Gray Taylor,

executive director of Conexxus, a group that works on payments

technology issues for the gas-station industry.

Gas stations are already taking other steps to reduce fraud,

including the simple action of padlocking pumps or putting special

seals on them so that criminals can't place skimming devices inside

them.

Chip cards don't prevent skimming because the devices steal card

data that is located on the magnetic strip on the back of the

cards.

The card networks also have fraud-protection programs

specifically targeted toward gas stations that use technology to

determine whether a card user is its true owner. Customers whose

cards trip certain risk factors are asked to complete the

transaction inside the station.

Visa says card fraud has been cut in half at the more than

53,000 gas stations that use its technology.

It is difficult to track the amount of gas-station fraud, in

part because losses are spread among station owners, card-issuing

banks and consumers who often don't realize their card data was

stolen. The gas-station industry estimates it incurred losses of

$250 million in 2013, the most recent year for which information is

available, while the payment-card industry estimates it lost $500

million on fuel-related fraud that year.

Write to Robin Sidel at robin.sidel@wsj.com

(END) Dow Jones Newswires

December 02, 2016 02:48 ET (07:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

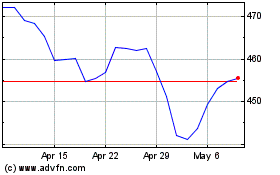

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024