MasterCard Profit, Revenue Tops Expectations

October 28 2016 - 9:10AM

Dow Jones News

MasterCard Inc. profit grew 21% in the latest period, as card

companies have been trying to attract new customers and increase

transactions.

Results easily beat Wall Street's expectations, and shares rose

1.9% to $105.61 in premarket trading.

Purchase, N.Y.-based MasterCard said transactions rose 18%

during the quarter as cross-border volumes climbed 12%. Those

factors were partly offset by higher rebates and incentives.

MasterCard is expanding from traditional physical credit and

debit cards as its customers move to digital formats. MasterCard is

expanding its digital payment platform, Masterpass, to let shoppers

use the service on their mobile phones at store checkout terminals,

a rival service to Apple Inc.'s Apple Pay and a number of other

mobile-payment products.

Like its main rival Visa Inc., MasterCard charges fees to

financial institutions for transactions that travel over their

networks. Visa on Monday said earnings rose on growth in payments

volume and processed transactions.

In all, MasterCard reported a profit of $1.18 billion, or $1.08

a share, up from $977 million, or 86 cents, a year prior. Revenue

rose 14% to $2.88 billion. Analysts polled by Thomson Reuters

expected 98 cents in per-share profit on $2.75 billion in

sales.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

October 28, 2016 08:55 ET (12:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

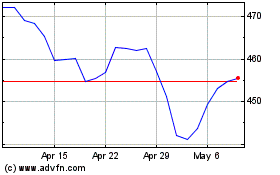

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024