PayPal Partnership With Credit Cards Aims at Gaining Ground in Physical Stores

October 25 2016 - 8:54PM

Dow Jones News

By Deepa Seetharaman

LAGUNA BEACH, Calif. -- PayPal Holdings Inc. is looking for

allies in the real world.

PayPal partnered with MasterCard Inc. and Visa Inc. -- rather

than compete with them -- to gain a foothold in the 90% of retail

transactions that still take place in physical stores, Chief

Executive Dan Schulman said Tuesday.

"We think we can be great allies...to advance the cause of

digital payments," Mr. Schulman said at the WSJDLive conference in

Laguna Beach, Calif.

The company recently struck deals with the credit-card companies

as part of its strategy to make PayPal a universally accepted

method of payment, a year after it split off from eBay Inc.

"People are starting to partner with us and use our capabilities

instead of competing," Mr. Schulman said.

He added that mobile phones were blurring the lines between

shopping online and in stores. "In the not-too-distant future,

commerce will just be commerce," he said.

But some analysts have argued that deals with MasterCard and

Visa come at the expense of profitability in the short term. The

moves shift PayPal away from promoting free bank transfers to fund

customers' transactions and toward the networks, which charge a

fee.

Mr. Schulman said that while transaction costs will rise,

engagement from new users will rise as well. "Over the medium to

long term, this is a tremendous positive for PayPal," he said.

Mr. Schulman said PayPal's cash pile is an advantage. The

company reviews more than 100 possible acquisition targets every

quarter -- but it wouldn't acquire a bank.

(END) Dow Jones Newswires

October 25, 2016 20:39 ET (00:39 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

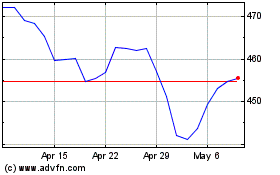

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024