By Robin Sidel

The ATM is the newest front in the war against cyberthieves.

A year after millions of U.S. merchants began installing

equipment at the check-out line to accept credit and debit cards

with security chips, the automated teller machine is getting

similar technology.

The move comes as thieves increasingly target ATMs. While

chip-enabled credit cards are expected to slow growth in fraud at

the checkout counter, the number of ATMs compromised by criminals

jumped more than sixfold from 2014, according to a recent report

from FICO, a credit-score provider and analytics firm. FICO says

the number of 2015 compromises was the highest it ever recorded,

though it declined to disclose specific numbers.

The burst of ATM-related fraud also was the largest one-year

increase since FICO started keeping track of such data about a

dozen years ago. Meanwhile, rates of credit-card fraud, a more

popular scheme for criminals, have largely leveled off.

The push to make ATMs more secure takes on added significance

this month: Under MasterCard Inc.'s network rules, ATM operators on

Oct. 21 will become liable for any fraud costs that occur if a

MasterCard chip-enabled card is used at a machine that isn't

equipped with chip technology. That cost is currently borne by the

card-issuing bank. Visa makes a similar shift next October.

The shift to more secure ATMs is expected to tackle the growing

problem known as skimming, by which criminals rig a machine with a

surreptitious device that can steal a customer's card data, often

including the personal identification number. The crook can then

use the data to make a counterfeit card and drain the associated

bank account.

The computer chip embedded in many new U.S. credit and debit

cards fights such fraud by creating a one-time code for each

transaction, limiting the ability of a thief to steal and replicate

data.

"The U.S. market is definitely being targeted with card

skimming," says Owen Wild, global marketing director for enterprise

fraud and security at NCR Corp., one of the largest makers of ATMs.

Nonbank ATMs account for 60% of recent incidents, up from 39% in

2014, the FICO analysis found.

Cyberthieves make at least 1.5 million illicit ATM cash

withdrawals in the U.S. each year, according to consulting firm

Tremont Capital Group. That figure represents a tiny fraction of

the 5.8 billion ATM withdrawals consumers made in 2013, according

to a Federal Reserve estimate.

Still, theft from ATM skimming can be more dangerous to

consumers than credit-card fraud because the debit card is tied

directly to a consumer's checking account. Banks will typically

reimburse customers for losses, but the process can be

complicated

Cost is an issue for ATM operators; It typically costs between

$300 and $700 to upgrade an existing ATM to accept chip cards, says

Brad Daniel, president at America's ATM, a Plantation, Fla.,

company that maintains a fleet of the machines.

Everything ATM, an ATM operator and supplier based in Brooklyn,

N.Y., has requested 5,000 upgrade kits from a supplier, but has

only received 1,000 so far, says Jim Shrayef, principal at the

firm. "I cannot get the product I need to satisfy the demand," he

said.

So far, it appears that ATM operators are better prepared for

the transition to chip cards than merchants that have grappled with

challenges to get the equipment ready at the check-out line.

In part, that is because many of the nation's 420,000 ATMs are

owned and operated by large financial institutions or independent

companies that manage thousands of machines.

MasterCard estimates that 40% of ATMs will be chip-ready by the

end of October. That compares with industry estimates that fewer

than 20% of merchants were ready to process chip cards when their

liability shift took place last year. Millions of smaller merchants

-- and some big grocery chains -- still haven't upgraded their

equipment.

J.P. Morgan Chase & Co. and Bank of America Corp., which

operate about 34,000 ATMs between them, say that most of their

machines are ready to accept chip cards.

PNC Financial Services Group Inc.'s 9,000 ATMs are already

accepting chip cards. "We have been preparing for this for a few

years," says Ken Justice, head of the ATM network at the Pittsburgh

bank.

However, many consumers still don't have chip-enabled debit

cards since card-issuing banks initially concentrated on credit

cards.

MasterCard says that close to one-third of its branded U.S.

debit cards are embedded with chips, well below the 88% of its U.S.

consumer credit cards. Visa says that 42% of its branded debit

cards have chips, compared with 64% for its credit-card

portfolio.

"We're continuing to see a rise," in the percentage of debit

cards with chips, says Chiro Aikat, senior vice president for

chip-card delivery at MasterCard. "But there is no doubt that debit

was a laggard."

(END) Dow Jones Newswires

October 15, 2016 07:14 ET (11:14 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

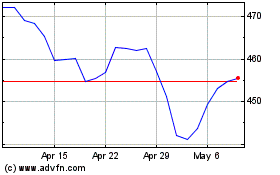

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024