By Ellie Ismailidou and Barbara Kollmeyer, MarketWatch

Ford, Whole Foods slump on weak earnings; Facebook, GoPro jump

after results beat expectations

U.S. stocks on Thursday fell for the second straight session,

weighed down by disappointing earnings, a drop in oil prices and

mixed U.S. economic data.

The moves added to Wednesday's losses, after the Federal Reserve

left interest rates unchanged but attempted to tentatively set the

table for a possible rate rise as soon as September, stating that

near-term risks to the economic outlook

(http://www.marketwatch.com/story/fed-appears-more-open-to-september-rate-hike-2016-07-27)have

diminished.

The S&P 500 index was off 4 points, or 0.2%, at 2,163, led

by a 1% drop in telecom shares, followed by a 0.4% loss in

materials stocks, which were pulled lower by the sixth straight

decline

(http://www.marketwatch.com/story/oil-prices-catch-a-small-break-from-a-weaker-dollar-2016-07-28)

for oil futures. Eight of the index's main sectors were in negative

territory, while utilities were leading the gains, up 0.2%,

followed by consumer staples, up less than 0.1%.

Ford Motor Co.(F)slumped 9.7% following an earnings miss

(http://www.marketwatch.com/story/fords-stock-tumbles-after-profit-misses-expectations-2016-07-28),

leading the S&P decliners and on track to see their largest

daily drop in more than five years.

The Dow Jones Industrial Average lost 70 points, or 0.4%, at

18,402, led by a 2.3% drop in Boeing Co..(BA) but boosted by a 0.8%

gain in Apple Inc. (AAPL).

Read: Apple's historic stock surge could confirm something

Warren Buffett already knew

(http://www.marketwatch.com/story/apples-historic-stock-surge-could-confirm-what-buffett-already-knew-2016-07-27)

Meanwhile the Nasdaq Composite Index was dipping in and out of

negative territory, last trading down a point, or less than 0.1%,

at 5,138. Upbeat results from Facebook Inc.

(http://www.marketwatch.com/story/facebook-posts-huge-revenue-beat-2016-07-27)(FB)

boosted the tech-heavy Nasdaq, after the company late Wednesday

soundly beat Wall Street expectations for earnings and revenue.

But the social-media network's chief financial officer, Dave

Wehner, said the company expects lower ad revenue growth in the

next two quarters and just modest growth in its ad load. Shares of

Facebook were up 0.8%.

Read:Facebook's rapid growth is about to slow down

(http://www.marketwatch.com/story/facebooks-rapid-growth-is-about-to-slow-down-2016-07-27)

(http://www.marketwatch.com/story/facebooks-rapid-growth-is-about-to-slow-down-2016-07-27)Meanwhile,

the Fed's hint at a potential interest-rate hike weighed on

telecom, the market's big winner this year, up 20% year to

date.

"Telecom and utilities have been the place where fixed income

investors have gone to hide," while government bond yields recently

tumbled to all-time lows, said Kim Forrest, senior portfolio

manager at Fort Pitt Capital. Now that "a September rate hike is on

the table, though December is more probable," these bond-like

stocks are taking a hit.

More broadly, with equity valuations at historical highs and

earnings reports coming in mixed, "all the market wants to know is

whether the earnings recession is ending," said Quincy Krosby,

market strategist at Prudential Financial, pointing to the main

benchmarks' inability to push toward new highs over the last couple

of sessions.

But others said that the fact that the market hasn't fallen

precipitously after an impressive run that brought the S&P and

the Dow to all-time highs, is a good sign.

"Simply seeing the range remain intact has been a constructive

phenomenon: the longer the [S&P] moves sideways after an almost

10% move, the greater the odds that another up leg results," said

Frank Cappelleri, technical analyst at Instinet, in an email.

On the economic front, the number of people who applied for

unemployment benefits

(http://www.marketwatch.com/story/jobless-claims-climb-14000-to-266000-2016-07-28)last

week rose from historical lows, while the nation's trade gap

widened in June to $63.3 billion, as imports rose faster than

exports. Meanwhile, wholesale inventories were unchanged and retail

inventories inched higher.

Stocks to watch: Shares of ConocoPhilips (COP) inched higher by

0.5% despite the fact that the oil company reported a bigger loss

than expected.

(http://www.marketwatch.com/story/conocophillip-loss-widens-as-revenue-slumps-36-2016-07-28)

Dow Chemicals Co.(DOW) edged up 0.1% after earnings and revenue

came in better than forecast by Wall Street.

Colgate-Palmolive Co.(CL) lost 0.1% even after the consumer

products firm said profit rose in the second quarter.

(http://www.marketwatch.com/story/colgate-palmolive-shares-rise-after-earnings-beat-estimates-2016-07-28)

Harley-Davidson Inc.(HOG) gained 0.7% after the company beat on

both profit and revenue

(https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=6&cad=rja&uact=8&ved=0ahUKEwjY3P-mkZbOAhUDTCYKHVGmBs8QqQIILTAF&url=http%3A%2F%2Fwww.marketwatch.com%2Fstory%2Fharley-davidson-beats-on-earnings-revenue-lowers-2016-motorcycle-shipment-guidance-2016-07-28&v6u=https%3A%2F%2Fs-v6exp1-ds.metric.gstatic.com%2Fgen_204%3Fip%3D205.203.130.22%26ts%3D1469708091514619%26auth%3Dol6dpt42mbijwgltfzjjxqkdfopmhwzt%26rndm%3D0.7774477069103305&v6s=2&v6t=5112&usg=AFQjCNG1hOjwMybsdl4OL7kojLkSNvrvaw&sig2=KsifhvXI0hzUzuk2isGAhQ&bvm=bv.128450091,bs.2,d.dmo).

Hershey(HSY) swung to a profit in the second quarter

(https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=8&cad=rja&uact=8&ved=0ahUKEwjUqaiykZbOAhWD3SYKHWGQAVsQqQIIMTAH&url=http%3A%2F%2Fwww.marketwatch.com%2Fstory%2Fhershey-co-beats-second-quarter-earnings-expectations-2016-07-28&usg=AFQjCNG6tO8gVxg-k6yqBqTCEYiDGTeLfg&sig2=b8nvyO71rUAmRmkBzu0qXA&bvm=bv.128450091,bs.2,d.dmo)

(https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=8&cad=rja&uact=8&ved=0ahUKEwjUqaiykZbOAhWD3SYKHWGQAVsQqQIIMTAH&url=http%3A%2F%2Fwww.marketwatch.com%2Fstory%2Fhershey-co-beats-second-quarter-earnings-expectations-2016-07-28&usg=AFQjCNG6tO8gVxg-k6yqBqTCEYiDGTeLfg&sig2=b8nvyO71rUAmRmkBzu0qXA&bvm=bv.128450091,bs.2,d.dmo),

leading the shares to rise 3%.

Shares of MasterCard Inc. (MA) climbed 1.4%, after the payments

processing and credit card company beat second-quarter profit and

revenue expectations

(http://www.marketwatch.com/story/mastercards-stock-jumps-after-profit-sales-beat-expectations-2016-07-28).

HCA Holdings Inc.(HCA) lost 1.4% after its earnings missed

expectations.

(http://www.marketwatch.com/story/facebook-posts-huge-revenue-beat-2016-07-27)Shares

of Whole Foods Market Inc

(http://www.marketwatch.com/story/whole-foods-profit-falls-sales-slip-2016-07-27-18485051).(WFM)

plunged 9.8% after the upmarket grocer gave a weak forecast for the

current quarter as it booked a fourth-straight quarterly profit

fall on Wednesday.

GoPro Inc

(http://www.marketwatch.com/story/gopro-reports-loss-but-results-beat-estimates-2016-07-27).(GPRO)

swung to a loss, but results still beat expectations, and shares

jumped 11.8%. Groupon Inc

(http://www.marketwatch.com/story/groupon-shares-surge-as-results-top-expectations-2016-07-27-174852644).(GRPN)

soared 25.9% after posting better-than-expected results late on

Wednesday.

Weight Watchers International Inc

(http://www.marketwatch.com/story/weight-watchers-boosts-membership-by-nearly-5-2016-05-04).(WTW)

shares inched lower by 0.3% after exploding overnight with a 13%

premarket gain, after increasing its membership rolls for the first

time in four years.

After Thursday's close, Alphabet Inc.(GOOGL), Amazon.com

Inc.(AMZN), Expedia Inc.(EXPE) CBS Corp.(CBSA) are expected to

report earnings.

Read:Alphabet earnings bring concern about Google search growth,

revenue

(http://www.marketwatch.com/story/alphabet-earnings-bring-concern-about-google-search-growth-revenue-2016-07-26)

And: Here's what to expect from Amazon earnings

(http://www.marketwatch.com/story/what-to-watch-for-in-amazon-earnings-2016-07-25).

Other markets: The Nikkei 225 index

(http://www.marketwatch.com/story/asian-markets-fall-ahead-of-bank-of-japan-meeting-2016-07-27)

slipped 1.1% as investors stayed cautious about a potential

stimulus plan. The Bank of Japan will wrap up its policy meeting

Friday, and some investors expect it to join forces with the

government to announce a big batch of stimulus measures the same

day.

As the Nikkei fell, the yen moved up against rival currencies,

pushing the dollar

(http://www.marketwatch.com/story/dollar-pulls-back-vs-yen-as-investors-await-boj-outcome-2016-07-28)

lower.

Gold prices surged to $1,331 as some investors took the view

that the Fed really doesn't have the option to raise interest rates

in September.

Check out: Why gold prices spiked after the Fed decision

(http://www.marketwatch.com/story/why-gold-prices-spiked-after-the-fed-decision-2016-07-27)

European stocks struggled amid a batch of big earnings

(http://www.marketwatch.com/story/european-stocks-wobble-as-avalanche-of-earnings-reports-rolls-in-2016-07-28).

Read:Do the math--Brexit really is starting to bite at European

companies

(http://www.marketwatch.com/story/brexit-beats-oil-low-growth-as-hot-topic-during-europes-earnings-season-2016-07-28)

(http://www.marketwatch.com/story/brexit-beats-oil-low-growth-as-hot-topic-during-europes-earnings-season-2016-07-28)--Sara

Sjolin contributed to this article.

(END) Dow Jones Newswires

July 28, 2016 13:09 ET (17:09 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

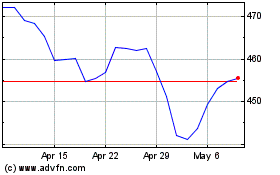

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024