MasterCard to Acquire Big Stake in U.K.'s VocaLink

July 21 2016 - 9:27AM

Dow Jones News

By Anne Steele

MasterCard Inc. on Thursday said it agreed to acquire most of

London-based payment-technology company VocaLink Holdings Ltd. for

about GBP700 million ($920 million), becoming the latest company to

take advantage of the steep fall in the pound after last month's

Brexit vote.

VocaLink operates key payments technology platforms on behalf of

U.K. payment schemes and reported GBP182 million in revenue last

year as it processed more than 11 billion transactions.

MasterCard said the deal enables it to "play a more strategic

role in the U.K. payments ecosystem," which Chief Executive Ajay

Banga called "a very strategic market for us."

MasterCard will take a 92.4% stake in the company and a majority

of VocaLink's shareholders will retain 7.6% ownership for at least

three years. Existing shareholders could earn up to an additional

GBP169 million ($220 million) if performance targets are met.

VocaLink CEO David Yates will join the MasterCard management

committee.

If the deal closes as expected in early 2017, MasterCard

anticipates an additional 5 cents in each of 2017 and 2018 earnings

per share.

Foreign bidders have made a raft of deals since Britain's

referendum to leave the European Union on June 23 as the pound has

dropped about 10% against the dollar in the past month. Perhaps

most notably, U.S.-based cinema operator unit AMC Entertainment

Holdings Inc. agreed to buy Europe's largest cinema chain,

Britain-based Odeon & UCI Cinemas Group. It said the lower

pound was a major factor, and AMC's CEO warned "there may even be a

stampede of U.S. acquirers looking at the United Kingdom."

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

July 21, 2016 09:12 ET (13:12 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

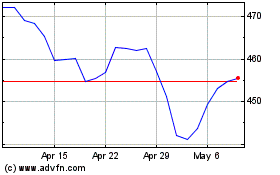

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024