Mastercard Ordered to Pay Sainsbury Millions in Card-Fees Case

July 14 2016 - 11:54AM

Dow Jones News

By Austen Hufford

MasterCard Inc. was ordered to pay U.K. supermarket chain J

Sainsbury PLC 68.6 million pounds ($90.8 million) because fees it

passed on to the grocer were too high, a London judge ruled.

The lawsuit concerned interchange fees that are charged when

credit or debit cards are used. The lawsuit alleged that the

default fees set up by MasterCard were too high.

The judge agreed, writing that merchants have little options

except to accept cards from all card issuers, leaving MasterCard

with the power to set unilateral rates that are higher than they

would otherwise be if MasterCard had negotiated.

The judge wrote that a merchant who considered the default rate

too high would be left with "unattractive alternatives" such as

complaining, refusing to accept cards and charging card users a

surcharge.

A number of U.K. retailers have sued card issuers such as

MasterCard with similar claims.

The judge ruled that credit-card transactions should have had a

fee of 0.5%, rather than 0.9%, and debit-card transactions should

have had a fee of 0.27%, rather than 0.36%, and calculated the

damages based on the difference in rates.

Last month a U.S. federal appeals court panel threw out a $7.25

billion antitrust settlement between Visa Inc. and MasterCard Inc.

and millions of retailers after determining that some of the

merchants covered by the pact weren't adequately represented. That

settlement involved the fees merchants must pay when customers use

cards and the rules Visa and MasterCard impose as conditions for

using their networks.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

July 14, 2016 11:39 ET (15:39 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

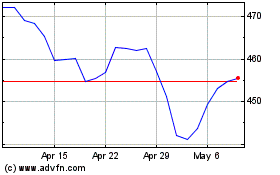

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024