MasterCard Reports Earnings Decline But Tops Expectations

April 28 2016 - 10:05AM

Dow Jones News

By Lisa Beilfuss

MasterCard International Inc. said profit slid 6% in the first

quarter as the card company offered increased rebates to grab

customers and came up against a period that included a one-time tax

benefit.

Still, results topped expectations. Shares edged 0.9% lower in

early trading.

Like fellow card company Visa Inc., MasterCard charges fees to

financial institutions for transactions that travel over their

networks. Card companies have been shelling out in bids to attract

new customers, in the face of more cautious consumer spending.

Competitor American Express Co. similarly reported a first-quarter

profit decline that it attributed to higher spending meant to win

new customers.

Purchase, N.Y.-based MasterCards said transactions rose 14%

during the quarter, helping to push revenue 9.7% higher from a year

earlier. But while higher rebates and promotional activity helped

the top line, such discounting bit into earnings.

Meanwhile, the strong U.S. dollar continued to dent results. The

company said operating expenses rose by about a quarter to $1.1

billion, thanks largely to differences in foreign exchange

hedging.

For the March quarter, MasterCard reported a profit of $959

million, or 86 cents a share, down from $1.02 billion, or 89 cents,

a year earlier. The year-ago period included a benefit of 8 cents a

share stemming from a one-time tax credit.

Revenue climbed to $2.45 billion. Analysts projected 85 cents in

per-share profit on $2.38 billion in sales, according to Thomson

Reuters.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

April 28, 2016 09:50 ET (13:50 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

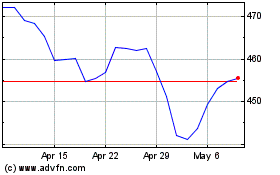

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024