MasterCard's Profit Tops Expectations--Update

October 29 2015 - 12:00PM

Dow Jones News

By Robin Sidel And Chelsey Dulaney

Payment-card network MasterCard Inc. on Thursday reported

stronger-than-expected earnings for its third quarter, though an

increase in rebates and other incentives to customers dented

revenue growth.

The Purchase, N.Y.-based company's results recently have been

pressured across the world from a strong U.S. dollar, particularly

when compared with the euro and the Brazilian real.

In a conference call with analysts, Chief Executive Officer Ajay

Banga said the company's results have been affected by slower

global growth in smaller emerging markets and worsening economic

conditions in Venezuela.

Mr. Banga cited Mexico as a bright spot for the company due to

strong consumer spending.

For the period ended Sept. 30, the company posted earnings of

$977 million, or 86 cents a share, compared with $1.02 billion, or

88 cents a share, a year earlier. The results included a $50

million after-tax charge related to the termination of a U.S.

employee pension plan.

Excluding that charge, per-share earnings were 91 cents.

Revenue grew 1.6% to $2.53 billion, or 8% excluding currency

impacts.

Analysts had projected 87 cents a share in profit and $2.54

billion in revenue, according to Thomson Reuters.

Like rival Visa Inc., MasterCard processes electronic payments

on its network, but doesn't collect interest or set interest

rates.

In the latest quarter, purchase volume grew 12%, on a

constant-currency basis, to $852 billion. Processed transactions

grew 12% to 12.3 billion, while cross-border volumes grew 16%.

Gross dollar volume grew 13%, in terms of local currency, to

$1.2 trillion.

In the weeks since the quarter ended on Sept. 30, trends through

Oct. 21 have been steady to slightly weaker, said Chief Financial

Officer Martina Hund-Mejean.

The company suffered a blow earlier this week when large issuer

USAA told customers it is switching its credit and debit portfolios

from MasterCard to Visa. USAA had been a longtime MasterCard issuer

and was one of its largest customers.

"The fact is that we tried our best to pursue that business, but

at a point we lost out," Mr. Banga said in response to an analyst's

question. The company previously said the loss wouldn't affect its

outlook for revenue and profits.

JetBlue Airways Corp. said Tuesday that it signed a deal for a

new co-brand card with issuer BarclayCard and MasterCard. The Wall

Street Journal reported earlier this year that JetBlue wasn't

renewing its co-brand arrangement with American Express Co.

Write to Robin Sidel at robin.sidel@wsj.com and Chelsey Dulaney

at Chelsey.Dulaney@wsj.com

(END) Dow Jones Newswires

October 29, 2015 11:45 ET (15:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

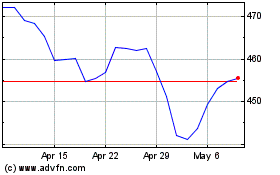

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024