Current Report Filing (8-k)

September 09 2015 - 8:20AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 9, 2015

MasterCard Incorporated

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Delaware | | 001-32877 | | 13-4172551 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| |

2000 Purchase Street Purchase, New York | | 10,577 |

(Address of principal executive offices) | | (Zip Code) |

(914) 249-2000

(Registrant’s telephone number, including area code)

NOT APPLICABLE

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

7.01 Regulation FD Disclosure

On September 9, 2015, MasterCard Incorporated (the “Company”) will host a meeting for members of the investment community, beginning at 8:30 am. As part of discussions at the meeting, the Company is providing the following 2016-2018 longer-term performance objectives:

| |

• | Net revenue compound annual growth rate (“CAGR”) of low double digits; |

| |

• | Annual operating margin of a minimum of 50%; and |

| |

• | Earnings per share CAGR in the mid-teens. |

At the meeting, the Company will provide additional context with respect to the above performance objectives. Materials for the financial perspective presentation by Martina Hund-Mejean, Chief Financial Officer of the Company, are attached hereto as Exhibit 99.1. Additionally, all presentation materials for the meeting will be promptly posted on the Company’s website at www.mastercard.com.

The descriptions of longer-term performance objectives set forth above and all information set forth in the attached presentation materials is furnished but not filed.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

|

| | |

| | |

Exhibit Number | | Exhibit Description |

| |

99.1 | | MasterCard Incorporated Financial Perspective Presentation by Chief Financial Officer to the Investment Community, dated September 9, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | |

| | | | | | |

| | | | MASTERCARD INCORPORATED |

| | | |

Date: September 9, 2015 | | | | By | | /s/ Janet McGinness |

| | | | | | Janet McGinness |

| | | | | | Corporate Secretary |

EXHIBIT INDEX

|

| | |

| | |

Exhibit Number | | Exhibit Description |

| |

99.1 | | MasterCard Incorporated Financial Perspective Presentation by Chief Financial Officer to the Investment Community, dated September 9, 2015. |

Martina Hund-Mejean Chief Financial Officer Financial Perspective 2015 Investment Community Meeting September 9, 2015

©2015 MasterCard. Proprietary.September 9, 2015 2015 Business Drivers Processed Q2 Jul/Aug 11% 11% 5% 6% 18% 18% 13% 12% 17% 16% As-Reported Growth Q1 Q2 Worldwide GDV 12% 13% U.S. GDV 6% 7% Rest-of-World GDV 15% 16% Processed Transactions 12% 13% Cross-Border Volume 19% 17% 2

©2015 MasterCard. Proprietary.September 9, 2015 2015 Financial Outlook Net Revenue* High single-digit growth, including 2 ppt from acquisitions * FX-adjusted Operating Expense* High single-digit growth, including 7 ppt from acquisitions Tax Rate Full-year rate of about 27% FX Impact 6-8 ppt net impact 3

©2015 MasterCard. Proprietary.September 9, 20154 Longer-Term 2013 – 2015 Performance Objectives* ** Excludes certain items, see Appendix Results 2013-2014** Projected 2013-2015 Net Revenue Growth 11-14% CAGR 12.5% Operating Margin Minimum 50% annually 55.4% Earnings Per Share Growth At least 20% CAGR 21.1% * On a constant currency basis and excluding future acquisitions

©2015 MasterCard. Proprietary.September 9, 2015 Projected EPS CAGR 2013 – 2015 • Solid underlying business performance • Disciplined investment for growth and expense management • Contribution from tax benefits and buybacks ~ 3% Tax Benefits Buybacks 20+% Underlying business 5 ~ 4%

©2015 MasterCard. Proprietary.September 9, 2015 Capital Planning Priorities Strong Balance Sheet Preserve strong balance sheet, liquidity and credit ratings Long-Term Business Growth Investments in organic opportunities and M&A Return Excess Cash to Shareholders Continue to return excess cash with bias towards share repurchases Capital Structure Gradual and disciplined migration to more normalized mix ofdebt and equity over time 6

©2015 MasterCard. Proprietary.September 9, 2015 Return of Capital Historical Perspective $1.8 $2.4 $3.4 $1.8 $2.4 $0.1 $0.3 $0.5 $0.4 $0.5 $1.9 $2.7 $3.9 $2.2 $2.9 2012 2013 2014 1H 2015 Through August 2015 $0.0 $1.0 $2.0 $3.0 $4.0 $ in b ill io ns Share Repurchase Dividends 7

©2015 MasterCard. Proprietary. Services September 9, 2015 Investing for Growth 2011 2012 2013 2014 2015F Incremental Investments Capital expenditures Other organic M&A $1.2B $0.7B $0.6B $1.4B $1.5B Geographic Expansion Commercial / Prepaid Digital Convergence Safety and Security Loyalty Information Services Processing 8

©2015 MasterCard. Proprietary.September 9, 2015 Looking Ahead Drivers of Growth Macroeconomic • PCE growth, secular shift and increased international trade • Increased commerce, with continued shift to ePayments Core Growth • Drive deal pipeline and enhance card usage • Continued product expansion and differentiation • Deepening government relationships to drive financial inclusion • Accelerate geographic expansion and acceptance footprint Services Expansion • Focus on information services and data analytics • Expansion across the payments value chain 9

©2015 MasterCard. Proprietary.September 9, 2015 Long-Term Revenue Growth Global PCE 5% Secular Growth 4 - 6% Industry Purchase Volume Adj. for Available Market (1%) MA Market Opportunity 9 - 11% 8 - 10% Revenue Low - Mid Teens Volume Core Products Services Mix Pricing Share 10

©2015 MasterCard. Proprietary.September 9, 2015 Longer-Term 2016 – 2018 Performance Objectives* * On a constant currency basis and excluding future acquisitions Net Revenue CAGR % Low double-digits Operating Margin % Minimum 50% annually Earnings Per Share CAGR % Mid-teens 11

Appendix

©2015 MasterCard. Proprietary.September 9, 201513 Appendix GAAP Reconciliation 2013-2014 Results – Progress towards 2013-2015 Objectives Net Revenue GAAP (CAGR) 13.2% Acquisitions 1 -0.8% Foreign Currency 2 0.1% Net Revenue Non-GAAP (CAGR) 12.5% Operating Margin GAAP (average) 53.9% Acquisitions 1 0.9% Provision for Litigation Settlement 3 0.5% Operating Margin Non-GAAP (average) 55.4% Diluted Earnings Per Share GAAP (CAGR) 19.0% Acquisitions 1 0.8% Provision for Litigation Settlement 3 -0.3% Discrete Tax Items 4 1.7% Diluted Earnings Per Share Non-GAAP (CAGR) 21.1% 1 Impact of acquisitions for businesses acquired in 2014 2 Impact of adjusting for currency by re-measuring the prior period’s results using the current period’s exchange rates 3 Impact of incremental accrual for U.S. merchant litigation of $95M in 2013 and $20M in 2012 4 Impact of certain discrete tax items recorded in 2012 Note: Figures may not sum due to rounding

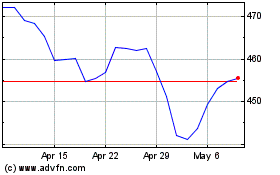

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024