UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_______________________________________

FORM 8-K

_______________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

|

| | | | |

Date of Report (Date of earliest event reported): July 29, 2015 |

_______________________________________ |

MasterCard Incorporated

(Exact name of registrant as specified in its charter) |

_______________________________________ |

Delaware

(State or other jurisdiction

of incorporation) | 001-32877 (Commission

File Number) | 13-4172551

(IRS Employer

Identification No.) |

2000 Purchase Street

Purchase, New York

(Address of principal executive offices) | 10577

(Zip Code) |

(914) 249-2000 (Registrant's telephone number, including area code)

|

NOT APPLICABLE

(Former name or former address, if changed since last report) |

_______________________________________ |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| | |

o | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| | |

o | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| | |

o | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| | |

o | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition

On July 29, 2015, MasterCard Incorporated (“MasterCard”) issued a press release announcing financial results for its second quarter 2015.

A copy of the press release is attached hereto as Exhibit 99.1. All information in the press release is furnished but not filed.

Non-GAAP Financial Information

In the attached press release, MasterCard discloses the following non-GAAP financial measures:

| |

• | Total operating expenses, operating income, net income and earnings per diluted share, as well as related applicable growth rates, presented on a pro forma basis giving effect to the exclusion of a charge related to a UK merchant litigation settlement recorded during each of the three-month and six-month periods ended June 30, 2015. MasterCard excluded this item because its management monitors material litigation settlements separately from ongoing operations and evaluates ongoing performance without these amounts. MasterCard’s management believes that the non-GAAP financial measures presented facilitate an understanding of MasterCard’s operating performance and meaningful comparison of its results between periods. |

| |

• | Operating margin presented on a pro forma basis giving effect to the exclusion of a pre-tax charge related to the UK merchant litigation settlement during the three-month and six-month periods ended June 30, 2015. MasterCard’s management believes that the non-GAAP financial measure presented facilitates an understanding of MasterCard’s operating performance and meaningful comparison of its results between periods. |

| |

• | Effective tax rate presented on a pro forma basis giving effect to the exclusion of income tax benefits associated with the after-tax charge related to the UK merchant litigation settlement during the three-month and six-month periods ended June 30, 2015. MasterCard’s management believes that the non-GAAP financial measure presented facilitates an understanding of MasterCard’s operating performance and meaningful comparison of its results between periods. |

| |

• | Presentation of growth rates adjusted for currency. Due to the impact of foreign currency rate fluctuations on reported results, MasterCard’s management believes the presentation of certain growth rates adjusted for currency, calculated by re-measuring the prior period’s results using the current period’s exchange rates, provides relevant information. |

MasterCard’s management uses non-GAAP financial measures to, among other things, evaluate its ongoing operations in relation to historical results, for internal planning and forecasting purposes and in the calculation of performance-based compensation. Pursuant to the requirements of Regulation S-K, the attached press release includes reconciliations of the requisite non-GAAP financial measures to the most directly comparable GAAP financial measures. The presentation of non-GAAP financial measures should not be considered in isolation or as a substitute for the Company’s related financial results prepared in accordance with GAAP.

Item 7.01 Regulation FD Disclosure

On July 29, 2015, MasterCard will host a conference call to discuss its second-quarter 2015 financial results. A copy of the presentation to be used during the conference call is attached hereto as Exhibit 99.2. All information in the presentation is furnished but not filed.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

|

| |

Exhibit Number | Exhibit Description |

99.1 | Press Release issued by MasterCard Incorporated, dated July 29, 2015 |

99.2 | Presentation of MasterCard Incorporated, dated July 29, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | MASTERCARD INCORPORATED |

| | | |

Date: | July 29, 2015 | By: | | /s/ Janet McGinness |

| | | | Janet McGinness |

| | | | Corporate Secretary |

EXHIBIT INDEX

|

| |

Exhibit Number | Exhibit Description |

99.1 | Press Release issued by MasterCard Incorporated, dated July 29, 2015 |

99.2 | Presentation of MasterCard Incorporated, dated July 29, 2015 |

MasterCard Incorporated Reports

Second-Quarter 2015 Financial Results

| |

• | Second-quarter net income of $965 million, excluding a special item, or $0.85 per diluted share |

| |

• | Second-quarter net income of $921 million, including a special item, or $0.81 per diluted share |

| |

• | Second-quarter net revenue increase of 1%, to $2.4 billion |

| |

• | Second-quarter gross dollar volume up 13% and purchase volume up 12% |

Purchase, NY, July 29, 2015 - MasterCard Incorporated (NYSE: MA) today announced financial results for the second quarter of 2015. Excluding a special item, the company reported net income of $965 million, up 4%, or 12% after adjusting for currency, and earnings per diluted share of $0.85, up 6% or 15% adjusted for currency, versus the year-ago period. Including the special item, a $44 million after-tax charge related to a U.K. merchant litigation settlement, the company reported net income of $921 million, a decrease of 1%, or an increase of 7% after adjusting for currency, and earnings per diluted share of $0.81, up 1%, or 9% adjusted for currency, versus the year-ago period. The net income and earnings per diluted share figures, excluding the special item, are reconciled to their comparable GAAP measures in the accompanying tables. Acquisitions had a $0.03 dilutive impact on earnings per diluted share.

Net revenue for the second quarter of 2015 was $2.4 billion, a 1% increase versus the same period in 2014. Adjusted for currency, net revenue increased 7%. Net revenue growth was driven by the impact of the following:

| |

• | An increase in cross-border volumes of 17%; |

| |

• | A 13% increase in gross dollar volume, on a local currency basis, to $1.1 trillion; and |

| |

• | An increase in processed transactions of 13%, to 12.0 billion. |

These factors were partially offset by an increase in rebates and incentives, primarily due to new and renewed agreements and increased volumes. Acquisitions contributed 2 percentage points to total net revenue growth.

Worldwide purchase volume during the quarter was up 12% on a local currency basis versus the second quarter of 2014, to $841 billion. As of June 30, 2015, the company’s customers had issued 2.2 billion MasterCard and Maestro-branded cards.

“Our business continues to perform well with good transaction and volume growth, particularly in cross-border, despite the mixed global economic environment and foreign exchange headwinds,” said Ajay Banga, president and CEO, MasterCard. “We are executing on our strategy to grow our business by focusing on winning new deals in our core payments business, while building out our data analytics, processing and safety applications. A blend of acquisitions and organic investments in these spaces remain at the foundation of our strategy.”

MasterCard Incorporated - Page 2

Excluding the special item, total operating expenses increased 9%, or increased 14% when adjusted for currency, to $1.1 billion during the second quarter of 2015 compared to the same period in 2014. Acquisitions contributed 10 percentage points of the FX-adjusted growth, with the remainder primarily due to higher data processing and advertising & marketing expenses. Including the special item, total operating expenses increased 15%, or 21% when adjusted for currency, from the year-ago period.

Operating income for the second quarter of 2015 decreased 5%, or increased 2% adjusted for currency, versus the year-ago period, excluding the special item. The company delivered an operating margin of 54.9%.

MasterCard reported other expense of $10 million in the second quarter of 2015, unchanged from the second quarter of 2014.

MasterCard’s effective tax rate was 25.8% in the second quarter of 2015, versus a rate of 32.2% in the comparable period in 2014, excluding the special item. The decrease was primarily due to a larger repatriation benefit, the recognition of a discrete U.S. foreign tax credit benefit and a more favorable mix of taxable earnings.

During the second quarter of 2015, MasterCard repurchased approximately 9 million shares of Class A common stock at a cost of approximately $849 million. Quarter-to-date through July 22nd, the company repurchased an additional 1.9 million shares at a cost of approximately $182 million, with $2.0 billion remaining under the current repurchase program authorization.

Year-to-Date 2015 Results

For the six months ended June 30, 2015, excluding the special item, MasterCard reported net income of $2.0 billion, an increase of 10%, or 18% after adjusting for currency, and earnings per diluted share of $1.73, up 13%, or 21% adjusting for currency versus the year-ago period. Including the special item, net income was $1.9 billion and earnings per diluted share was $1.69. Acquisitions had a $0.06 dilutive impact on earnings per diluted share.

Net revenue for the first half of 2015 was $4.6 billion, an increase of 2%, or 8% after adjusting for currency, versus the same period in 2014. Gross dollar volume growth of 12%, transaction processing growth of 13% and cross-border volume growth of 18% contributed to the net revenue growth in the year-to-date period. These factors were partially offset by an increase in rebates and incentives. Acquisitions contributed 2 percentage points to total net revenue growth.

Excluding the special item, total operating expenses increased 4%, or 9% after adjusting for currency, to $2.0 billion, for the first half of 2015, compared to the same period in 2014. The increase was entirely due to the impact of acquisitions. Including the special item, total operating expenses increased 8%, or 12% after adjusting for currency.

MasterCard Incorporated - Page 3

Excluding the special item, operating income of $2.7 billion was essentially unchanged versus the first half of 2014 or increased 7% adjusted for currency, resulting in an operating margin of 57.7%.

MasterCard’s effective tax rate was 24.9% for the first half of 2015 versus a rate of 32.1% in the same period in 2014, excluding the special item. The decrease was primarily due to the recognition of a discrete U.S. foreign tax credit benefit, a larger repatriation benefit and a more favorable mix of taxable earnings.

Second-Quarter Financial Results Conference Call Details

At 9:00 a.m. ET today, the company will host a conference call to discuss its second-quarter financial results.

The dial-in information for this call is 866-393-4306 (within the U.S.) and 734-385-2616 (outside the U.S.), and the passcode is 66650115. A replay of the call will be available for 30 days and can be accessed by dialing 855-859-2056 (within the U.S.) and 404-537-3406 (outside the U.S.), and using passcode 66650115.

This call can also be accessed through the Investor Relations section of the company’s website at www.mastercard.com/investor.

Non-GAAP Financial Information

The company has presented certain financial data that are considered non-GAAP financial measures that are reconciled to their most directly comparable GAAP measures in the accompanying tables.

The presentation of growth rates adjusted for currency represent a non-GAAP measure and are calculated by remeasuring the prior period’s results using the current period’s exchange rates.

About MasterCard Incorporated

MasterCard (NYSE: MA), www.mastercard.com, is a technology company in the global payments industry. We operate the world’s fastest payments processing network, connecting consumers, financial institutions, merchants, governments and businesses in more than 210 countries and territories. MasterCard’s products and solutions make everyday commerce activities – such as shopping, traveling, running a business and managing finances – easier, more secure and more efficient for everyone. Follow us on Twitter @MasterCardNews, join the discussion on the Cashless Pioneers Blog and subscribe for the latest news on the Engagement Bureau.

Forward-Looking Statements

Statements in this press release which are not historical facts, including statements about MasterCard’s plans, strategies, beliefs and expectations, are forward-looking and subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements speak only as of the date they are made. Accordingly, except for the company’s ongoing obligations under the U.S. federal

MasterCard Incorporated - Page 4

securities laws, the company does not intend to update or otherwise revise the forward-looking information to reflect actual results of operations, changes in financial condition, changes in estimates, expectations or assumptions, changes in general economic or industry conditions or other circumstances arising and/or existing since the preparation of this press release or to reflect the occurrence of any unanticipated events. Such forward-looking statements include, without limitation, statements related to our business performance and the execution of our strategy.

Actual results may differ materially from such forward-looking statements for a number of reasons, including those set forth in the company’s filings with the Securities and Exchange Commission (SEC), including the company’s Annual Report on Form 10-K for the year ended December 31, 2014, the company’s Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that have been filed with the SEC during 2015, as well as reasons including difficulties, delays or the inability of the company to achieve its strategic initiatives set forth above. Factors other than those listed above could also cause the company’s results to differ materially from expected results.

###

Contacts:

Investor Relations: Barbara Gasper or Matt Lanford, investor_relations@mastercard.com, 914-249-4565

Media Relations: Seth Eisen, Seth_Eisen@mastercard.com, 914-249-3153

MasterCard Incorporated - Page 5

MASTERCARD INCORPORATED

CONSOLIDATED STATEMENT OF OPERATIONS

(UNAUDITED)

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

| (in millions, except per share data) |

Net Revenue | $ | 2,390 |

| | $ | 2,368 |

| | $ | 4,620 |

| | $ | 4,540 |

|

Operating Expenses | | | | | | | |

General and administrative | 810 |

| | 731 |

| | 1,460 |

| | 1,396 |

|

Advertising and marketing | 176 |

| | 173 |

| | 318 |

| | 322 |

|

Depreciation and amortization | 92 |

| | 81 |

| | 179 |

| | 154 |

|

Provision for litigation settlement | 61 |

| | — |

| | 61 |

| | — |

|

Total operating expenses | 1,139 |

| | 985 |

| | 2,018 |

| | 1,872 |

|

Operating income | 1,251 |

| | 1,383 |

| | 2,602 |

| | 2,668 |

|

Other Income (Expense) | | | | | | | |

Investment income | 6 |

| | 6 |

| | 15 |

| | 13 |

|

Interest expense | (17 | ) | | (15 | ) | | (34 | ) | | (21 | ) |

Other income (expense), net | 1 |

| | (1 | ) | | (2 | ) | | (6 | ) |

Total other income (expense) | (10 | ) | | (10 | ) | | (21 | ) | | (14 | ) |

Income before income taxes | 1,241 |

| | 1,373 |

| | 2,581 |

| | 2,654 |

|

Income tax expense | 320 |

| | 442 |

| | 640 |

| | 853 |

|

Net Income | $ | 921 |

| | $ | 931 |

| | $ | 1,941 |

| | $ | 1,801 |

|

| | | | | | | |

Basic Earnings per Share | $ | 0.81 |

| | $ | 0.80 |

| | $ | 1.70 |

| | $ | 1.53 |

|

Basic Weighted-Average Shares Outstanding | 1,138 |

| | 1,165 |

| | 1,143 |

| | 1,175 |

|

Diluted Earnings per Share | $ | 0.81 |

| | $ | 0.80 |

| | $ | 1.69 |

| | $ | 1.53 |

|

Diluted Weighted-Average Shares Outstanding | 1,141 |

| | 1,169 |

| | 1,146 |

| | 1,179 |

|

MasterCard Incorporated - Page 6

MASTERCARD INCORPORATED

CONSOLIDATED BALANCE SHEET

(UNAUDITED)

|

| | | | | | | |

| June 30, 2015 | | December 31, 2014 |

| (in millions, except share data) |

ASSETS | | | |

Cash and cash equivalents | $ | 3,361 |

| | $ | 5,137 |

|

Restricted cash for litigation settlement | 541 |

| | 540 |

|

Investments | 1,716 |

| | 1,238 |

|

Accounts receivable | 1,128 |

| | 1,109 |

|

Settlement due from customers | 1,274 |

| | 1,052 |

|

Restricted security deposits held for customers | 1,000 |

| | 950 |

|

Prepaid expenses and other current assets | 903 |

| | 671 |

|

Deferred income taxes | 294 |

| | 300 |

|

Total Current Assets | 10,217 |

| | 10,997 |

|

Property, plant and equipment, net of accumulated depreciation of $474 and $437, respectively | 632 |

| | 615 |

|

Deferred income taxes | 32 |

| | 96 |

|

Goodwill | 1,940 |

| | 1,522 |

|

Other intangible assets, net of accumulated amortization of $743 and $663, respectively | 862 |

| | 714 |

|

Other assets | 1,589 |

| | 1,385 |

|

Total Assets | $ | 15,272 |

| | $ | 15,329 |

|

LIABILITIES AND EQUITY | | | |

Accounts payable | $ | 481 |

| | $ | 419 |

|

Settlement due to customers | 1,330 |

| | 1,142 |

|

Restricted security deposits held for customers | 1,000 |

| | 950 |

|

Accrued litigation | 722 |

| | 771 |

|

Accrued expenses | 2,385 |

| | 2,439 |

|

Other current liabilities | 558 |

| | 501 |

|

Total Current Liabilities | 6,476 |

| | 6,222 |

|

Long-term debt | 1,495 |

| | 1,494 |

|

Deferred income taxes | 101 |

| | 115 |

|

Other liabilities | 764 |

| | 674 |

|

Total Liabilities | 8,836 |

| | 8,505 |

|

Commitments and Contingencies |

| |

|

Stockholders’ Equity | | |

|

Class A common stock, $0.0001 par value; authorized 3,000,000,000 shares, 1,367,937,580 and 1,352,378,383 shares issued and 1,110,771,314 and 1,115,369,640 outstanding, respectively | — |

| | — |

|

Class B common stock, $0.0001 par value; authorized 1,200,000,000 shares, 23,247,190 and 37,192,165 issued and outstanding, respectively | — |

| | — |

|

Additional paid-in-capital | 3,936 |

| | 3,876 |

|

Class A treasury stock, at cost, 257,166,266 and 237,008,743 shares, respectively | (11,785 | ) | | (9,995 | ) |

Retained earnings | 14,746 |

| | 13,169 |

|

Accumulated other comprehensive income (loss) | (493 | ) | | (260 | ) |

Total Stockholders’ Equity | 6,404 |

| | 6,790 |

|

Non-controlling interests | 32 |

| | 34 |

|

Total Equity | 6,436 |

| | 6,824 |

|

Total Liabilities and Equity | $ | 15,272 |

| | $ | 15,329 |

|

MasterCard Incorporated - Page 7

MASTERCARD INCORPORATED

CONSOLIDATED STATEMENT OF CASH FLOWS

(UNAUDITED)

|

| | | | | | | |

| Six Months Ended June 30, |

| 2015 | | 2014 |

| (in millions) |

Operating Activities | | | |

Net income | $ | 1,941 |

| | $ | 1,801 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

Amortization of customer and merchant incentives | 358 |

| | 325 |

|

Depreciation and amortization | 179 |

| | 154 |

|

Share-based payments | (23 | ) | | (46 | ) |

Deferred income taxes | 1 |

| | (77 | ) |

Other | (23 | ) | | 22 |

|

Changes in operating assets and liabilities: | | | |

Accounts receivable | (51 | ) | | (121 | ) |

Income taxes receivable | (63 | ) | | — |

|

Settlement due from customers | (290 | ) | | 1 |

|

Prepaid expenses | (522 | ) | | (443 | ) |

Accrued litigation and legal settlements | (49 | ) | | (87 | ) |

Accounts payable | 37 |

| | 29 |

|

Settlement due to customers | 261 |

| | (90 | ) |

Accrued expenses | (120 | ) | | (209 | ) |

Net change in other assets and liabilities | 96 |

| | 38 |

|

Net cash provided by operating activities | 1,732 |

| | 1,297 |

|

Investing Activities | | | |

Purchases of investment securities available-for-sale | (789 | ) | | (1,473 | ) |

Purchases of other short-term investments held-to-maturity | (744 | ) | | — |

|

Acquisition of businesses, net of cash acquired | (584 | ) | | (341 | ) |

Purchases of property, plant and equipment | (56 | ) | | (39 | ) |

Capitalized software | (87 | ) | | (63 | ) |

Proceeds from sales of investment securities available-for-sale | 716 |

| | 426 |

|

Proceeds from maturities of investment securities available-for-sale | 322 |

| | 887 |

|

(Increase) decrease in restricted cash for litigation settlement | (1 | ) | | 183 |

|

Other investing activities | 1 |

| | (12 | ) |

Net cash used in investing activities | (1,222 | ) | | (432 | ) |

Financing Activities | | | |

Purchases of treasury stock | (1,795 | ) | | (2,827 | ) |

Proceeds from debt | — |

| | 1,487 |

|

Dividends paid | (367 | ) | | (260 | ) |

Tax benefit for share-based payments | 34 |

| | 42 |

|

Cash proceeds from exercise of stock options | 21 |

| | 16 |

|

Other financing activities | (9 | ) | | (43 | ) |

Net cash used in financing activities | (2,116 | ) | | (1,585 | ) |

Effect of exchange rate changes on cash and cash equivalents | (170 | ) | | (1 | ) |

Net decrease in cash and cash equivalents | (1,776 | ) | | (721 | ) |

Cash and cash equivalents - beginning of period | 5,137 |

| | 3,599 |

|

Cash and cash equivalents - end of period | $ | 3,361 |

| | $ | 2,878 |

|

| | | |

Non-Cash Investing and Financing Activities | | | |

Fair value of assets acquired, net of cash acquired | $ | 625 |

| | $ | 572 |

|

Fair value of liabilities assumed related to acquisitions | $ | 41 |

| | $ | 128 |

|

MasterCard Incorporated - Page 8

MASTERCARD INCORPORATED OPERATING PERFORMANCE

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the 3 Months Ended June 30, 2015 |

| GDV (Bil.) | | Growth (USD) | | Growth (Local) | | Purchase Volume (Bil.) | | Growth (Local) | | Purchase Trans. (Mil.) | | Cash Volume (Bil.) | | Growth (Local) | | Cash Trans (Mil.) | | Accounts (Mil.) | | Cards (Mil.) |

All MasterCard Credit, Charge and Debit Programs | | | | | | | | | | | | | | | | | | | | | |

APMEA | $ | 344 |

| | 7.1 | % | | 14.9 | % | | $ | 232 |

| | 15.4 | % | | 2,895 |

| | $ | 112 |

| | 13.9 | % | | 1,055 |

| | 478 |

| | 511 |

|

Canada | 34 |

| | 3.8 | % | | 17.3 | % | | 33 |

| | 19.1 | % | | 453 |

| | 2 |

| | -8.2 | % | | 6 |

| | 46 |

| | 55 |

|

Europe | 320 |

| | -7.0 | % | | 16.5 | % | | 220 |

| | 15.0 | % | | 4,391 |

| | 100 |

| | 19.9 | % | | 753 |

| | 371 |

| | 388 |

|

Latin America | 80 |

| | -9.5 | % | | 14.9 | % | | 47 |

| | 17.9 | % | | 1,378 |

| | 32 |

| | 10.9 | % | | 221 |

| | 144 |

| | 164 |

|

Worldwide less United States | 777 |

| | -1.1 | % | | 15.7 | % | | 531 |

| | 15.7 | % | | 9,117 |

| | 246 |

| | 15.6 | % | | 2,035 |

| | 1,039 |

| | 1,118 |

|

United States | 364 |

| | 7.3 | % | | 7.3 | % | | 310 |

| | 7.1 | % | | 5,580 |

| | 54 |

| | 8.0 | % | | 344 |

| | 334 |

| | 371 |

|

Worldwide | 1,141 |

| | 1.4 | % | | 12.8 | % | | 841 |

| | 12.4 | % | | 14,697 |

| | 300 |

| | 14.2 | % | | 2,379 |

| | 1,373 |

| | 1,489 |

|

MasterCard Credit and Charge Programs | | | | | | | | | | | | | | | | | | | | | |

Worldwide less United States | 447 |

| | -2.9 | % | | 11.5 | % | | 406 |

| | 12.7 | % | | 5,549 |

| | 41 |

| | 0.8 | % | | 195 |

| | 520 |

| | 586 |

|

United States | 172 |

| | 6.7 | % | | 6.7 | % | | 165 |

| | 6.4 | % | | 1,836 |

| | 7 |

| | 13.4 | % | | 9 |

| | 156 |

| | 188 |

|

Worldwide | 619 |

| | -0.4 | % | | 10.1 | % | | 571 |

| | 10.8 | % | | 7,385 |

| | 48 |

| | 2.6 | % | | 203 |

| | 676 |

| | 774 |

|

MasterCard Debit Programs | | | | | | | | | | | | | | | | | | | | | |

Worldwide less United States | 331 |

| | 1.6 | % | | 21.9 | % | | 126 |

| | 26.6 | % | | 3,568 |

| | 205 |

| | 19.2 | % | | 1,840 |

| | 519 |

| | 532 |

|

United States | 192 |

| | 7.8 | % | | 7.8 | % | | 145 |

| | 8.0 | % | | 3,744 |

| | 47 |

| | 7.3 | % | | 336 |

| | 178 |

| | 183 |

|

Worldwide | 522 |

| | 3.8 | % | | 16.3 | % | | 271 |

| | 15.9 | % | | 7,312 |

| | 251 |

| | 16.8 | % | | 2,176 |

| | 697 |

| | 715 |

|

| For the 6 Months Ended June 30, 2015 |

| GDV (Bil.) | | Growth (USD) | | Growth (Local) | | Purchase Volume (Bil.) | | Growth (Local) | | Purchase Trans. (Mil.) | | Cash Volume (Bil.) | | Growth (Local) | | Cash Trans (Mil.) | | Accounts (Mil.) | | Cards (Mil.) |

All MasterCard Credit, Charge and Debit Programs | | | | | | | | | | | | | | | | | | | | | |

APMEA | $ | 673 |

| | 7.9 | % | | 14.9 | % | | $ | 452 |

| | 15.2 | % | | 5,553 |

| | $ | 221 |

| | 14.4 | % | | 2,064 |

| | 478 |

| | 511 |

|

Canada | 64 |

| | 3.0 | % | | 16.2 | % | | 60 |

| | 18.2 | % | | 846 |

| | 4 |

| | -8.9 | % | | 11 |

| | 46 |

| | 55 |

|

Europe | 605 |

| | -7.7 | % | | 15.8 | % | | 420 |

| | 14.1 | % | | 8,329 |

| | 185 |

| | 19.8 | % | | 1,420 |

| | 371 |

| | 388 |

|

Latin America | 159 |

| | -6.6 | % | | 14.5 | % | | 95 |

| | 17.9 | % | | 2,709 |

| | 65 |

| | 9.9 | % | | 434 |

| | 144 |

| | 164 |

|

Worldwide less United States | 1,501 |

| | -0.7 | % | | 15.3 | % | | 1,027 |

| | 15.2 | % | | 17,437 |

| | 474 |

| | 15.5 | % | | 3,929 |

| | 1,039 |

| | 1,118 |

|

United States | 702 |

| | 6.9 | % | | 6.9 | % | | 596 |

| | 7.0 | % | | 10,687 |

| | 106 |

| | 5.9 | % | | 670 |

| | 334 |

| | 371 |

|

Worldwide | 2,203 |

| | 1.6 | % | | 12.5 | % | | 1,623 |

| | 12.0 | % | | 28,125 |

| | 580 |

| | 13.7 | % | | 4,599 |

| | 1,373 |

| | 1,489 |

|

MasterCard Credit and Charge Programs | | | | | | | | | | | | | | | | | | | | | |

Worldwide less United States | 868 |

| | -2.3 | % | | 11.2 | % | | 788 |

| | 12.5 | % | | 10,706 |

| | 80 |

| | 0.4 | % | | 380 |

| | 520 |

| | 586 |

|

United States | 324 |

| | 6.0 | % | | 6.0 | % | | 311 |

| | 6.3 | % | | 3,445 |

| | 13 |

| | 1.2 | % | | 16 |

| | 156 |

| | 188 |

|

Worldwide | 1,192 |

| | -0.2 | % | | 9.8 | % | | 1,099 |

| | 10.6 | % | | 14,151 |

| | 94 |

| | 0.5 | % | | 395 |

| | 676 |

| | 774 |

|

MasterCard Debit Programs | | | | | | | | | | | | | | | | | | | | | |

Worldwide less United States | 633 |

| | 1.6 | % | | 21.3 | % | | 239 |

| | 25.1 | % | | 6,731 |

| | 394 |

| | 19.2 | % | | 3,550 |

| | 519 |

| | 532 |

|

United States | 378 |

| | 7.6 | % | | 7.6 | % | | 285 |

| | 7.9 | % | | 7,242 |

| | 93 |

| | 6.6 | % | | 654 |

| | 178 |

| | 183 |

|

Worldwide | 1,011 |

| | 3.7 | % | | 15.8 | % | | 525 |

| | 15.1 | % | | 13,974 |

| | 487 |

| | 16.6 | % | | 4,204 |

| | 697 |

| | 715 |

|

| For the 3 months ended June 30, 2014 |

| GDV (Bil.) | | Growth (USD) | | Growth (Local) | | Purchase Volume (Bil.) | | Growth (Local) | | Purchase Trans. (Mil.) | | Cash Volume (Bil.) | | Growth (Local) | | Cash Trans (Mil.) | | Accounts (Mil.) | | Cards (Mil.) |

All MasterCard Credit, Charge and Debit Programs | | | | | | | | | | | | | | | | | | | | | |

APMEA | $ | 321 |

| | 14.6 | % | | 17.9 | % | | $ | 214 |

| | 17.6 | % | | 2,419 |

| | $ | 107 |

| | 18.5 | % | | 928 |

| | 417 |

| | 447 |

|

Canada | 33 |

| | -1.4 | % | | 4.9 | % | | 31 |

| | 6.7 | % | | 380 |

| | 2 |

| | -14.4 | % | | 6 |

| | 40 |

| | 48 |

|

Europe | 344 |

| | 14.1 | % | | 13.1 | % | | 233 |

| | 10.1 | % | | 3,575 |

| | 111 |

| | 19.9 | % | | 669 |

| | 328 |

| | 344 |

|

Latin America | 88 |

| | 4.3 | % | | 13.0 | % | | 54 |

| | 20.1 | % | | 1,232 |

| | 34 |

| | 3.4 | % | | 205 |

| | 128 |

| | 148 |

|

Worldwide less United States | 786 |

| | 12.4 | % | | 14.6 | % | | 531 |

| | 13.8 | % | | 7,606 |

| | 254 |

| | 16.4 | % | | 1,808 |

| | 913 |

| | 987 |

|

United States | 339 |

| | 9.4 | % | | 9.4 | % | | 290 |

| | 10.2 | % | | 5,146 |

| | 50 |

| | 4.7 | % | | 328 |

| | 304 |

| | 339 |

|

Worldwide | 1,125 |

| | 11.5 | % | | 13.0 | % | | 821 |

| | 12.5 | % | | 12,752 |

| | 304 |

| | 14.3 | % | | 2,137 |

| | 1,217 |

| | 1,326 |

|

MasterCard Credit and Charge Programs | | | | | | | | | | | | | | | | | | | | | |

Worldwide less United States | 460 |

| | 9.1 | % | | 11.0 | % | | 411 |

| | 12.5 | % | | 4,976 |

| | 49 |

| | 0.4 | % | | 210 |

| | 498 |

| | 562 |

|

United States | 161 |

| | 9.8 | % | | 9.8 | % | | 155 |

| | 10.3 | % | | 1,713 |

| | 6 |

| | -0.9 | % | | 7 |

| | 144 |

| | 173 |

|

Worldwide | 622 |

| | 9.3 | % | | 10.7 | % | | 566 |

| | 11.9 | % | | 6,689 |

| | 56 |

| | 0.3 | % | | 217 |

| | 641 |

| | 735 |

|

MasterCard Debit Programs | | | | | | | | | | | | | | | | | | | | | |

Worldwide less United States | 325 |

| | 17.3 | % | | 20.1 | % | | 121 |

| | 18.5 | % | | 2,629 |

| | 205 |

| | 21.1 | % | | 1,598 |

| | 416 |

| | 425 |

|

United States | 178 |

| | 8.9 | % | | 8.9 | % | | 134 |

| | 10.0 | % | | 3,433 |

| | 43 |

| | 5.6 | % | | 321 |

| | 160 |

| | 166 |

|

Worldwide | 503 |

| | 14.2 | % | | 15.9 | % | | 255 |

| | 13.9 | % | | 6,062 |

| | 248 |

| | 18.1 | % | | 1,919 |

| | 576 |

| | 591 |

|

| For the 6 Months ended June 30, 2014 |

| GDV (Bil.) | | Growth (USD) | | Growth (Local) | | Purchase Volume (Bil.) | | Growth (Local) | | Purchase Trans. (Mil.) | | Cash Volume (Bil.) | | Growth (Local) | | Cash Trans (Mil.) | | Accounts (Mil.) | | Cards (Mil.) |

All MasterCard Credit, Charge and Debit Programs | | | | | | | | | | | | | | | | | | | | | |

APMEA | $ | 623 |

| | 13.6 | % | | 18.5 | % | | $ | 417 |

| | 18.1 | % | | 4,636 |

| | $ | 207 |

| | 19.3 | % | | 1,812 |

| | 417 |

| | 447 |

|

Canada | 62 |

| | -1.7 | % | | 6.0 | % | | 58 |

| | 7.7 | % | | 716 |

| | 5 |

| | -12.1 | % | | 11 |

| | 40 |

| | 48 |

|

Europe | 656 |

| | 13.8 | % | | 13.8 | % | | 445 |

| | 10.5 | % | | 6,821 |

| | 211 |

| | 21.5 | % | | 1,266 |

| | 328 |

| | 344 |

|

Latin America | 171 |

| | 3.6 | % | | 14.2 | % | | 103 |

| | 20.9 | % | | 2,427 |

| | 67 |

| | 5.2 | % | | 404 |

| | 128 |

| | 148 |

|

Worldwide less United States | 1,512 |

| | 11.8 | % | | 15.4 | % | | 1,023 |

| | 14.3 | % | | 14,599 |

| | 489 |

| | 17.7 | % | | 3,492 |

| | 913 |

| | 987 |

|

United States | 657 |

| | 8.8 | % | | 8.8 | % | | 557 |

| | 9.5 | % | | 9,864 |

| | 100 |

| | 5.3 | % | | 639 |

| | 304 |

| | 339 |

|

Worldwide | 2,169 |

| | 10.9 | % | | 13.3 | % | | 1,580 |

| | 12.6 | % | | 24,463 |

| | 589 |

| | 15.4 | % | | 4,131 |

| | 1,217 |

| | 1,326 |

|

MasterCard Credit and Charge Programs | | | | | | | | | | | | | | | | | | | | | |

Worldwide less United States | 889 |

| | 8.4 | % | | 11.7 | % | | 791 |

| | 12.9 | % | | 9,599 |

| | 97 |

| | 2.5 | % | | 408 |

| | 498 |

| | 562 |

|

United States | 306 |

| | 9.0 | % | | 9.0 | % | | 293 |

| | 9.2 | % | | 3,223 |

| | 13 |

| | 3.5 | % | | 13 |

| | 144 |

| | 173 |

|

Worldwide | 1,195 |

| | 8.5 | % | | 11.0 | % | | 1,084 |

| | 11.9 | % | | 12,822 |

| | 111 |

| | 2.6 | % | | 421 |

| | 641 |

| | 735 |

|

MasterCard Debit Programs | | | | | | | | | | | | | | | | | | | | | |

Worldwide less United States | 623 |

| | 17.0 | % | | 21.2 | % | | 231 |

| | 19.5 | % | | 5,000 |

| | 392 |

| | 22.2 | % | | 3,084 |

| | 416 |

| | 425 |

|

United States | 351 |

| | 8.7 | % | | 8.7 | % | | 265 |

| | 9.8 | % | | 6,641 |

| | 87 |

| | 5.5 | % | | 626 |

| | 160 |

| | 166 |

|

Worldwide | 975 |

| | 13.9 | % | | 16.4 | % | | 496 |

| | 14.1 | % | | 11,640 |

| | 479 |

| | 18.8 | % | | 3,710 |

| | 576 |

| | 591 |

|

| | | | | | | | | | | | | | | | | | | | | |

APMEA = Asia Pacific / Middle East / Africa |

Note that the figures in the preceding tables may not sum due to rounding; growth represents change from the comparable year-ago period |

MasterCard Incorporated - Page 9

Footnote

The tables set forth the gross dollar volume (“GDV”), purchase volume, cash volume and the number of purchase transactions, cash transactions, accounts and cards on a regional and global basis for MasterCard®-branded and MasterCard Electronic™-branded cards. Growth rates over prior periods are provided for volume-based data.

Debit transactions on Maestro® and Cirrus®-branded cards and transactions involving brands other than MasterCard are not included in the preceding tables.

For purposes of the table: GDV represents purchase volume plus cash volume and includes the impact of balance transfers and convenience checks; “purchase volume” means the aggregate dollar amount of purchases made with MasterCard-branded cards for the relevant period; and “cash volume” means the aggregate dollar amount of cash disbursements obtained with MasterCard-branded cards for the relevant period. The number of cards includes virtual cards, which are MasterCard-branded payment accounts that do not generally have physical cards associated with them.

The MasterCard payment product is comprised of credit, charge and debit programs, and data relating to each type of program is included in the tables. Debit programs include MasterCard-branded debit programs where the primary means of cardholder validation at the point of sale is for cardholders either to sign a sales receipt or enter a PIN. The tables include information with respect to transactions involving MasterCard-branded cards that are not processed by MasterCard and transactions for which MasterCard does not earn significant revenues.

Information denominated in U.S. dollars is calculated by applying an established U.S. dollar/local currency exchange rate for each local currency in which MasterCard volumes are reported. These exchange rates are calculated on a quarterly basis using the average exchange rate for each quarter. MasterCard reports period-over-period rates of change in purchase volume and cash volume on the basis of local currency information, in order to eliminate the impact of changes in the value of foreign currencies against the U.S. dollar in calculating such rates of change.

The data set forth in the GDV, purchase volume, purchase transactions, cash volume and cash transactions columns is provided by MasterCard customers and is subject to verification by MasterCard and partial cross-checking against information provided by MasterCard’s transaction processing systems. The data set forth in the accounts and cards columns is provided by MasterCard customers and is subject to certain limited verification by MasterCard. A portion of the data set forth in the accounts and cards columns reflects the impact of routine portfolio changes among customers and other practices that may lead to over counting of the underlying data in certain circumstances. All data is subject to revision and amendment by MasterCard’s customers subsequent to the date of its release.

Performance information for prior periods can be found in the “Investor Relations” section of the MasterCard website at www.mastercard.com/investor.

MasterCard Incorporated - Page 10

GAAP Reconciliations

($ in millions, except per share data)

|

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2015 | | Three Months Ended June 30, 2014 | | Percent Increase / (Decrease) |

| Actual | | Special Item 1 | | Non-GAAP | | Actual | | Actual | | Special Item 1 | | Non-GAAP |

Total operating expenses | $ | 1,139 |

| | $ | (61 | ) | | $ | 1,078 |

| | $ | 985 |

| | 15% | | 6% | | 9% |

Operating income | $ | 1,251 |

| | $ | 61 |

| | $ | 1,312 |

| | $ | 1,383 |

| | (10)% | | (5)% | | (5)% |

Operating Margin | 52.4 | % | | | | 54.9 | % | | 58.4 | % | | | | | | |

Income tax expense | $ | 320 |

| | $ | 17 |

| | $ | 337 |

| | $ | 442 |

| | (28)% | | (4)% | | (24)% |

Effective Tax Rate | 25.7 | % | | | | 25.8 | % | | 32.2 | % | | | | | | |

Net Income | $ | 921 |

| | $ | 44 |

| | $ | 965 |

| | $ | 931 |

| | (1)% | | (5)% | | 4% |

Diluted Earnings per Share | $ | 0.81 |

| | $ | 0.04 |

| | $ | 0.85 |

| | $ | 0.80 |

| | 1% | | (5)% | | 6% |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Six Months Ended June 30, 2015 | | Six Months Ended June 30, 2014 | | Percent Increase / (Decrease) |

| Actual | | Special Item 1 | | Non-GAAP | | Actual | | Actual | | Special Item 1 | | Non-GAAP |

Total operating expenses | $ | 2,018 |

| | $ | (61 | ) | | $ | 1,957 |

| | $ | 1,872 |

| | 8% | | 4% | | 4% |

Operating income | $ | 2,602 |

| | $ | 61 |

| | $ | 2,663 |

| | $ | 2,668 |

| | (2)% | | (2)% | | —% |

Operating Margin | 56.3 | % | | | | 57.7 | % | | 58.8 | % | | | | | | |

Income tax expense | $ | 640 |

| | $ | 17 |

| | $ | 657 |

| | $ | 853 |

| | (25)% | | (2)% | | (23)% |

Effective Tax Rate | 24.8 | % | | | | 24.9 | % | | 32.1 | % | | | | | | |

Net Income | $ | 1,941 |

| | $ | 44 |

| | $ | 1,985 |

| | $ | 1,801 |

| | 8% | | (2)% | | 10% |

Diluted Earnings per Share | $ | 1.69 |

| | $ | 0.04 |

| | $ | 1.73 |

| | $ | 1.53 |

| | 10% | | (3)% | | 13% |

| | | | | | | | | | | | | |

Note: Figures may not sum due to rounding |

1 Represents effect of UK Merchant Litigation Settlement |

©2015 MasterCard. Proprietary MasterCard Incorporated Second-Quarter 2015 Financial Results Conference Call July 29, 2015

©2015 MasterCard. Proprietary Business Update Financial & Operational Overview Economic Update Business Highlights Page 2

©2015 MasterCard. Proprietary 2nd Quarter Selected Financial Performance ($ in millions, except per share data) 2Q 15 Non-GAAP excl. special item* 2Q 14 Net revenue 2,390$ 2,368$ 1% 7% Total operating expenses 1,078 985 9% 14% Operating income 1,312 1,383 (5)% 2% Operating margin 54.9% 58.4% (3.5) ppts (2.7) ppts N t income 965$ 931$ 4% 12% Diluted EPS 0.85$ 0.80$ 6% 15% Effective tax rate 25.8% 32.2% FX Adjusted YOY Growth Non-GAAP Note: Figures may not sum due to rounding. * See Appendix A for GAAP reconciliations of this special item for the 3 months ended June 30, 2015 Page 3

©2015 MasterCard. Proprietary 2nd Quarter Gross Dollar Volume (GDV) ($ in billions) Notes: 1. Growth rates are shown in local currency 2. Figures may not sum due to rounding $622 $619 $161 $172 $460 $447 $503 $522 $178 $192 $325 $331 $0 $200 $400 $600 $800 $1,000 $1,200 2Q 14 2Q 15 2Q 14 2Q 15 2Q 14 2Q 15 Credit Debit $1,125 $1,141 $339 $364 $786 $777 4 Worldwide 13% Growth United States 7% Growth Rest of World 16% Growth Page

©2015 MasterCard. Proprietary 2nd Quarter Processed Transactions and Cards Cards 8% Growth Note: Figures may not sum due to rounding 1,326 1,489 698 701 0 500 1,000 1,500 2,000 2,500 2Q 14 2Q 15 Car d s ( in m ill io n s ) MasterCard Cards Maestro Cards 2,024 10,609 12,012 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 2Q 14 2Q 15 T ra n s a cti o n s ( in m ill io n s ) Processed Transactions 13% Growth 5 2,190 Page

©2015 MasterCard. Proprietary $1,008 $750 $995 $392 ($777) $2,368 $1,028 $777 $1,051 $474 ($940) $2,390 -$1,500 -$1,000 -$500 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 Domestic Assessments Cross-Border Volume Fees Transaction Processing Fees Other Revenues Rebates and Incentives Total Net Revenue 2Q 14 2Q 15 Note: 1. Figures may not sum due to rounding. 2nd Quarter Revenue ($ in millions) 2% 3% 6% 21% 21% 1%As-reported 7%28%29%12%9%FX-adjusted 9% Page 6

©2015 MasterCard. Proprietary $731 $173 $81 $985 $810 $176 $92 $1,078 $0 $400 $800 $1,200 General & Administrative Advertising & Marketing Depreciation & Amortization Total Operating Expenses* 2Q 14 2Q 15 2nd Quarter Operating Expenses ($ in millions) 14% 12% 16% 14%*Including Acquisitions 4% FX-adjusted Growth 3% 12% 3% Note: Figures may not sum due to rounding * See Appendix B for Operating Expenses Growth GAAP reconciliations Page 7 10% 2% 15% 9%* Excluding Acquisitions * = As-reported Growth

©2015 MasterCard. Proprietary Looking Ahead Business update through July 21st Thoughts for 2015 Long-Term Performance Objectives • Discussion on FX • Revenue • Expenses • Tax Rate Page 8

©2015 MasterCard. Proprietary 9 Three Months Ended June 30, 2014 Actual Special Item 1 Non-GAAP Actual Actual Special Item 1 Non-GAAP Total operating expenses 1,139$ (61)$ 1,078$ 985$ 15% 6% 9% Operating income 1,251 61 1,312 1,383 (10)% (5)% (5)% Operating Margin 52.4% 54.9% 58.4% Income tax expense 320 17 337 442 (28)% (4)% (24)% Effective Tax Rate 25.7% 25.8% 32.2% Net Income 921 44 965 931 (1)% (5)% 4% Diluted Earnings per Share 0.81$ 0.04$ 0.85$ 0.80$ 1% (5)% 6% Three Months Ended June 30, 2015 Percent Increase / (Decrease) 1 Represents effect of UK Merchant Litigation Settlement Appendix A GAAP Reconciliation ($ in millions, except per share data) Note: Figures may not sum due to rounding

©2015 MasterCard. Proprietary Appendix B Operating Expenses Growth GAAP Reconciliation Page 10 Note: Figures may not sum due to rounding ** Not meaningful 1 Represents effect of UK Merchant Litigation Settlement 2 Represents impact of foreign currency calculated by remeasuring the prior period’s results using the current period’s exchange rates 3 Impact from our 2014 and 2015 acquisitions Q2 2015 Growth Rate - Increase / (Decrease) As-Reported Special Item1 FX2 Acquisitions3 Excluding All Impacts General and administrative 10% - (4)% 12% 3% Advertising and marketing 2% - (10)% - 12% Depreciation and amortization 15% - (1)% 13% 3% Provision for litigation settlement ** ** ** ** ** Total operating expenses 15% 6% (5)% 10% 4%

©2015 MasterCard. Proprietary

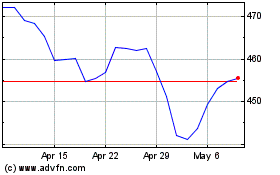

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024