By Suzanne Kapner

The new chief executive of Macy's Inc. says he knows what ails

the struggling department-store chain: A "sea of sameness" that

characterizes too much of what it sells today.

His fix? Cutting back on what he calls "fashion basics" to make

room for higher-priced, trendier clothing, as well as more options

for bargain shoppers that have turned to T.J. Maxx and other

discounters.

"We're trying to create the best of both worlds with an

off-price/full-price environment," said Jeffrey Gennette, who took

to take the reins at the 159-year-old retailer on Thursday.

In an interview above Macy's flagship store in Manhattan's

Herald Square, Mr. Gennette laid out his plans. The 55-year-old,

who joined Macy's as an executive trainee in 1983 and worked his

way up to president, has been gearing up for the job since June,

when Macy's announced that longtime CEO Terry Lundgren would step

down but remain chairman.

Macy's is the biggest U.S. department-store chain by sales, but

it is fighting to stay atop a shrinking market as spending has

shifted to fast fashion retailers and discount chains as well as

online rivals. In addition, more brands Macy's carries now sell

directly to consumers, calling into question its reason for

being.

Observers applauded Mr. Gennette's plan to eliminate uninspiring

merchandise but worried that his strategy isn't radical enough.

They would like to see him close more stores and overhaul the

experience at the remaining locations by adding more technology,

entertainment and services.

"Macy's is at a crossroads," said Mark Cohen, a director of

retail studies at Columbia Business School. "What he described

doesn't move the needle."

Profits fell 42% to $619 million on a nearly 5% drop in sales

for the year ended in January, the second consecutive year in which

Macy's sales and earnings shrank. The company, which also owns

Bloomingdale's, is closing 100 of its 728 Macy's stores, and Wall

Street is wondering whether the department-store era has run its

course.

"Even after the closures, they will still have too many stores,

and the locations are too big," said Liz Dunn, CEO of retail

consulting firm Talmage Advisors. "They need a more engaging store

environment that turns shopping into entertainment."

Macy's shares closed Thursday at $28.27, down 61% from their

all-time high of $72.80 in July 2015. Activist investor Starboard

Value LP recently sold its Macy's stake, people familiar with the

situation said, backing away after it urged the company to sell

some of its real estate to unlock value for shareholders.

Macy's weakened position made it a target of Hudson's Bay Co.

The Canadian owner of Saks Fifth Avenue and Lord & Taylor

approached Macy's about a takeover earlier this year, though talks

have stalled as Hudson's Bay has switched its focus to buying

Neiman Marcus Group Ltd., people familiar with the discussions have

said.

Mr. Gennette said the department-store model is far from dead,

but he conceded that Macy's sales are too concentrated among a

relatively small group of shoppers. Roughly 10% of its 43 million

customers account for half of its sales, which totaled $25.8

billion in its most recent financial year.

"She still loves us," Mr. Gennette said of this core customer.

"The remaining 90% is where we have a lot of work to do."

He is also overhauling the company's pricing and promotional

activity. He hired a new marketing chief from Toys "R" Us Inc., who

is shifting the focus away from promotions and toward branding

Macy's as a place to shop for fashion and special events.

Macy's is stripping out layers of coupons so that products will

now be eligible for one discount, not multiple ones, though

shoppers who use Macy's credit card can still qualify for an extra

20% off.

"We're still going to be a promotional department store," just

one that won't require, as Mr. Gennette put it, "a Ph.D. in math to

understand our pricing."

Analysts noted that there is a long list of retail executives

who have attempted to curtail coupons with little success. Mr.

Lundgren tried the tactic in 2007. "Customers stopped shopping, so

we knew that was a bad idea," he told the Journal in 2013. A Macy's

spokeswoman said the retailer is confident in its new CEO's

approach.

To boost sales of full-price merchandise, Mr. Gennette plans to

add new brands and designers, while improving the materials and

construction of some lines and varying the mix of items more. He

pointed to Macy's private label INC brand, which has raised prices

around 8% on average after adding embellishments such as additional

trim and better-quality fabrics.

Roughly 30% of Macy's sales come from its private brands or

national labels and products that it sells exclusively, a figure

that he said could rise to 40% over time.

The company's stores carry too many basics in similar styles and

colors. Mr. Gennette is cutting 40% of this assortment and adding

more apparel that reflect current trends.

Rajiv Lal, a professor of retailing at Harvard University,

applauded the move but said Macy's needs to bring in budding

designers to truly differentiate its offerings. Industry executives

pointed out, however, that carrying smaller labels is a challenge

for department stores, which typically demand margin guarantees

from suppliers that small designers can't meet.

Macy's new merchandise will be on display in several soon-to-be

remodeled stores. "For department stores to succeed, we've got to

arrest the decline," Mr. Gennette said. "We're going to figure

these stores out, and it's not going to be the same formula we used

the past."

To court bargain shoppers, he is doubling to 30 the number of

Backstage discount stores located inside Macy's locations.

Backstage was developed in 2015 to counter T.J. Maxx and other

off-price chains, initially as free-standing shops but eventually

as sections inside existing Macy's stores as a way to boost

sales.

Another new addition to Macy's, called Last Act, also borrows

from off-price retailers by lumping clearance goods together in one

space. The items are priced as marked, meaning all the discounts

are baked in, similar to how off-price chains sell their goods.

To pay for these initiatives, Mr. Gennette said Macy's will

continue to cut costs and extract value from its real estate by

selling select locations and working with real-estate developers to

reconfigure properties.

He also has created a team devoted to developing new concepts.

While Mr. Gennette declined to say what they might be, he offered

one hint: "It won't be another store."

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

March 23, 2017 16:37 ET (20:37 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

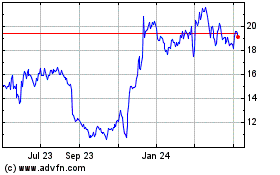

Macys (NYSE:M)

Historical Stock Chart

From Mar 2024 to Apr 2024

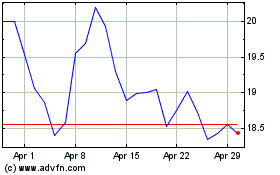

Macys (NYSE:M)

Historical Stock Chart

From Apr 2023 to Apr 2024