J.C. Penney to Close More Than 100 Stores--2nd Update

February 24 2017 - 9:49AM

Dow Jones News

By Anne Steele

J.C. Penney Co. will shutter two distribution centers and 130 to

140 stores as the big-box department store contends with falling

foot traffic and ramps up to compete with online retailers.

The closures announced Friday represent 13% to 14% of the

company's store portfolio, less than 5% of total annual sales and

0% of net income.

The announcement came as Penney reported its first annual profit

since 2010. Still, Penney's shares, battered 17% so far this year,

lost another 3.5% premarket to $6.62.

Penney joins a parade of traditional chains announcing plans to

close locations this year after struggling to draw shoppers during

the holiday season. Macy's Inc. has plans to close 100 locations

and is exploring options for the rest of its real estate, while

Sears Holdings Corp. is closing 108 Kmart and 42 Sears stores.

Analysts have said that hundreds of department stores are likely

to close, especially in weaker and older malls as they lose

business to online shopping as well as off-price retailers like TJX

Cos. This week the parent of TJ Maxx and Marshall's said it would

open about 1,800 stores--about a 50% increase from its current

base.

Chief Executive Marvin Ellison said closing stores will allow

Penney to adjust its business to "effectively compete against the

growing threat of online retailers."

He said maintaining a large store base gives Penney a

competitive advantage in the evolving retail landscape since its

locations are a destination for personalized beauty offerings,

special sizes, affordable private brands, and home goods and

services.

"While many pure-play e-commerce companies are experiencing

dramatically increasing fulfillment costs, we are pleased with the

double-digit growth of jcpenney.com and how leveraging our brick

and mortar locations is enabling us to offset the last-mile

delivery cost,' he said. "We believe the future winners in retail

will be the companies that can create a frictionless interaction

between stores and e-commerce, while leveraging physical locations

to minimize the growing operational costs of delivery."

In 2016, about 75% of all Penney's online orders touched a

physical store.

"Even with a reduced store count, JCPenney is competitively

positioned to deliver a differentiated department-store model that

meets the expectations of a digital world with an inspiring,

tangible shopping environment," Mr. Ellison said.

Mr. Ellison said the company is starting an early retirement

program for about 6,000 eligible associates. He said Penney expects

to see a net increase in hiring as the number of full-time

associates expected to take advantage of the early retirement

incentive will exceed the number of full-time positions affected by

the store closures.

During the quarter ended Jan. 31, the company's same-store sales

fell 0.7%, compared with 4.1% growth in the previous year's period

and worse than the 0.5% decline analysts cited by Consensus Metrix

were expecting. Penney expects the metric to be down 1% to up 1%

for the year.

Also for the fiscal year ending January 2018, the company guided

for adjusted earnings between 40 cents and 65 cents a share,

bracketing the average analyst estimate for 56 cents a share,

according to Thomson Reuters.

In all for the quarter, Penney posted a profit of $192 million,

or 61 cents a share, compared with a loss of $131 million, or 43

cents, the prior year.

Excluding certain items, earnings were 64 cents a share, up from

39 cents. Revenue slipped 0.9% to $3.96 billion.

Analysts had forecast adjusted earnings of 61 cents a share on

$3.98 billion in revenue.

Gross margin fell to 33.1%% from 34.1% a year ago, on more

promotional activity during the quarter as well as the continued

growth in both online and major appliances.

On Thursday, fellow retailers Macy's and Kohl's Corp. reported

lower revenue and comparable-store sales, a key retail metric that

removes the sales impact of recently opened or closed stores.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

February 24, 2017 09:34 ET (14:34 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

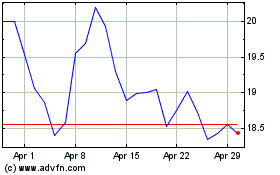

Macys (NYSE:M)

Historical Stock Chart

From Mar 2024 to Apr 2024

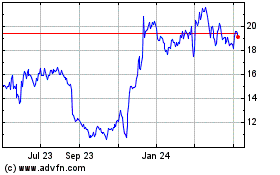

Macys (NYSE:M)

Historical Stock Chart

From Apr 2023 to Apr 2024