By Suzanne Kapner

Macy's Inc. said it will slash more than 10,000 jobs and

detailed plans to close dozens of stores after another holiday

season of weak sales, providing more evidence that department

stores have lost their once-central place in American

retailing.

Like its rival, Kohl's Corp., which also warned Wednesday of

lackluster holiday results, Macy's hasn't been able to solve

consumers' shift to online shopping. Macy's will close stores from

San Diego to Bangor, Maine, and use the savings to boost its

efforts to capture more e-commerce spending.

"We are closing locations that are unproductive or are no longer

robust shopping destinations," Chief Executive Terry Lundgren said

in a statement, adding that the company could make money off highly

valued real estate.

On top of eliminating about 3,900 jobs with 63 store closings

this spring -- part of a plan announced last summer that will

shutter about 100 locations -- Macy's will cut about 6,200 other

positions to streamline operations so it can invest more in digital

efforts and other growth areas such as the expansion of its

Bluemercury beauty outlets and Macy's Backstage off-price

concept.

Analysts generally expect the recently completed holiday season

to be a strong one for U.S. retailers, helped by higher wages,

lower gas prices and rising employment. The National Retail

Federation, for instance, expects retail sales increased 3.6%, more

than the 3% gain of a year ago. But much of the growth has come

online. Mastercard SpendingPulse estimated that e-commerce spending

jumped 19% during the holidays, compared with an overall 4%

increase in retail spending.

But department stores face particular challenges given their

large size and dependence on brands, which now have their own

retail stores and online venues that compete with the big box

chains, as well as price pressures from fast-fashion retailers such

as H&M and Zara. Also, analysts say demand was stronger for

gadgets and toys than for the apparel and handbags that fill much

of department stores.

On Wednesday, Kohl's warned that holiday results were weak,

saying comparable sales declined 2.1% in the months of November and

December from a year ago. The chain, which operates 1,100 stores,

lowered its profit targets for the current year.

"Strong sales on Black Friday and during the week before

Christmas were offset by softness in early November and December,"

said Kohl's CEO Kevin Mansell.

Shares of Kohl's tumbled more than 12% in late trading, while

Macy's fell 8%. The news pressured other retailers, with Nordstrom

Inc. and J.C. Penney Co., also trading lower after the market

closed.

Macy's said its sales declined 2.1% on a comparable store basis

in November and December from a year ago. Assuming, business

doesn't pick up considerably in January, it would mark the eighth

consecutive quarter that Macy's sales have declined on that basis.

Macy's lowered its per-share earnings goal for the current fiscal

year, which ends Jan. 28, to a range of $2.95 to $3.10 from a

previous estimate of $3.15 to $3.40.

Mr. Lundgren, who is preparing to step aside as Macy's CEO this

year, said he expects 2017 sales to decline at a similar rate to

the company's holiday performance. The company has ramped up its

digital efforts and Mr. Lundgren said the company's online sales

were strong this holiday, but Macy's continues to "experience

declining traffic in our stores where the majority of our business

is still transacted."

The retailer, which also owns upscale department store

Bloomingdale's, is only closing Macy's locations.

Macy's said the latest store closings would result in a $250

million charge in the fourth quarter and reduce its 2017 revenue by

about $575 million. However, Macy's expects the closing to result

in annual savings of about $550 million.

"The big thing we're focusing on is what should our stores look

like going forward?" said Karen Hoguet, Macy's chief financial

officer, in an interview.

Ms. Hoguet said that Macy's will be testing a variety of new

strategies this spring.

She added that the addition of Macy's Backstage, a discount

concept similar to T.J. Maxx, to existing Macy's department stores

has helped boost traffic. As a result, Macy's plans to add 50

Backstage locations to department stores over the next few years.

The company has also been exploring options for some of its

flagship properties such as its Herald Square store in New York

City.

Ms. Hoguet said that despite the challenges, brick-and-mortar

locations will continue to be crucial to retailers. "Research tells

us that customers are visiting stores, and then buying online."

Other retailers, including Wal-Mart Stores Inc. and Sears

Holdings Corp., have tried to adapt to the shift by closing weaker

locations and trying to compete with Amazon.com Inc. for customer

loyalty.

Wal-Mart closed more than 100 U.S. stores last year and agreed

to spend $3 billion to last fall to acquire online retailer

Jet.com.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

January 04, 2017 19:29 ET (00:29 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

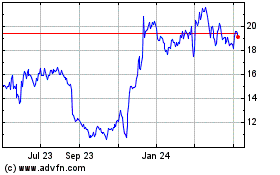

Macys (NYSE:M)

Historical Stock Chart

From Mar 2024 to Apr 2024

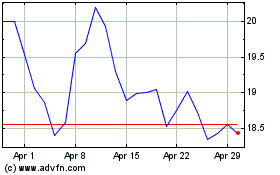

Macys (NYSE:M)

Historical Stock Chart

From Apr 2023 to Apr 2024