Macy’s, Inc. (NYSE:M) today announced that its comparable sales

on an owned plus licensed basis declined by 2.1 percent in the

months of November and December 2016 combined, compared to the same

period last year. On an owned basis, comparable sales declined by

2.7 percent in the combined November/December period.

(Editor’s Note: Macy’s, Inc. this afternoon also issued a

separate news release announcing actions to streamline its store

portfolio, intensify cost efficiency efforts and execute its real

estate strategy.)

“While our sales trend is consistent with the lower end of our

guidance, we had anticipated sales would be stronger. We believe

that our performance during the holiday season reflects the broader

challenges facing much of the retail industry. We are pleased with

the performance of our digital business, with double-digit gains at

both macys.com and bloomingdales.com; however, store sales

continued to be impacted by changing customer behavior. Our apparel

business, which includes women’s, men’s and children’s, performed

well, with particular strength in active and cold-weather

merchandise. Sales were also strong in fine jewelry, as well as

furniture and bedding, reflecting the success of our initiatives in

those categories. However, ongoing weakness in handbags and watches

negatively impacted our results,” said Terry J. Lundgren, Macy’s,

Inc. chairman and chief executive officer.

2016 Guidance

Macy’s, Inc. maintains its previously provided full-year sales

guidance of a 2.5 percent to 3.0 percent decrease in comparable

sales on an owned plus licensed basis, and expects to come in at

the lower end of that guidance, with comparable sales on an owned

basis to be approximately 50 basis points lower.

The company now expects full-year 2016 diluted earnings per

share (excluding asset impairment, restructuring, retirement

settlement and other charges) to be in a range of $2.95 to $3.10

(compared with previous guidance of $3.15 to $3.40).

Important Information Regarding

Financial Measures

Please see the last page of this news release for important

information regarding the calculation of the company’s non-GAAP

measures.

Fourth Quarter Earnings

Announcement

Macy’s, Inc. is scheduled to report fourth quarter sales and

earnings on February 21, 2017. Additional detail on financial

performance will be provided at that time. The company will webcast

a call with financial analysts and investors at 10 a.m. ET on

February 21, 2017. Macy’s, Inc.’s webcast is accessible to the

media and general public via the company's website at

www.macysinc.com. Analysts and investors may call in on

888-599-8686, passcode 4375466. A replay of the conference call can

be accessed on the website or by calling 888-203-1112 about two

hours after the conclusion of the call.

About Macy’s, Inc.

Macy’s, Inc., with corporate offices in Cincinnati and New York,

is one of the nation’s premier retailers, with fiscal 2015 sales of

$27.079 billion. The company operates about 880 stores in 45

states, the District of Columbia, Guam and Puerto Rico under the

names of Macy’s, Bloomingdale’s, Bloomingdale’s Outlet, Macy’s

Backstage and Bluemercury, as well as the macys.com,

bloomingdales.com and bluemercury.com websites. Bloomingdale’s in

Dubai is operated by Al Tayer Group LLC under a license

agreement.

All statements in this press release that are not statements of

historical fact are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. Such

statements are based upon the current beliefs and expectations of

Macy’s management and are subject to significant risks and

uncertainties. Actual results could differ materially from those

expressed in or implied by the forward-looking statements contained

in this release because of a variety of factors, including

conditions to, or changes in the timing of, proposed real estate

and other transactions, prevailing interest rates and non-recurring

charges, store closings, competitive pressures from specialty

stores, general merchandise stores, off-price and discount stores,

manufacturers’ outlets, the Internet, mail-order catalogs and

television shopping and general consumer spending levels, including

the impact of the availability and level of consumer debt, the

effect of weather and other factors identified in documents filed

by the company with the Securities and Exchange Commission.

(NOTE: Additional information on Macy’s, Inc., including past

news releases, is available at www.macysinc.com/pressroom.)

MACY’S, INC.

Important Information

Regarding Non-GAAP Financial Measures

The Company reports its financial results in accordance with

U.S. generally accepted accounting principles ("GAAP"). However,

management believes that certain non-GAAP financial measures

provide users of the Company's financial information with

additional useful information in evaluating operating performance.

Management believes that providing changes in comparable sales on

an owned plus licensed basis, which includes the impact of growth

in comparable sales of departments licensed to third parties

supplementally to its results of operations calculated in

accordance with GAAP assists in evaluating the Company's ability to

generate sales growth, whether through owned businesses or

departments licensed to third parties, on a comparable basis, and

in evaluating the impact of changes in the manner in which certain

departments are operated. Management believes that excluding

certain items that may vary substantially in frequency and

magnitude from diluted earnings per share attributable to Macy's,

Inc. shareholders provides useful supplemental measures that assist

in evaluating the Company's ability to generate earnings and

leverage sales and to more readily compare these metrics between

past and future periods. The reconciliation of the forward-looking

non-GAAP financial measure of changes in comparable sales on an

owned plus licensed basis to GAAP comparable sales (i.e., on an

owned basis) is in the same manner as illustrated below, where the

impact of growth in comparable sales of departments licensed to

third parties is the only reconciling item. In addition, the

Company does not provide the most directly comparable

forward-looking GAAP measure of diluted earnings per share

attributable to Macy’s, Inc. shareholders because the timing and

amount of excluded items (e.g., asset impairment charges,

retirement settlement charges and other store closing related

costs) are unreasonably difficult to fully and accurately

estimate.

Non-GAAP financial measures should be viewed as supplementing,

and not as an alternative or substitute for, the Company's

financial results prepared in accordance with GAAP. Certain of the

items that may be excluded or included in non-GAAP financial

measures may be significant items that could impact the Company's

financial position, results of operations and cash flows and should

therefore be considered in assessing the Company's actual and

future financial condition and performance. Additionally, the

amounts received by the Company on account of sales of departments

licensed to third parties are limited to commissions received on

such sales. The methods used by the Company to calculate its

non-GAAP financial measures may differ significantly from methods

used by other companies to compute similar measures. As a result,

any non-GAAP financial measures presented herein may not be

comparable to similar measures provided by other companies.

Change in Comparable Sales

The following is a reconciliation of the non-GAAP financial

measure of changes in comparable sales on an owned plus licensed

basis, to GAAP comparable sales (i.e., on an owned basis), which

the Company believes to be the most directly comparable GAAP

financial measure.

9 Weeks Ended December 31, 2016

Decrease in comparable sales on an owned basis (Note

1)

(2.7%)

Impact of growth in comparable sales of

departments licensed to third parties (Note 2)

0.6%

Decrease in comparable sales on an owned

plus licensed basis

(2.1%) Notes: (1) Represents the

period-to-period change in net sales from stores in operation

throughout the year presented and the immediately preceding year

and all online sales, excluding commissions from departments

licensed to third parties. (2) Represents the impact of

including the sales of departments licensed to third parties

occurring in stores in operation throughout the year presented and

the immediately preceding year and all online sales in the

calculation of comparable sales. The Company licenses third parties

to operate certain departments in its stores and online and

receives commissions from these third parties based on a percentage

of their net sales. In its financial statements prepared in

conformity with GAAP, the Company includes these commissions

(rather than sales of the departments licensed to third parties) in

its net sales. The Company does not, however, include any amounts

in respect of licensed department sales (or any commissions earned

on such sales) in its comparable sales in accordance with GAAP

(i.e. on an owned basis). The Company believes that the amounts of

commissions earned on sales of departments licensed to third

parties are not material to its results of operations for the

periods presented.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170104006292/en/

Macy’s, Inc.MediaHolly

Thomas646-429-5250holly.thomas@macys.comorInvestorsMatt

Stautberg513-579-7780

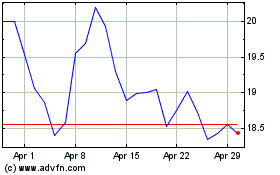

Macys (NYSE:M)

Historical Stock Chart

From Mar 2024 to Apr 2024

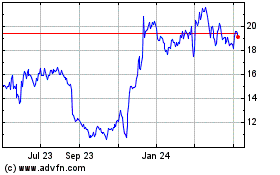

Macys (NYSE:M)

Historical Stock Chart

From Apr 2023 to Apr 2024